In June 2020, the DAX-listed German fintech unicorn Wirecard collapsed. More than €20 billion in assets were wiped out. A trial against former CEO Braun, among others, starts today. Three former Wirecard executives are accused: former CEO Markus Braun, the former managing director of a Wirecard subsidiary in Dubai, Oliver Bellenhaus, and ex-chief accountant Stephan von Erffa. There are many unanswered questions that this trial is to answer in the 100 hearings scheduled. Stay tuned for our background and trial reports.

The Crown Witness

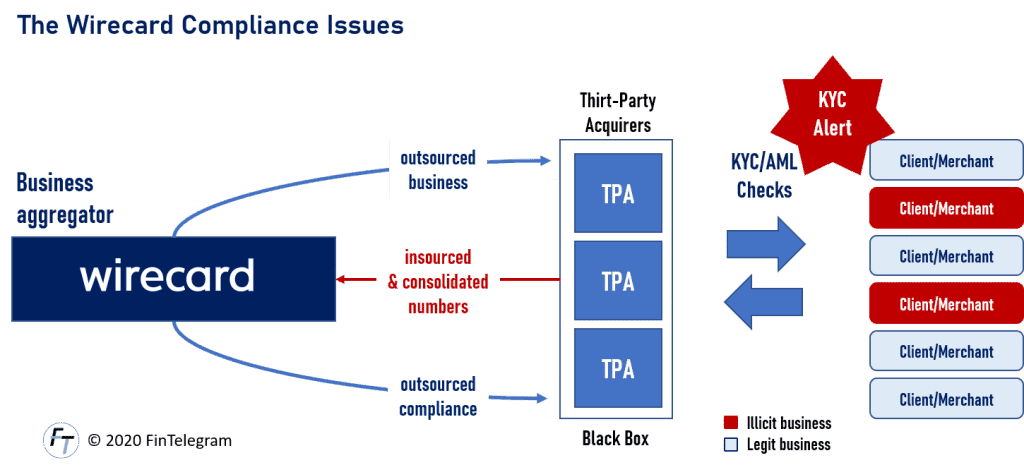

According to information known, Oliver Bellenhaus cooperates with the public prosecutor’s office as a crown witness. At the very center of the trial is the question of whether or the so-called third-party partner business existed. Third-party partners – the so-called “shadow organization” processed credit card payments for Wirecard in Asia, for example. To secure these payments financially, trustees were supposed to hold money for Wirecard in accounts.

Bellenhaus reportedly told prosecutors that this third-party business did not exist and was just a Potemkin village. According to Bellenhaus, starting in 2010, he created an array of shell companies based in Hong Kong and the British Virgin Islands at the behest of Jan Marsalek. He and Marsalek allegedly shifted corporate funds out of Wirecard and into bank accounts in the name of the shell companies and to a private foundation.

Victim Or Perpetrator

Markus Braun and his defense team, on the other hand, say it has evidence of the existence of this business. The money is said to have been moved abroad by a gang around the fugitive former board member Jan Marsalek via convoluted company constructions. Markus Braun and Wirecard are thus victims of this gang.

The Austrian Jan Marsalek was the Wirecard COO and is said to have had the best connections to various intelligence services. Rumors have it that he organized money laundering via Wirecard. He is currently said to be in Russia. It seems certain that Braun is happy about Marsalek’s absence. Thus, he can build Marsalek up as the great villain who destroyed Wirecard with his shadow organization. Braun would have been only the victim. That is probably essentially the defense strategy as well.

The Prosecutors’ View

The Munich I public prosecutor’s office accuses the defendants of incorrect presentation of Wirecard’s balance sheets since 2015, market manipulation, breach of trust, and commercial racket fraud. The three defendants are said to have subsequently portrayed Wirecard to the public as a “rapidly growing, extremely successful FinTech company” listed on the DAX.

To financially secure online card payments of the third-party partners, Philippine escrow accounts were supposed to hold €1.9 billion in the end. However, because this business was probably not present, also this €1.9 billion did never exist. This is the conclusion reached not only by the public prosecutor’s office but also by insolvency administrator Michael Jaffé.

Without the alleged revenues and profits from the third-party business, Wirecard would have ended up in the red. The consequence is that investors, banks, and small investors would probably not have invested so much money in the payment service provider. The Wirecard bankruptcy has destroyed assets worth more than €20 billion.

Share Information

If you have information about Wirecard, the people involved, and the network, please let us know via our whistleblower system, Whistle42.