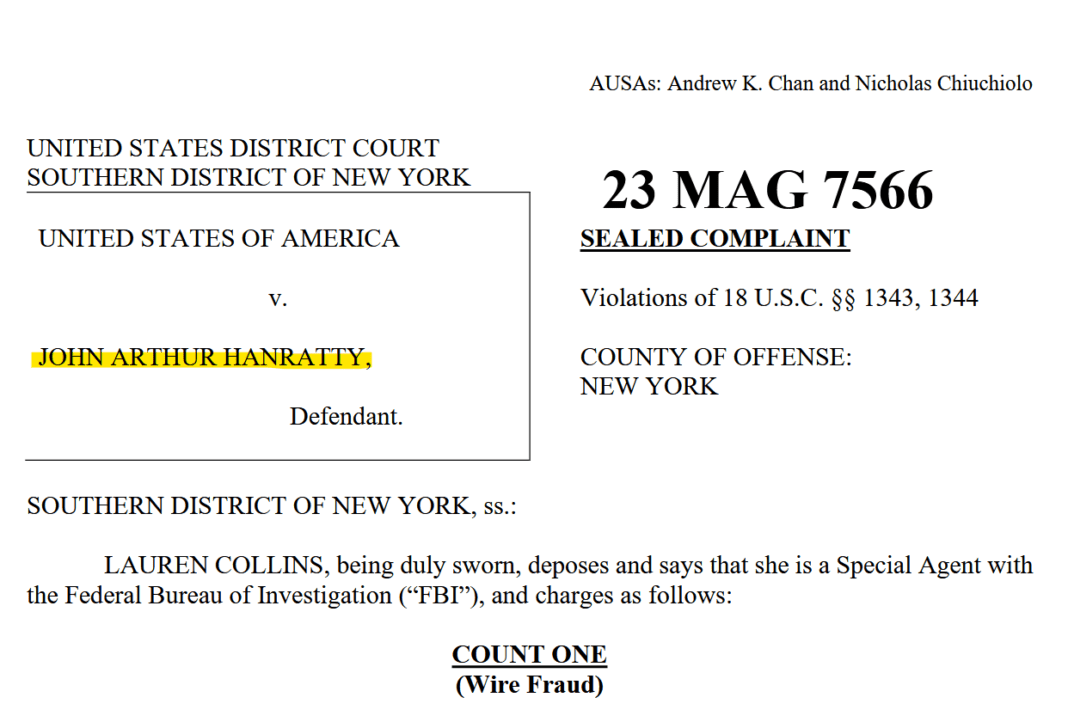

John Arthur Hanratty, a New York-licensed attorney and founder of Ebury Street Capital, faces charges of wire fraud and bank fraud. He allegedly misused $20 million in lines of credit from an FDIC-insured bank, making false statements about the value of municipal tax liens as collateral and misappropriating funds to pay off investors. Hanratty, arrested in Puerto Rico, could face up to 30 years in prison for each count if convicted.

John Arthur Hanratty was the Founder and Managing Director of Ebury Street Capital, LLC, an investment firm with a portfolio primarily comprised of municipal tax liens. Hanratty has been an attorney licensed to practice law in the State of New York since 2002 and has previously held legal and compliance positions at well-known investment firms and financial institutions, including serving as the Chief Compliance Officer and General Counsel for a trading broker dealer.

Between 2017 and 2021, Hanratty participated in a fraudulent scheme to steal money from an FDIC-insured bank by drawing down on $20 million in commercial lines of credit that had been extended to Ebury Street Capital. Specifically, Hanratty made materially false statements on spreadsheets submitted to the bank of victims summarizing the value of the municipal tax liens that Ebury Street Capital was offering as collateral for its commercial line of credit.

As a result of these false statements on Ebury Street Capital’s borrowing base certificates, the bank paid Ebury Street Capital large sums of money to which it was not entitled. The false statements on Ebury Street Capital’s borrowing base certificates included, among other things, listing large quantities of municipal tax liens on the borrowing base certificates that Ebury Street Capital did not actually own and double-counting municipal tax liens by listing the same liens on multiple borrowing base certificates.

Although Ebury Street Capital was contractually required to use money from bank of the victim either to purchase municipal tax liens or for ordinary business expenses, Hanratty actually used portions of the money obtained to pay off Ebury Street Capital’s investors who were threatening to sue.