The European Funds Recovery Initiative (EFRI) was founded in 2018 by FinTelegram together with auditors, lawyers, and victims of scams. At the beginning of 2020, EFRI became a mass movement with more than 1,000 registered victims and members. Therefore, EFRI was reorganized as a non-government organization registered in the UN city Vienna. The NGO represents the interests of victims towards scammers and their facilitators. The Dutch FinTech Payvision was one of them. EFRI even goes so far as to call Payvision the Wirecard of the Netherlands.

Criminal files provide evidence

The criminal files of the various public prosecution offices in different jurisdictions, as well as the research of FinTelegram and EFRI, prove beyond any reasonable doubt that at least between 2014 and 2019 the Payvision founders and the company’s top management around Rudolph Booker knowingly and willfully cooperated with binary options and brokers scammers. Apparently, the goal was to get access to the high payment volumes and the high fees associated with those illicit proceeds. Payvision happily laundered the money for many scam schemes.

A facilitator’s liability

Lawyers in various jurisdictions qualify Payvision as a scam and fraud facilitator which is jointly responsible for the loss of tens of thousands of victims of binary options, broker, and crypto scams. At the Vienna Cybercrime Trials (“#VCT“) in early September 2020, the court found the Israeli citizen Gal Barak guilty of investment fraud and money laundering conducted in his capacity as a principal of a Europe-wide operating cybercrime organization.

Barak was sentenced to a four years jail-time and restitution payments. More individuals of Barak’s cybercrime organization will be indicted in the #VCT over the months to come. Payvision was one of the most important payment processors for the Barak organization and, until shortly before his arrest in early 2019, still transferred millions to Barak’s scam operator entities.

The ‘Creating Awareness’ Task

Is Payvision really a kind of Dutch Wirecard Mini-me as various media reports claim? If you study the criminal files you will find this provocative statement certainly confirmed. At least when it comes to the cooperation between Payvision and cybercrime organizations and scammers. And when it comes to money-laundering and AML issues.

The case of Payvision goes far beyond the concrete claims for damages. Especially in the FinTech and PayTech scene, violations of compliance rules or money laundering are still considered excusable trivial offenses. Therefore scammer and cybercrime organizations are happily accepted as clients. In this respect, the publicly dealt with Payvision case should also create awareness among the FinTech scene and alert regulators and authorities. Without willingly participating payment processors, scammers would have a much harder time doing their dirty business.

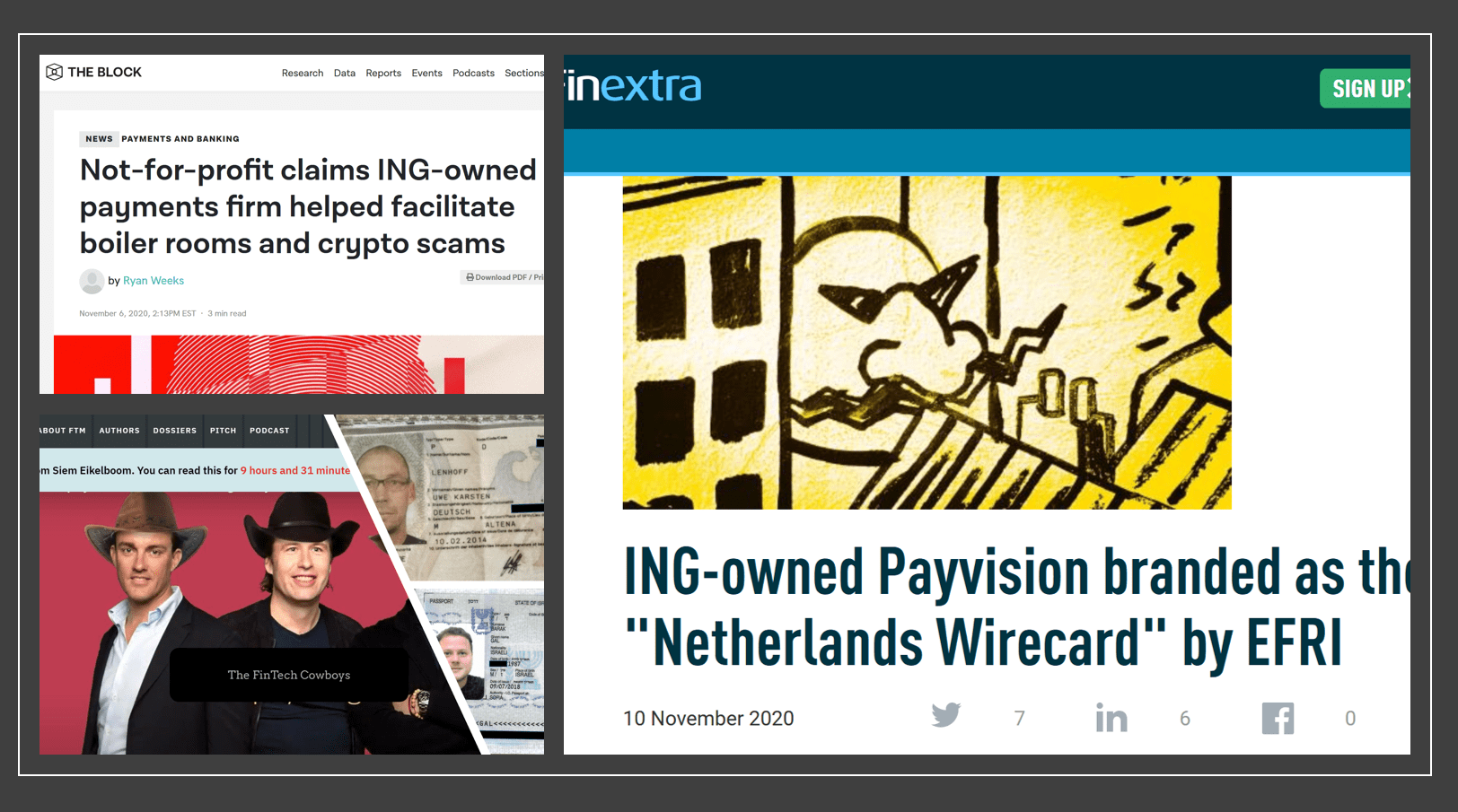

In the meantime, international media started to cover the Payvision topic and with it the issue of scam facilitating payment processors. Online media such as

- the Dutch Follow The Money (read more here),

- the crypto magazine The Block, or

- the financial magazine Finextra

have also become aware of Payvision, started to cover the EFRI campaign and thus creating awareness.

Accepting past failures

The Dutch banking giant ING has taken over Payvision for several hundred million Euros from the founders, Rudolph Booker, and the founding team had to leave and ING had Andre Valkenburg installed as the CEO. This reshaping of the company will not clear its past and neither will it make the liability disappear. It remains a legal fact in all recognized western jurisdictions, however, that co-conspirators or knowingly and willfully acting facilitators of fraud are liable for the victims’ losses together with the main perpetrators. The question remains as to how long Payvision and ING will need to accept their dark past in this respect.

Well, on the other hand, Wirecard never did, right?