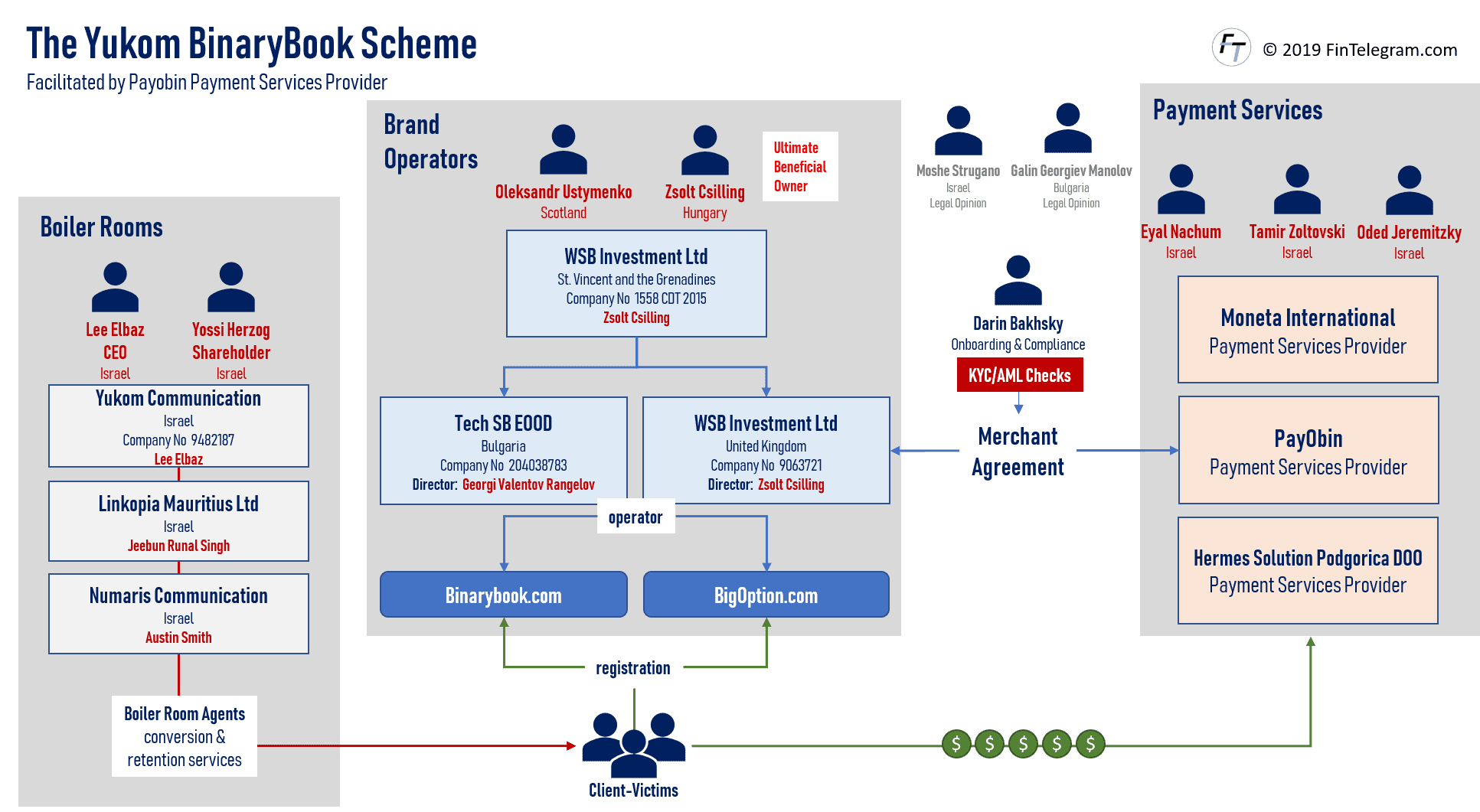

In the US, the landmark trial in the Yukom Case began on July 16, 2019. The accused are Lee Elbaz, the former CEO of Yukom, Yossi Herzog, the company’s shareholder and 16 other persons from the Yukom environment. Five of them have already pleaded guilty to binary options fraud. The Israeli Yukom Communications has operated boiler rooms for the fraudulent binary options platforms BinaryBook, BigOption according to the indictment. The agents of the Boiler Rooms have lured money out of the customers of these platforms under false names (stage names) with false promises and pretenses. According to the US accusation, Yukom has received about $150 million from investors via participating payment service providers.

The role of payment service providers

Broker scams such as the accused BinaryBook and BigOption are only possible with the cooperation of payment service providers (PSP). These PSPs register the operating entities behind the scams as so-called

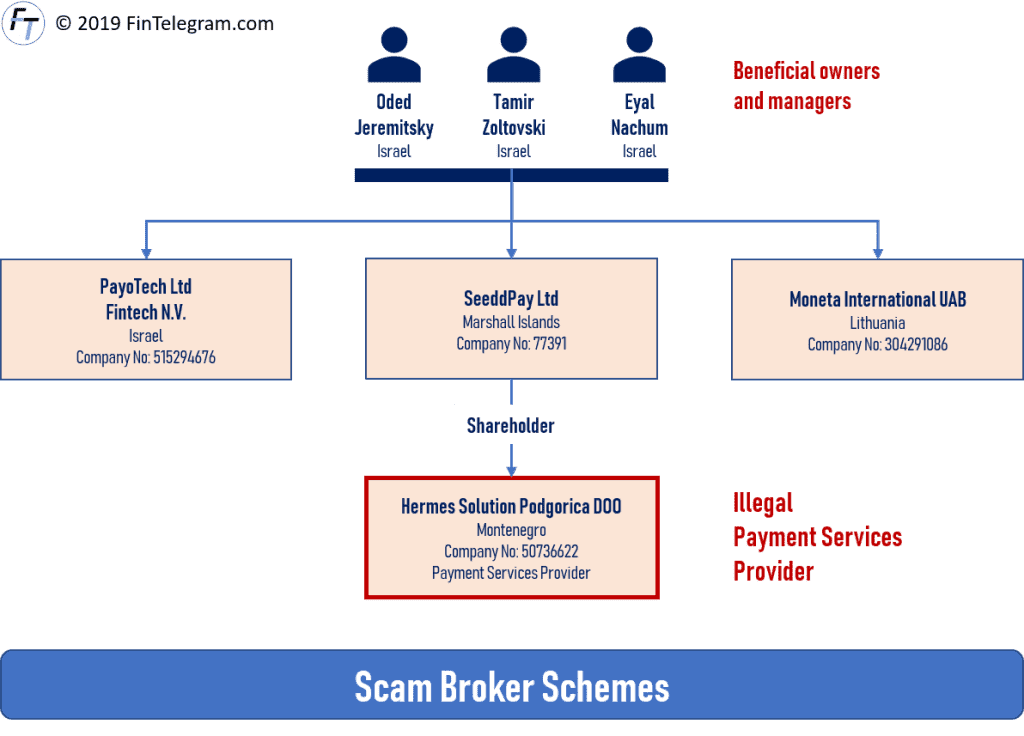

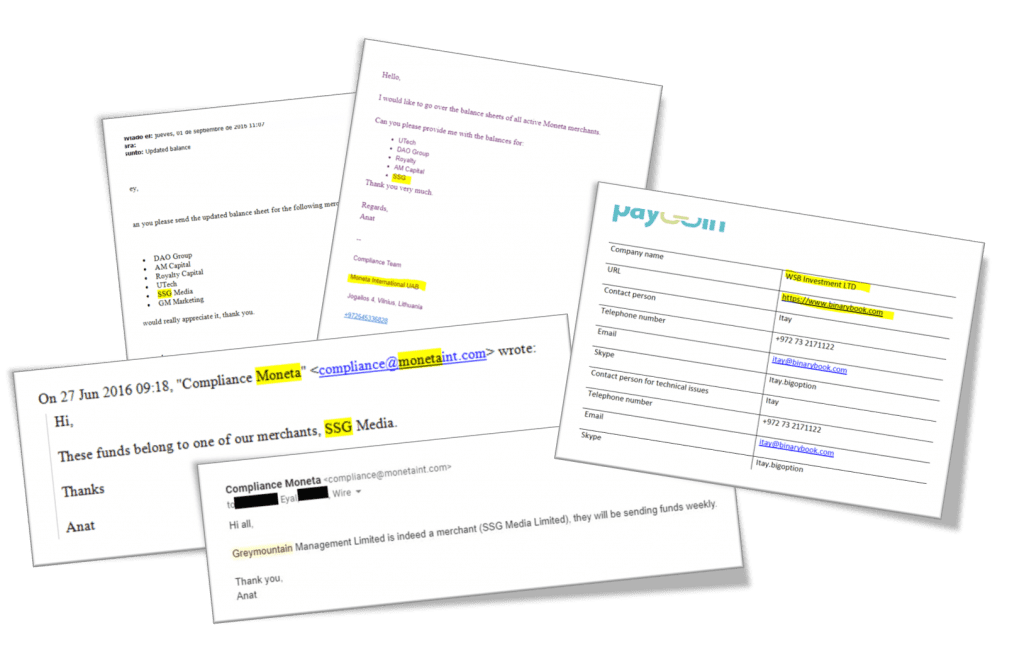

In the case of BinaryBook, one of the PSPs involved was the Israeli PayoBin of Eyal Nachum, Tamir Zoltovski and Oded Jeremitsky. Hermes Solutions DOO in Montenegro, controlled by Nachum and Zoltovski via SeeddPay, was also heavily involved in the BinaryBook Scam and many other scams. FinTelegram has reported about it.

These companies have accepted the UK registered WSB Investment Ltd as their merchant. This company was the operator of the binary options platforms BinaryBook and BigOption. As a result, the customer-victims of these platforms paid the money into the accounts of WSB Investment which

Moneta International and GreyMountain Management Scam Scheme

The payment platforms of Nachum and Zoltovski were also involved in the huge scam network of GreyMountain Management (GMM) as payment service providers. SSG Media Ltd, registered

The GMM registered in Ireland was sent into liquidation in 2017. Currently, 35 former customers of GMM-Scams the former directors and owners David Cartu, Jonathan Cartu, Ryan Coates and Liam Grainger are suing for millions of GMM-Scams customers in Ireland. Only recently, the lawsuit was admitted before the Commer

Facilitator in the MigFin Scams

Besides the involvement in Yukom and GMM, Payobin was also involved in dozens of other broker scams. This is confirmed, among other things, by a court case conducted in the US. The court records show that Payobin was involved in the ICoption scam, for example. According to the FinTelegram documents available and checked, Payobin, Moneta International, and Hermes Solution were involved in several scams operated by the people behind ICoption. In this regard, we recommend the FinTelegram report on the GMM-Moneta network.

Know-Your-Customer, Anti-Money-Laundering, and Compliance?

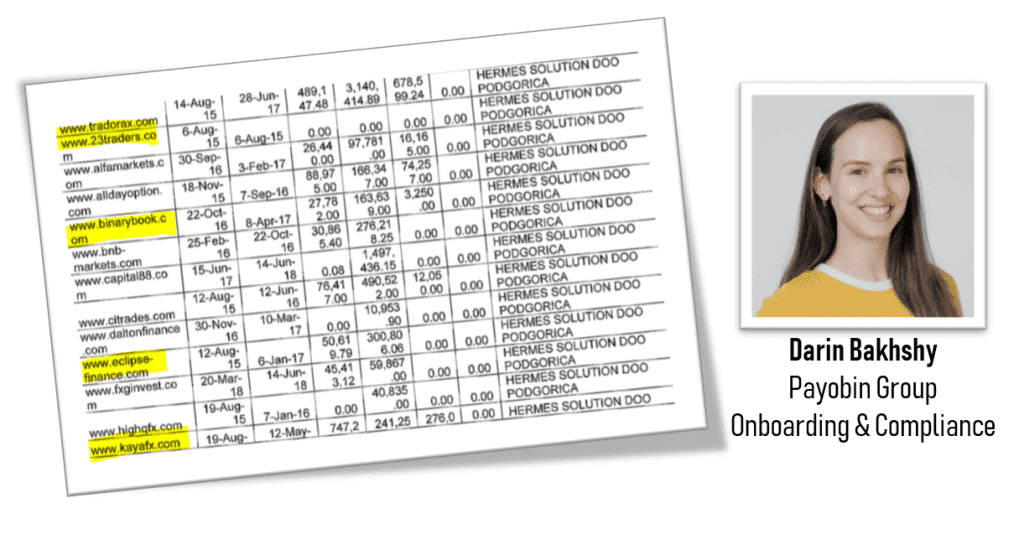

It is very obvious that Payobin and Hermes Solution deliberately and knowingly failed to perform the required KYC/AML checks. There is no other way to explain why the operators of broker scams are accepted as merchants on a massive scale. According to the documents available to us, Darin Bakhshy was responsible for compliance at Payobin.

According to her LinkedIn profile, Darin Bakhshy was responsible for onboarding the merchants and checking the relevant documents. It was also responsible for ensuring compliance with the relevant compliance processes. Since many of the so-called merchants were actually the operators of broker scams, one can probably not speak of a proper KYC being carried out here. That obviously didn’t work with the many scams from Payobin. In addition, Hermes Solution was an unlicensed payment service provider in Montenegro.

Regulators and authorities should care

Today Darin Bakhshy works for Moneta International UAB. This is the regulated financial services provider of Eyal Nachum and Tamir Zoltovski in Lithuania. The question arises, what does the Lithuanian financial market authority say about the history of the persons involved and their involvement in the many broker scams about Payobin and Hermes Solution?

In any case, intentionally or negligently acting payment service providers are not only responsible to the authorities, but also to the victims of the scams. You are to be regarded as a contributor and are liable for damages.

We can say with beyond any doubt that Payobin was involved in most major broker scams in the era of binary options. These are currently being judicially processed in different jurisdictions in Europe and North America. The involvement of payment service providers and their civil, criminal and regulatory responsibilities should be examined.