Whistleblower Credits: We would like to thank our whistleblowers for their reports and insights, which help us expose scammers and their payment processors. Together we can make a difference in cyberspace. Together we are an invincible force.

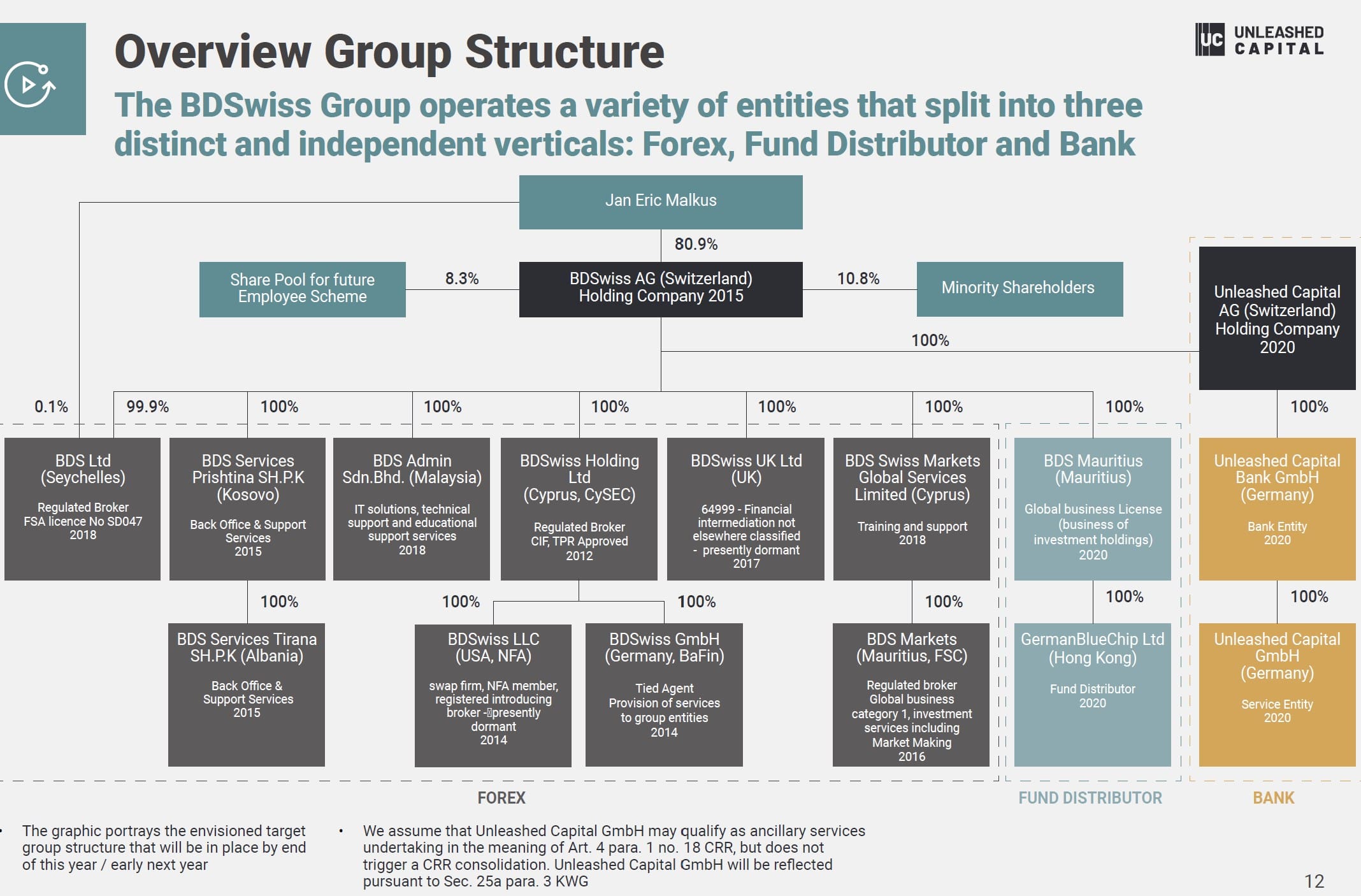

In February 2021, the CySEC-regulated broker issued an impressive company presentation. According to this presentation, BDSwiss used to be the fastest-growing CFD Broker in Europe and among the fastest growing in the world. Accordingly, in February 2021, the broker had more than 1.7 million customer accounts through which 200 million transactions with a volume of €1,000 billion were processed. The growth would have been 1000% over the previous two years. And the intention was to establish a bank in Germany with Unleashed Capital Bank (UCB).

Key data

| Trading name | Unleashed Capital Bank UCB |

| Business activity | Online banking |

| Legal entities | BDSwiss AG (Switzerland) Unleashed Capital AG (Switzerland) Unleashed Capital Bank GmbH (Germany) Unleashed Capital GmbH (Germany |

| Domain | https://unleashedcapital.com |

| Related individuals | Jan Eric Malkus (UBO) Alexander Oelfke (UBO) Konstantin Oelfke (Project Lead) Karl Hunger (director) Ivan Vasylchenko (director) |

Still no new clients accepted

At the time of our review on May 12, 2022, the CySEC-regulated broker’s website still informed that no new clients can be accepted at the moment. This should be the third week without new clients. We do not know the reasons for this new client block, but assume that this is a result of regulatory intervention. BDSwiss has already been blocked by the FCA. We do not know if and how this halt of new customer business will affect the ambitious plans with Unleashed Capital Bank (UCB).

The Digital FinTech Group

With UCB, BDSwiss wanted or wants to establish a digital bank to compete with N26 or Revolut with a focus on the investment business based on the BDSwiss brokerage. With a marketing budget of €28 million, they wanted to acquire 530,000 customers within 3 years, with the direct brokerage business being the most important growth driver.

In a presentation introducing the Unleashed Capital Bank project in late summer 2020, BDSwiss claimed that id had available cash of €40M on its balance and would generate an average monthly cash flow of €4.8M. Impressive numbers, indeed. BDSwiss’s financial situation would be a key ingredient to the sustainability of the new bank.

BDSwiss Group Structure

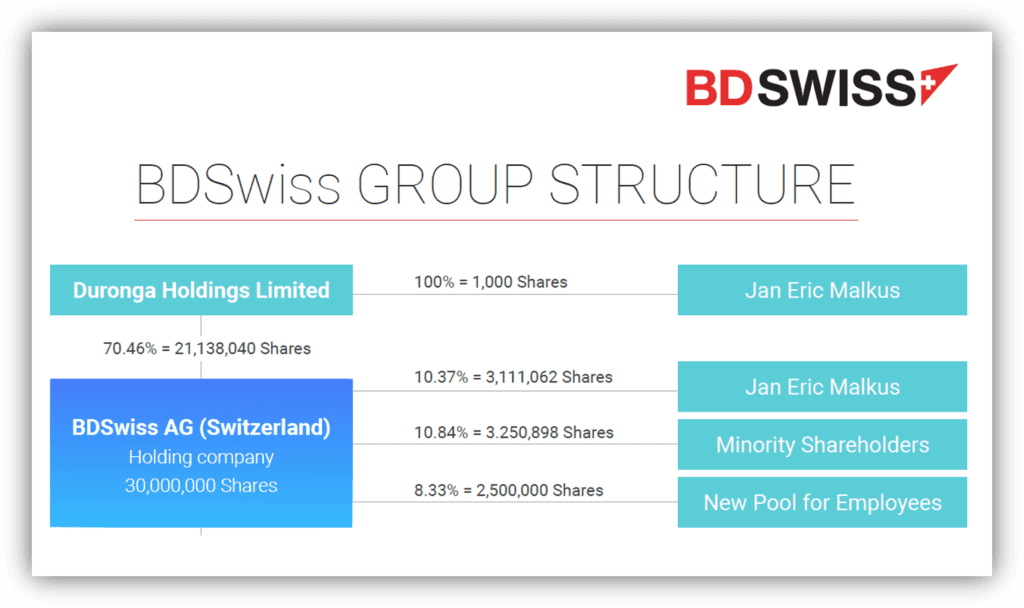

The present presentations also show the ownership structure of the BDSwiss Group. This is dominated by the German Jan Eric Malkus who holds more than 70% of BDSwiss AG, Switzerland, through his Cyprus-based Duronga Holding Limited In addition, he still holds more than 10% directly in this Swiss holding company.

Share information

If you have any information about BDSwiss and its projects, please share it with us through our whistleblower system Whistle42.