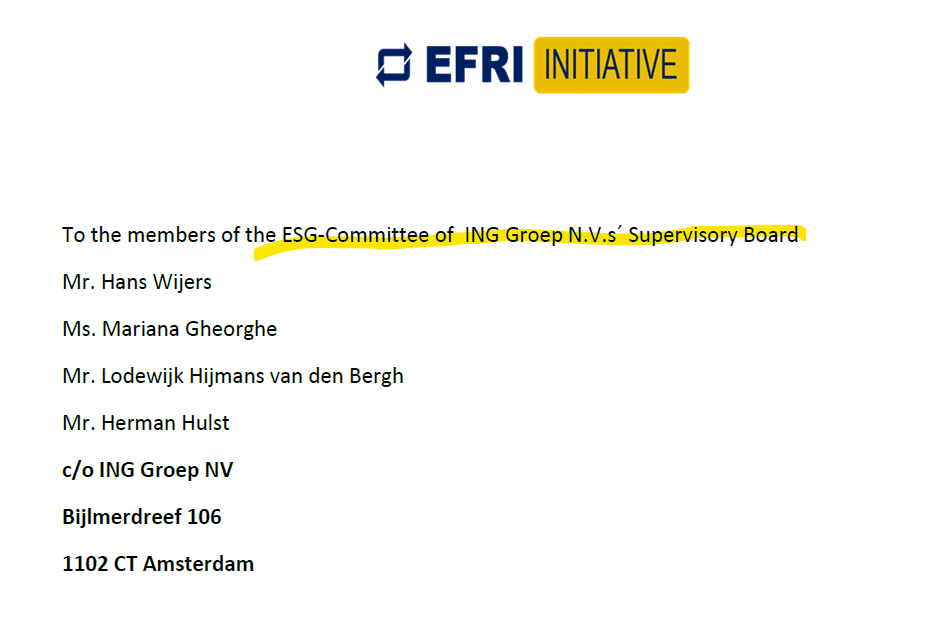

Currently, the global banking landscape is in a state of shock. First, the collapse of Silicon Valley Bank and Signature Bank in the U.S. followed UBS‘s incredible bail-out deal for Credit Suisse. Things are bad for banks. So perhaps it’s not quite so striking that ING of the Netherlands can’t solve its problems with Payvision, which it bought. Thousands of victims have lost their money via Payvision. The European Fund Recovery Initiative (EFRI) has written an open letter to ING‘s ESG committee.

The Endless Case

This case has been running for four years now. At the beginning of 2019, Payvision customers Uwe Lenhoff and Gal Barak were arrested. They were the operators of large cybercrime organizations that ran various scams. The deposits of the victims were processed mainly via Payvision. Criminal records show that Payvision, founded and headed by Rudolf Booker, was aware that its customers were scam operators and defrauded consumers.

In an audit, the Dutch financial markets authority DNB found that Payvision had violated financial laws and systematically breached money laundering guidelines. Dutch law enforcement agencies are currently investigating Payvision and its managers. ING is very well aware of that. A few months ago, the Dutch Investors’ association VEB sent an open letter to ING and asked the bank to explain the Payvision situation.

Read more about the DNB investigation and prosecution in the Payvision case.

So it is completely undisputed that Payvision was a cybercrime enabler and helped steal from thousands of European consumers. Nevertheless, ING management refuses to treat the victims decently and find a solution. A disgrace for ING. This is why EFRI wrote the open letter to ING’s ESG Commission. In it, one reads, among other things.

Unfortunately, PAYVISION BV, part of ING Groep NV, was one of the significant financial crime enablers for these online fraud scams during the years 2013 up to at least April 2020. We trust you are aware of the devastating audit report of DNB (De Nederlandsche Bank) about the willful blindness approach applied by the management of PAYVISION over the years and the ongoing criminal proceedings.

EFRI letter sent to ING

You can download the entire open letter to ING here.

Time To Get Angry!

If you see how badly the banks work and how often the state and taxpayers have to step in for the bank managers, you must be angry. One must demand legal responsibility if one sees how much the bank managers earn despite their mismanagement. ING allegedly paid Rudolf Booker around €340 million for his cybercrime-facilitating Payvision.

We would ask you to share this open letter via social media. It needs to be shown to the banks that they actually have to bear their social responsibility. It’s time to get angry about banks and their behavior.

Share Information

If you have any information about Payvision, ING, or the criminal activities surrounding their scam clients, please share it with us via our whistleblower system, Whistle42.

I warned the ING board of their compliance risks during interviews for the PV Managing Director role. I explained I would flush 10-15% of the PV merchants to safeguard the investment and safeguard the remaining merchants whose flow, processed by PV usually ‘at cost’, was being used to camouflage the revenue-generating junk. Odd that I wasn’t invited back for further interviews. . .