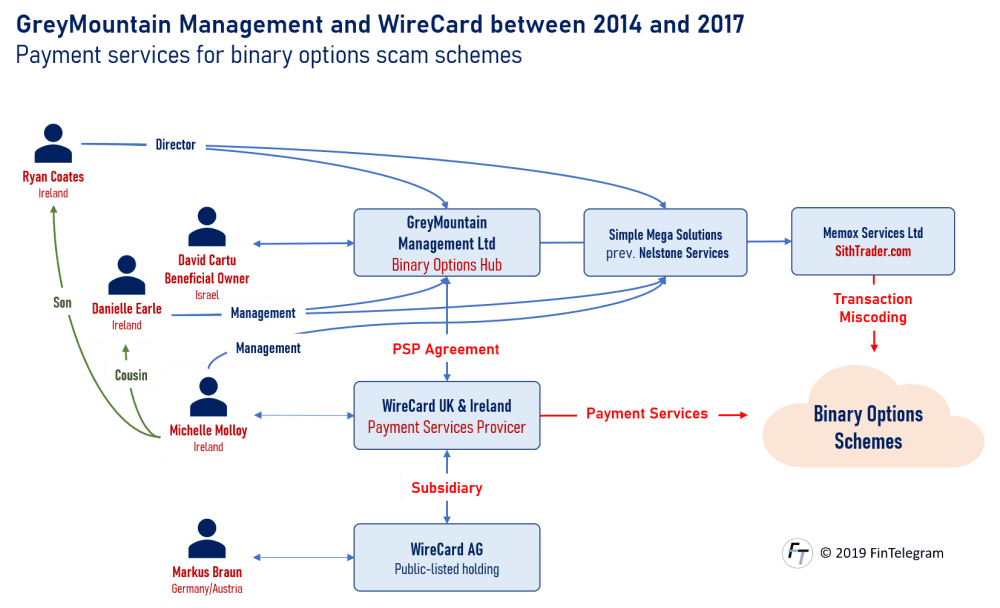

The listed German Fintech WireCard is being shaken by a crisis that has lasted for months. The situation was triggered by reports in the Financial Times (FT) about alleged balance sheet manipulations and fake customers in the WireCard Group. This would affect in particular the subsidiary in Singapore but also the subsidiaries in Ireland and Dubai. FinTelegram has reported on WireCard‘s strange dealings with David Cartu‘s GreyMountain Management (GMM) binary options scheme in the past. A former employee sent a whistleblower report to the authorities. FinTelegram reports the details.

Ernst & Young issue in Singapore

A few days ago, it became known that Ernst & Young (EY) had refused to confirm the balance sheet of WireCard‘s Singapore subsidiary, WireCard Singapore Pte Ltd, in 2017. The transactions and accounts were said to be incomprehensible. WireCard is currently being audited by KMPG, which, according to its CEO Markus Braun, is intended to show whether the allegations of balance sheet manipulation are correct. Shareholders, supervisory authorities and the public are eagerly awaiting the result.

GreyMountain Management issue in Ireland

FinTelegram’s research confirms the allegation of balance sheet manipulation, fictitious transactions, and fake clients for WireCard UK & Ireland Ltd. At least for the years 2014 to 2017. These three years were the climax of the notorious global binary options fraud, which, according to estimates by the US FBI, has cost hundreds of thousands of retail investors worldwide up to 10 billion annually. The binary options industry was invented in Israel around 2010 and was “exported” by Israeli perpetrators globally. Simona Weinglass, investigative journalist of the Times of Israel extensively covered these so-called Wolves of Tel Aviv and their fraud activities.

In May 2014 the Canadian-born Israeli David Cartu (LinkedIn profile) and his brothers Joshua (“Josh”) Cartu founded GreyMountain Management Ltd (GMM) in Ireland.

The Whistleblower Report

According to information provided by the former employees Simon Kinsella, the Cartu brothers have concluded a special agreement with Michelle Molloy, then CEO of WireCard UK & Ireland Ltd. This agreement allowed GMM to act as a payment provider for binary options scams through specially established shell companies (e.g. Nelstone Services Ltd). As Kinsella was already outed to the public by one of the many binary options victims, we decided to publish his name.

This former GMM employee was responsible for the development of the Snow Charge payment system, making him an insider and expert on transactions and systems. In 2017 he created a comprehensive whistleblower report code-named “Project Avalanche“. In it, he lists in great detail the names, companies, and transactions relating to GMM and WireCard.

WireCard and GMM were related companies

This whistleblower report shows that in GMM, the cousin of WireCard UK & Ireland, Danielle Earle (LinkedIn profile), was responsible for accounting. Molloy’s son, Ryan Coates, was a GMM manager. GMM and WireCard were, therefore, related companies between 2014 and 2017. According to the former employee, hundreds of millions of payment transactions of binary options scams would have been settled via GMM during this period. A large part of these apparently via WireCard.

The Fake Starwars Merchandizing Company

The GMM whistleblower states that bogus companies were used to disguise the fraudulent binary options transactions. For example, Nelstone Services Ltd, founded by David Cartu in 2014, operated the SithTrader.com domain which is said to have appeared on the victims’ credit card statements on many binary options transactions. On the 2014-website of SithTrader, one can see, that it presented itself as a sort of Starwars merchandizer! To the issuing bank of the credit card holder (i.e. binary options victim), the transactions apparently were reported as the purchase of merchandizing stuff. That’s called bank fraud, isn’t it?

While the domain www.sithtrader.com was registered by Nelstone Service it was operated the UK-registered Memox Services Ltd with David Cartu as one of its directors and the controlling shareholder (see Companies House).

GMM, on the other hand, was never mentioned in these transactions even though WireCard and GMM have been fully aware of the real transactions, i.e. binary options fraud. GMM and David Cartue or his organization and co-conspirators were themselves officially the operators of some of the worst binary options scams, such as BeeOptions, Glenridge Capital, Edgedale Finance or Innovate Markets.

In addition, GMM and WireCard served dozens of other binary options scams (mostly operated by Israelis) as payment service providers.

Nelstone Services Ltd later became Simple Mega Solutions (IE) Ltd, to which WireCard UK & Ireland CEO Michelle Molloy, among others, moved as Director (see company register entry).

Simple Mega Solutions (IE) Ltd was to be positioned to become a licensed financial services provider. At least that was David Cartu’s plan. Currently, the company’s websites (www.megacharge.com or www.megapower.io) are offline but David Cartu is still listed as an employee on the company’s LinkedIn site.

Liquidation and million-dollar lawsuit

In 2017, the liquidation of GMM was initiated at the request of David Cartu. In his application to the High Court (available to FinTelegram), Cartu confirms that he was the beneficial owner of GMM (through the Canadian trustee Adam Graves). Cartu also confirmed in this application that GMM was active in the field of binary options

A Significant Number of Customers in U.S

Acording to the David Cartu petition to the Irish High Court, a significant number of GMM customers were based in the United States. As Visa and MasterCard took steps to prohibit binary options payments with credit cards, GMM ceased trading on April 24, 2017, Cartu claims. No word on the partnership with WireCard, no word on his own binary options schemes.

Deloitte Touche was appointed as the liquidator of GMM as suggested by Cartu.

In the meantime, binary options investors of the former GMM platforms have filed a million-dollar lawsuit against David Cartu and the former management of GMM in Ireland. The lawsuit has not yet been decided.

David Cartu has now removed his GMM role from his LinkedIn profile. There only his activity for Simple Mega Solutions (IE) as founder and president is provided as his experience.