While the U.S. authorities and courts consequently work their way through the fraudulent binary options industry the Europeans are rather clueless. The Irish GreyMountain Management (GMM) and Wirecard mystery is one of the early binary options industry stretching from Israel to UK and Ireland to Canada and the U.S. And it’s one including the currently much discussed German Fintech wonder Wirecard.

In the U.S. the first big binary options trial and sentencings are scheduled throughout 2019 starting with the Yukom case. Hence, it’s a good time and the appropriate environment for FinTelegram to start deciphering the GMM mystery in a joint effort with victims and whistleblowers.

Let’s Start With The End

Greymountain Management Ltd was set up on the 20th of May 2014 in Dublin. In summer 2017, The Times of London reported that the Irish company has applied to the High Court to be wound up. GMM made the application after conceding to the court that it had dozens of customers around the world seeking their money back.

On July 19, 2018, Israeli lawyers filed a lawsuit for $1.5 million on behalf of a US woman against the Israeli company Tracy P.A.I. and its owner David Cartu. In his writ of defense, Cartu claimed that his Tracy P.A.I. merely provided white label services to the website BeeOptions. According to the Israel company register David’s brother, Jonathan Cartu was the shareholder of Tracy P.A.I.

In September 2018, the Irish Examiner reported that a group of investors from the United States, Canada, Singapore, the United Arab Emirates, and the UK claimed that they lost millions of euro in the GMM binary options scam. They brought a High Court damages action against GMM and its directors, Israel-based brothers Jonathan Cartu and David Cartu and Dublin-based Ryan Coates and Liam Grainger. The investors pu

Main Actors Involved

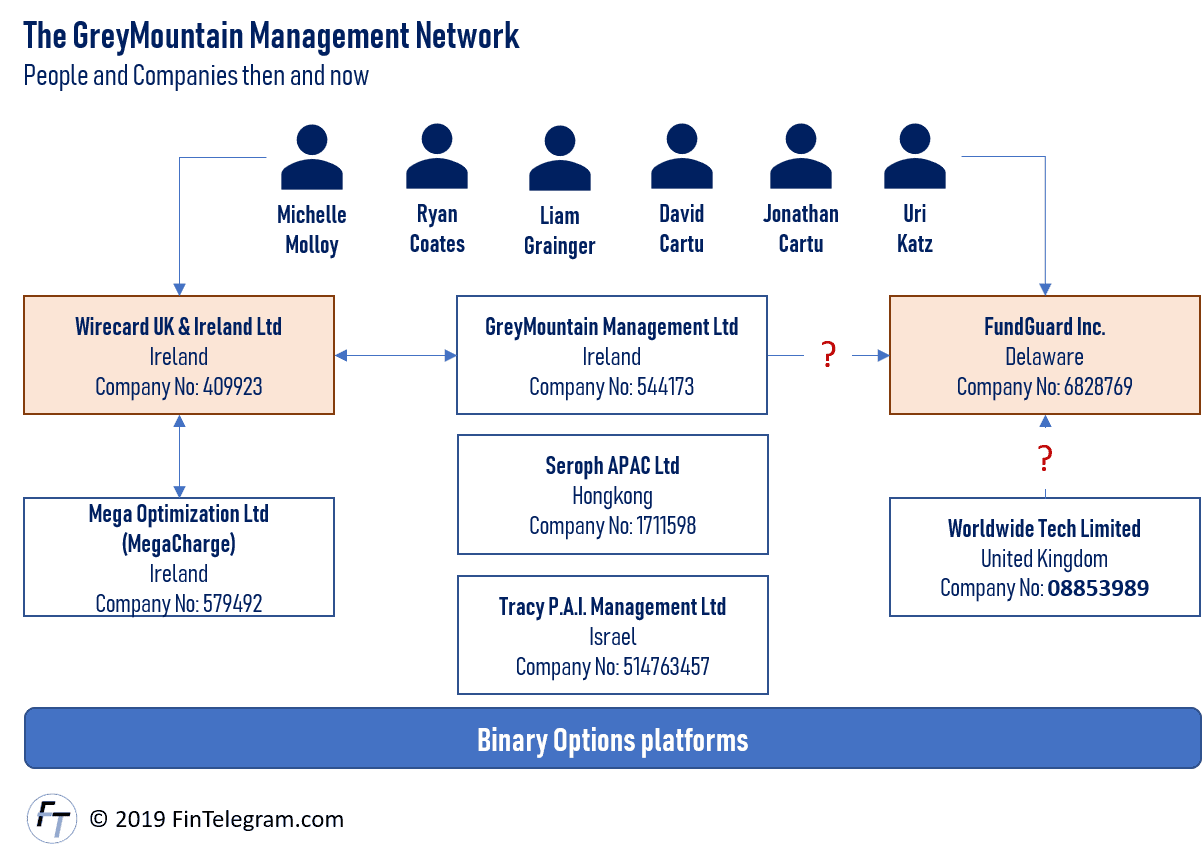

The following main actors have been identified in the GMM and Wirecard mystery performance:

- David

Cartu (LinkedIn profile) - Jonathan

Cartu (LinkedIn profile) - Uri Katz (LinkedIn profile)

- Michelle Molloy (Linkedin profile)

- Liam Grainger

- Ryan Coates

According to a FinanceFeeds article, Liam Grainger, of Charlemont, Griffith Avenue, Dublin, and Ryan Coates, of

The Israeli Uri Katz, a close partner of the Cartu brothers was also part of the GMM network of people and managed some companies and binary options brands. Among others, Katz was responsible for

Michelle Molloy was CEO of Wirecard UK & Ireland before moving to MegaCharge as Director. After the publication of our reports about Wirecard, Molloy has deleted the traces of MegaCharge in her LinkedIn profile and presents herself only as a Payment Consultant.

Gamification of Trading

The origin of binary options lies in online gambling. The Cartu brothers actually come from the online casino space and sort of evolved their business into the binary options with GMM. The binary options, however, were not sold as gambling, but as investment products. As a matter of fact, the Cartu brothers gamified securities trading.

The Cartu brothers were fierce competitors of the Israeli Gery Shalon. The latter attacked the Cartu casinos with DDoS campaigns to force them out of the market. The U.S. prosecutors charge Gery Shalon with DDoS

GERY SHALON, the defendant, and his co-conspirators engaged in massive hacks and

U.S. Indictment in the Gery Shalon case (download indictment here)cyberattacks against other internet gambling businesses to steal customer information, secretly review executives’emails, and cripple rival businesses. In particular, in or about 2012, SHALON orchestrated network intrusions of competitors in order to steal his competitors’ customer databases and other information

The Cartu brothers were the beneficial owners of Rome Partners which operated numerous online casinos with a focus on the US market. Rome Partners and the Cartu brothers have built up a miserable reputation in this already badly reputed industry. Hence, the Rome Partners affiliate program was blacklisted.

Dublin and Wirecard

Attacked by Gery Shalon and blacklisted for their scam casinos evidently forced the Cartu brothers to look for new business opportunities and found GMM and the gamification of trading. Rome Partners was closed in 2013 and GMM launched in 2014. The partnership with Wirecard has also been implemented with GMM which was located at the Wirecard address in the Ulysses House in Dublin.

Worldwide Tech and Uri Katz

While GMM and Wirecard acted as payment services providers (PSP) for the illegal binary options scheme Worldwide Tech Limited, registered in the UK with the company number 08853989 in Jan 2014, acted as a so-called white-label solution provider for the operators of the many illegal binary options platforms. The GMM manager Uri Katz (Israel) was the sole director of this company until its compulsory strike-off in April 2017.

According to the UK Companies House filings, the sole shareholder of Worldwide Tech Limited was a Smartech Limited, a company also controlled by Uri Katz and his friends. Uri Katz, in turn, is not only linked to GMM and Banc de Binary but also to the UKoptions scam (see website intel here).

Binary options scheme

June 2016 update:

Forex Peacy Army (FPA) – www.forexpeacearmy.comUKoptions is also part of the Greymountain Management group of binary companies. This group has a large number of FPA Traders Court cases against it. The FPA considers all brokers which are part of this group to be scams and warns all traders to avoid depositing money with them.

In April 2018, Uri Katz and other people founded FundGuard Inc in Delaware and received a $4m funding from Israeli LionBird. From the company’s website, www.fundguard.com and its Bloomberg profile page one learns that FundGuard provides investment funds technology solutions. Hence, it looks like sort of successor for the GMM and/or Worldwide Tech project.

to be continued in part II