Yes, the Plutus broker scam is still active and continues to scam consumers and small investors! And yes, these scammers stole millions! We reported about it a few days ago. Until around May 2020, the scam worked with Praxis Cashier and accepted credit cards and later switched to cryptocurrency payments only. Until recently, the scam operated by ITM Solutions LLC processed payments via BitTheBank and XchangePro of the licensed Estonian crypto payment processors Lipan Services OÜ and BlueData OÜ, respectively. We are trying to track down the operators. Here’s another update.

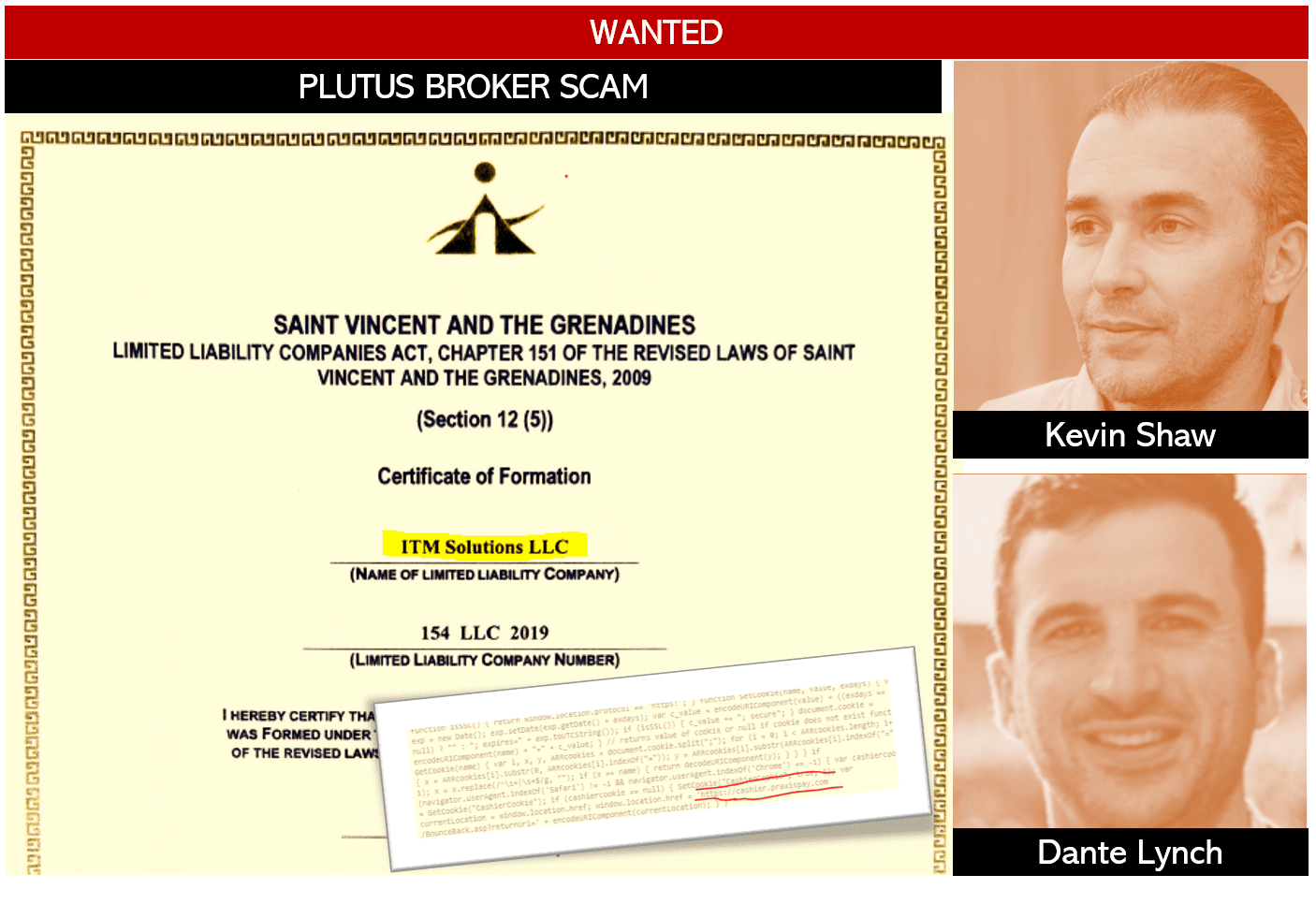

ITM Solutions LLC was registered in St. Vincent and the Grenadines in August 2019 under Company Number 154 LLC 2019. George Casper was registered as the sole manager and shareholder. We would like to know more about George Casper.

In fact, the Plutus scam is likely to have operated through London. One victim gave us 1 King Street as the address and the two managers Dante Lynch and Kevin Shaw (see the pictures above). These are certainly fake names, but the pictures are authentic, we are told. In addition to BitTheBank (www.bitthebank.com), victim deposits are also said to have been processed through XchangePro (wwwxchangepro.net), operated by the licensed Estonian BlueData OÜ. Both XchangePro and BitTheBank have already appeared to several scams as payment facilitators.

Wanted

We know that charges have already been filed with the UK FCA against Plutus. Unfortunately, the regulator does not have jurisdiction over fraud. The FCA has already issued an investor warning in December 2020.

If you have any additional information helping to find and expose the scammers and their co-conspirators, we would be grateful if you could share it with us. We want to hold the operators and their co-conspirators accountable and help victims recover their money back. This scam has stolen several million euros from small investors since 2019 and is still active on social media. Victims are still being acquired via Facebook. Let’s uncover the attackers and their facilitators together.

terminated almost 1 year ago, probably because of regulator warning, which is a policy at Praxis technology provider (not processor)… you are really scraping the bottom of the barrel on this one. someone must be paying fintelegram to target certain companies without even reaching out for comment.

Well, those payment processors have no idea how much damage they do to consumers and investors by accepting scams as their clients/merchants. They simply don’t care, but we do. We actually stated correctly that Praxis Cashier terminated the relationship with Plutus in May 2020. Nevertheless, the Praxis guys have all the data that could expose these scammers. And now what? They protect them, or did they file a criminal complaint which would have been their legal obligation? No, they don’t care! We don’t need to be paid by anybody to write about this and expose them.

This broker worked with several technology vendors other than praxis such as WordPress, Zendesk, crm provider, meta trader, Fx rate feed providers (oanda, xe), domain registrar (godaddy), hosting (Amazon), email provider (gmail, mail chimp). None of them are financial institutions or legally obliged to perform kyc/aml procedures like the financial institutions; or file criminal complaints.

You should provide links to authority website proving otherwise.

Sure, the broker worked with many software pieces and 3rd party services, and we don’t blame them for facilitating scams. However, there is a reason why financial services are regulated in the first place. Right?

Our educated opinion is that all “software-based” services in the financial space need to be regulated. We do think that services such as Praxis or BridgerPay actually would need regulatory permission, but Cyprus doesn’t care too much, as we all know. Even account information services (fully software-based) need permission, so why the hell should a payment gateway be able to operate without regulatory permission/approval.

Those payment gateways act as gatekeepers in the cyberfinance space, and regulators need to understand that.

1. you said “our educated opinion” – can you please tell us what education or experience you have that would make your opinion valid/authoritative or show some sort of expertise?

2. since Cyprus does not “care”, can you point out some sort of laws in Austria, Germany, UK or other countries that do “care” which state that payment gateways or technology providers are regulated the same as payment processors are?

Please post links to this as requested above.

I strongly advise you to read this, search on google and verify the content that you publish.

https://www.lexology.com/library/detail.aspx?g=a8de9519-2c01-47f7-b2da-5ebc42861849

“Those payment gateways act as gatekeepers in the cyberfinance space, and regulators need to understand that.”

thats not true, the banks and payment processors who provide merchant accounts are the gatekeepers and that is why they are regulated. If they do something wrong you can complain about them to the regulator or the card schemes.