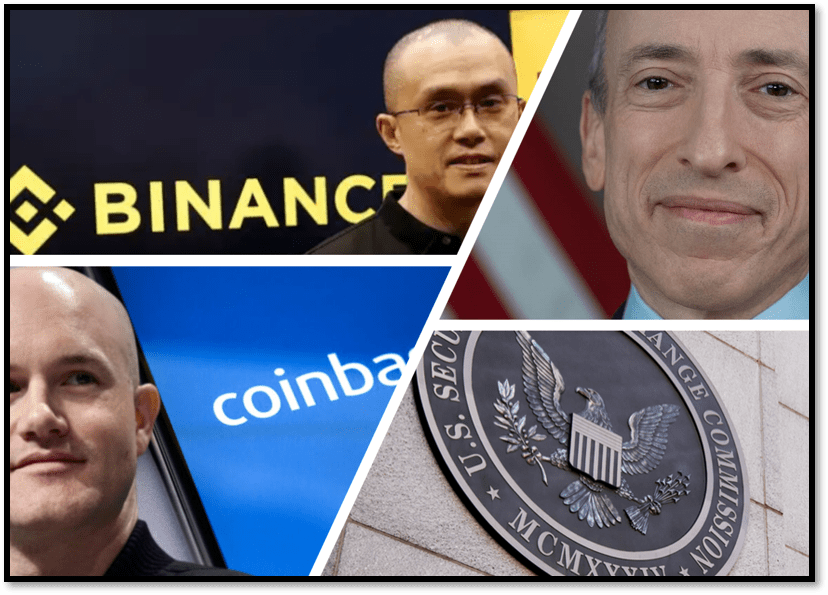

Gary Gensler, the 65-year-old old Chair of the U.S. Securities and Exchange Commission (SEC), has been calling for an aggressive approach to regulate the crypto industry. Its surging growth has rattled the financial world and raised concerns about its potential for fraud and abuse. Most recently, the SEC has brought lawsuits against Binance and Coinbase, and they are fighting back with the best and most expensive lawyers. The SEC Chair may lose his job over this ridiculous fight against the crypto industry.

The FIAT Crusade

Gary Gensler served as the 11th chairman of the U.S. Commodity Futures Trading Commission (CFTC) under Barack Obama between 2009 and 2014. He has been the CFO for the Hillary Clinton 2016 presidential campaign. In 2021, Joe Biden nominated Gensler to serve as the 33rd chair of the SEC.

It looks like the SEC’s tough approach is a personal crusade and mission of its Chair, Gary Gensler. He is a defender of the FIAT system and apparently has a problem with the crypto industry and doubts the need for cryptocurrencies in principle.

Look, we don’t need more digital currency,” Gensler said during an appearance on CNBC’s “Squawk on the Street … We already have digital currency. It’s called the U.S. dollar. It’s called the euro or it’s called the yen; they’re all digital right now. We already have digital investments.

SEC ChaIr Gary Gensler in an CNBC interview

Critics have bristled at the SEC’s approach, accusing the agency of failing to define the rules for their long-term policy for the crypto industry and instead regulating the market through lawsuits. Coinbase lawyers have most recently said in a court appeal that the regulator would create a Catch-22 for the U.S. crypto industry under Gensler.

Regulation By Lawsuits

In December 2020 (i.e., before the Gensler era), the SEC brought a lawsuit against crypto firm Ripple, claiming that its XRP token would be a security. It is an expensive court case. Ripple will have spent $200 million defending itself against the SEC lawsuit, CEO Brad Garlinghouse told CNBC.

In a Twitter video on June 16, Brad Garlinghouse expressed his criticism of the SEC and its current chair, Gary Gensler, regarding crypto regulation. He called Gensler a “bureaucrat” who uses regulation as a weapon. According to Garlinghouse, the regulatory body intentionally creates confusion surrounding regulations and exploits this ambiguity to enforce its authority selectively.

And now Gensler point blank refuses to comment on specific projects (besides BTC) but indirectly and incorrectly labels tokens as securities in lawsuits, and in the next breath, says how “clear the rules are” while his agency tries to front-run Congress.

Brad Garlinghouse on Twitter

In 2023, the SEC, led by Gensler, also brought cases against other leading crypto firms, accusing them of violating U.S. securities laws and other offenses. Among them, for example, Bittrex (report here) and BitTorrent (report here).

Calls For Gensler’s Resignation

The two GOP lawmakers, Warren Davidson and Tom Emmer, recently introduced the SEC Stabilization Act, a bill to restructure the SEC and remove Chairman Gary Gensler from his post. They point to what they say is Gensler’s “long series of abuses that have been permitted under the current SEC structure.“

There is already speculation on Twitter that Gensler might not survive 2023. Too many enemies, even for the bravest government official, can be too much. Crypto companies still have deep pockets and access to the best lawyers, even in crypto winter. Moreover, Hong Kong lures the big crypto firms with a crypto-friendly regulation.