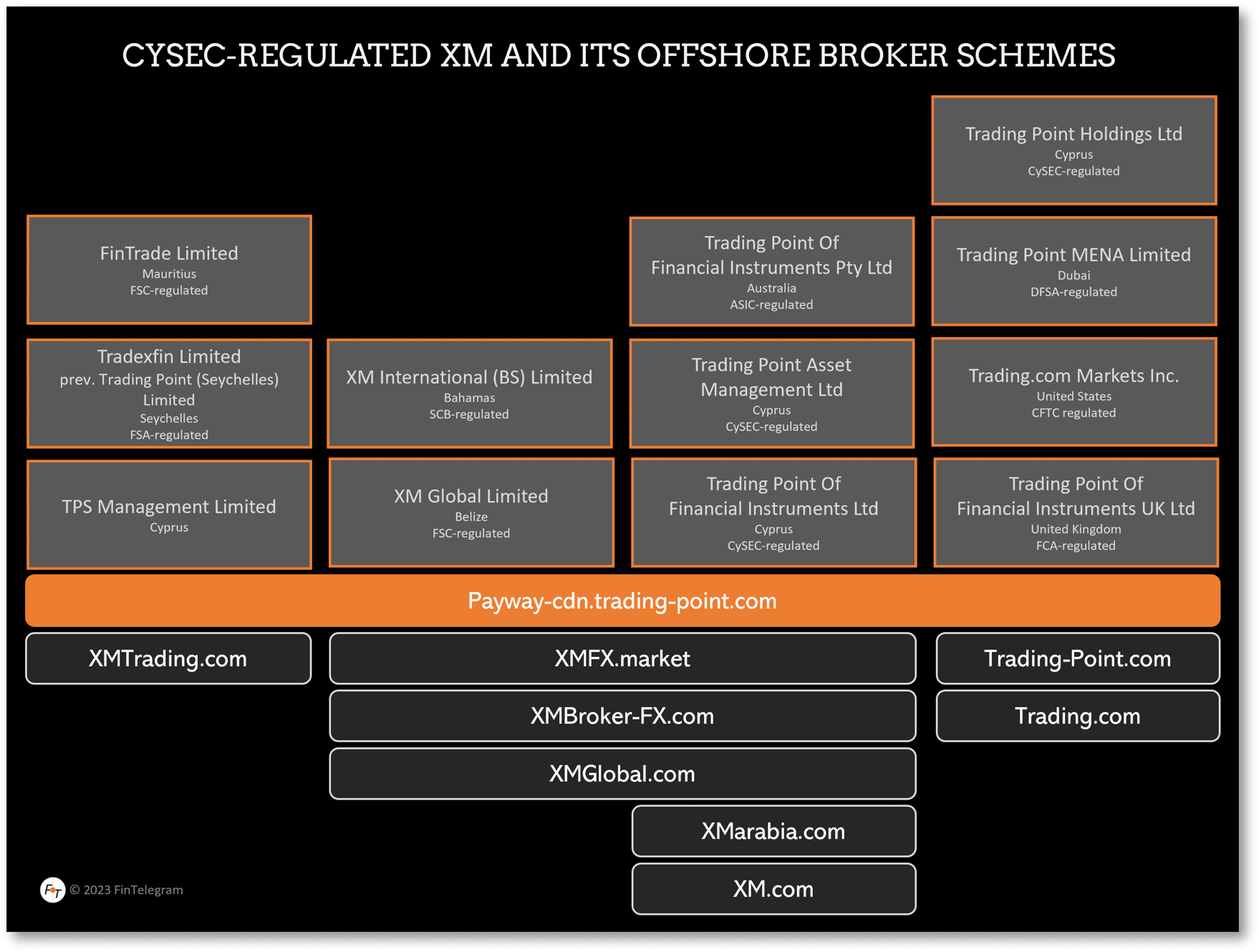

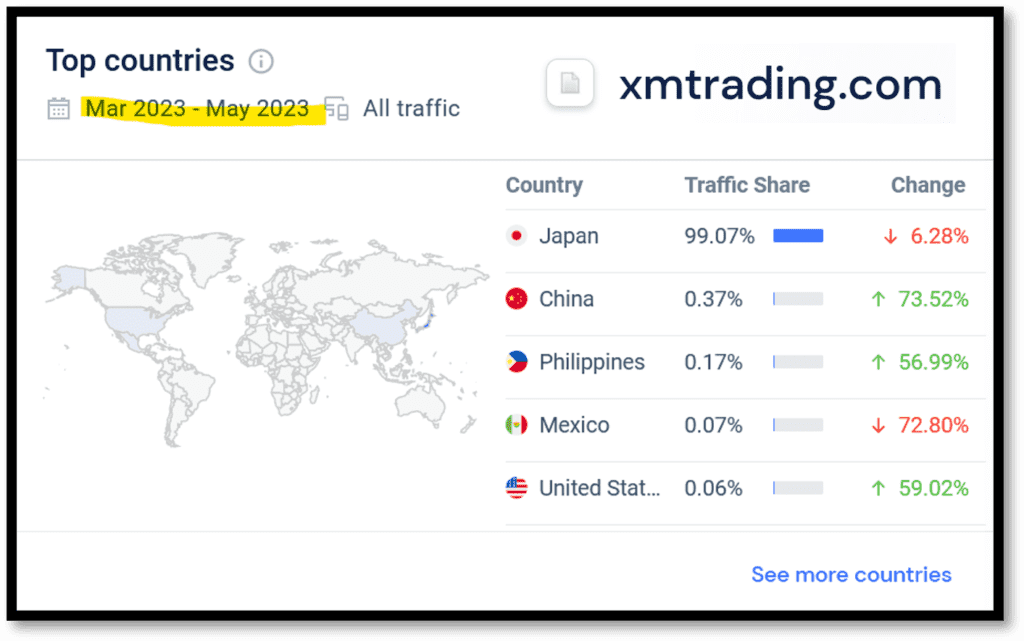

XM is a CySEC-regulated broker and part of the Trading Point Group, which also runs the offshore broker schemes XMTrading and XMGlobal through offshore entities and TPS Management Limited in Cyprus. The group’s offshore broker schemes receives most of its clients from Asian countries. While more than 99% of the XMTrading website visitors come from Japan, XMGlobal attracts visitors from Vietnam, Pakistan, and Uzbekistan. We have assigned the group an Orange Compliance rating.

Key data

| Trading names | XM XMTrading XMFX XMBroker Trading Point |

| Domains | www.xm.com www.xmtrading.com www.xmbroker-fx.com www.xmglobal.com www.xmfx.market www.xmfxglobal.org https://www.xmarabia.net www.trading.com https://www.trading-point.com |

| Legal entities | Tradexfin Limited (Seychelles), prev. Trading Point (Seychelles) Limited FinTrade Limited (Mauritius) Trading Point Holdings Ltd (Cyprus) Trading Point of Financial Instruments UK Limited (UK) Trading Point of Financial Instruments Pty Ltd (Australia) TPS Management Limited (Cyprus) Trading Point Asset Management Ltd (Cyprus) XM Global Limited (Belize) Trading Point MENA Limited (Dubai) Trading Point of Financial Instruments Ltd (CySEC) XM International (BS) Limited (Bahamas) |

| Jurisdictions | Seychelles, Mauritius, Cyprus |

| Regulator | CySEC for Trading Point with license number 120/10 CySEC for Trading Point Asset Management with license number 256/14 FCA for Trading Point of Financial Instruments UK ASIC for Trading Point of Financial Instruments FSC Belize for XM Global Limited DFSA for Trading Point MENA Limited CFTC for Trading.com Markets Inc. SCB for XM International (BS) Limited FSA Seychelles for XMTrading FSC Mauritius for XMTrading |

| Leverage | up to 1:30 for CySEC and FCA up to 1:1000 (offshore) |

| Proper KYC | yes |

| Investor protection & Ombudsman | yes, for the CySEC entity no for the offshore scheme |

| Payment options | Credit/debit cards, e-wallets |

| Payment processors | Eurobank Ergasias Payabl, Nuvei, Neteller, Skrill, SticPay |

| Related individuals | Dimitris Dimitriou Constantinos Cleanthous (LinkedIn) Christoforos Livadiotis (LinkedIn) Andreas Loizides (LinkedIn) Marios Papapostolou (LinkedIn) Bilal Waheed (LinkedIn) Rishi Zaveri (LinkedIn) Carol Papantoniou (LinkedIn) Elena Nicolaou (LinkedIn) Constantinos Costa (LinkedIn) |

The Trading Point Group

Until mid-2019, XMTrading was operated by Trading Point (Seychelles) Limited and was a visible part of the Trading Point Group. Around May 2019, the company was renamed Tradexfin Limited, and the website has removed all links to Trading Point.

In addition to the offshore entities FinTrade Limited and Tradefinex, Cyprus-based TPS Management Limited, a subsidiary of Tradefinex, is also named as the operator of XMTrading. The company is managed by Dimitris Dimitriou.

The logos of XM and XMTrading are almost identical; only the addition of “Trading” distinguishes them. The look and feel is also identical. Moreover, XMTrading uses Trading Point’s payment API (payway-cdn.trading-point.com). It is obvious that XMTrading is still closely affiliated with Trading Point Group and XM.

The XFMX.market, XMGlobal.com, and XMBroker-FX.com websites are operated by XM Global Limited in Belize and the CySEC entity, their websites state. Nevertheless, they offer leverage of up to 1:1000.

XM Global Limited, authorised and regulated by the Financial Services Commission (FSC) (license number 000261/397) and Trading Point of Financial Instruments Limited, authorised and regulated by Cyprus Securities and Exchange Commission (CySEC) (licence number 120/10), are members of Trading Point Group.

XMGlobal website

XMarabia.com is operated by the CySEC Entity, the website states.

Compliance Check

XMTrading does not officially accept clients from EEA jurisdictions. However, it was possible for us to register with an EEA residual address in our review on June 21, 2023. The XMGlobal mutations XMFX.market and XMBroker-FX.com officially welcomed EEA residents. In the dropdown menus, the EAA jurisdictions and their locations and streets are stored ready. Evidently, the onboarding of EEA residents is part of the strategy.

We could have theoretically transferred unlimited money to XM Global Limited‘s account at Greek Eurobank Ergasias without verifying our identity or address via international bank transfer in the XMGlobal broker schemes.

When depositing by credit/debit card, the amount was limited to €2,000. As payment processors for card payments, we discovered Payabl and Nuvei.

We would have been able to deposit a maximum of €2,000 before verifying our identity or address as part of the KYC check. Thus, XMTrading is also within the regulatory framework of ESMA.

In terms of leverage, XMTrading is very generous and offers up to 1:1000. In most jurisdictions. However, a maximum of 1:30 is allowed for retail clients. Japan, where the majority of clients apparently come from, is more flexible.

We have assigned an Orange Compliance Rating to the Trading Point Group and its broker schemes.

Share Information

If you have any information about XMTrading, its operators, and its facilitators, please share it through our whistleblower system, Whistle42.