The U.S. Securities and Exchange Commission (SEC) is already looking into the GameStop scheme currently performed. The German and UK regulators BaFin and FCA, too, issued warnings. On the other hand, celebrities like Elon Musk seem to endorse these new stock games driven by online boiler rooms on Reddit or Telegram and online trading platforms and apps like eToro, Robinhood, Interactive Brokers, or Kraken. Illegal social media-based market manipulation or simply the next generation trading approach, that’s the question. Anyway, it’s scammers’ paradise.

Endorsed by celebrities

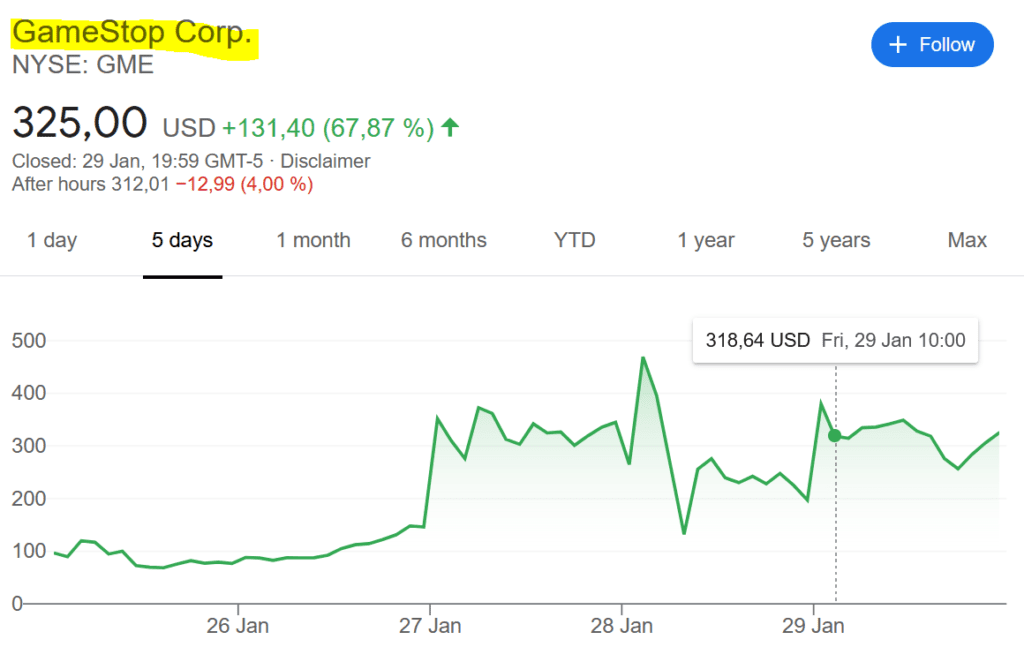

While GameStop (NYSE: GME) shares powered by WallStreetBets already skyrocketed early last week, Elon Musk weighed in (@DavidGelles of NYT) with a one-word tweet — “Gamestonk!!” — and a link to the WallStreetBets Reddit forum. His message was seen as an endorsement of sorts from one of the most influential individuals on the web. In the days that followed, investors bid up GameStop‘s price to new highs not supported by any material events or even phantasies.

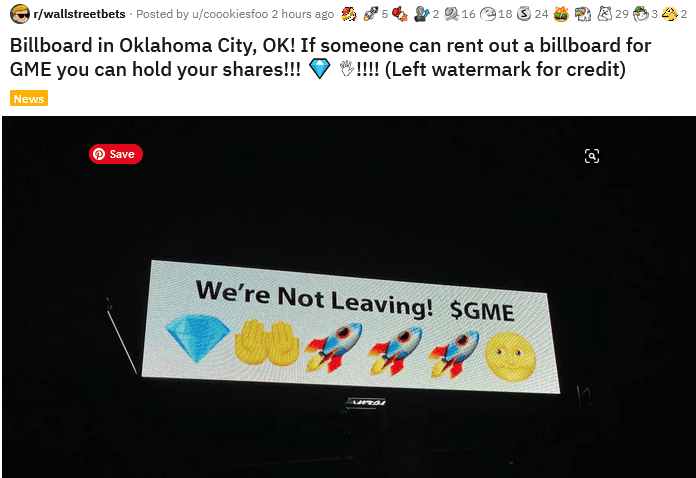

WallStreetBets members have come to stay. They say! And, yes, they walked the talk. They have also not left GameStop so far, despite the seemingly unreal highs of the stock. That’s atypical of the traditional pump-and-dump approach with quick profits for operators. Meanwhile, the forum has over 6.6 million members (and counting). The scheme seems to be designed for sustainability. No fraud or scam intent can be detected. Perplexity? Sure! Interesting? Sure! Market manipulation? Sure as hell? Cybercrime? Not sure now! Time will give us answers!

So far, only the Wall Street money elite has been able to pull off such market manipulation schemes. It takes quite some resources to run such a project. That has apparently now been democratized. Regardless of GameStop’s schemes’ legal assessment, this also poses a huge threat to small investors.

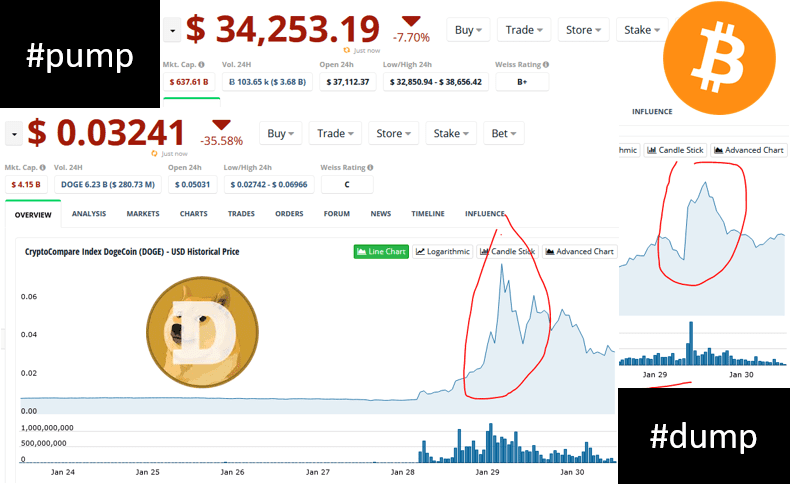

The great champion and role-model of all boiler room and pump-and-dump scheme operators, Jordan Belfort a/k/a The Wolf of Wall Street, said GameStop might be considered a sort of loose market manipulation (collusion). While the GameStop pump was still going on, the next one, Bitcoin (BTC), was already being launched.

It’s truly a modified pump and dump because, at the end of the day, it will most certainly go back down because it’s not trading on any rational, fundamental value

Jordan BelforT (Source: Complex)

Scammers Paradise

Scammers will take advantage of this gamification of assets and securities trading. Previously, it was reserved for scammers to make unrealistic promises about price gains and returns. Therefore, it is only logical that scammers welcome schemes like those of the WallStreetBets Forum with open arms. It is becoming increasingly difficult for investors to distinguish between the good and the bad providers in this environment. This starts with whether WallStreetBets is legal or illegal, a social media-based market manipulation scheme, or permitted activity.

Finally, social trading providers like eToro also offer a similar concept with their copy-trading features. And eToro is considered reputable and is planning a billion-dollar IPO for 2021.

Regulators hell

While scammers applaud the gamification of assets, trading regulators are currently still looking on rather helplessly. Perhaps aside from the U.S. SEC and CFTC, regulators have had issues with new online-based and social media-driven financial products like binary options, CDFs, forex, or crypto for years. This problem is due to a lack of factual expertise as well as country boundaries. The new generation of trading platforms, traders, and scammers knows no country borders and is highly educated.

The German BaFin recently demonstrated this helplessness and incompetence in the case of Wirecard. But that is another story.

Crypto has always been there

The crypto scene has already pulled off such pump-and-dump schemes times and again. Just recently, with Bitcoin (BTC) and DogdeCoin. Crypto traders play the trading game all the time, mostly outside any regulatory framework. Market manipulation campaigns are even easier to execute in the crypto space, with the nearly 4,000 coins and tokens (listed on CoinMarketCap) as unregulated but tradable assets.

Preliminary conclusion

Gamification of the securities sector has come to stay.