updated on 13 Oct 2020 – we included the information received by Kai Petersen who pointed out that FinTech Service GmbH and FinTechServices GmbH would be different legal entities and he was not connected to the latter.

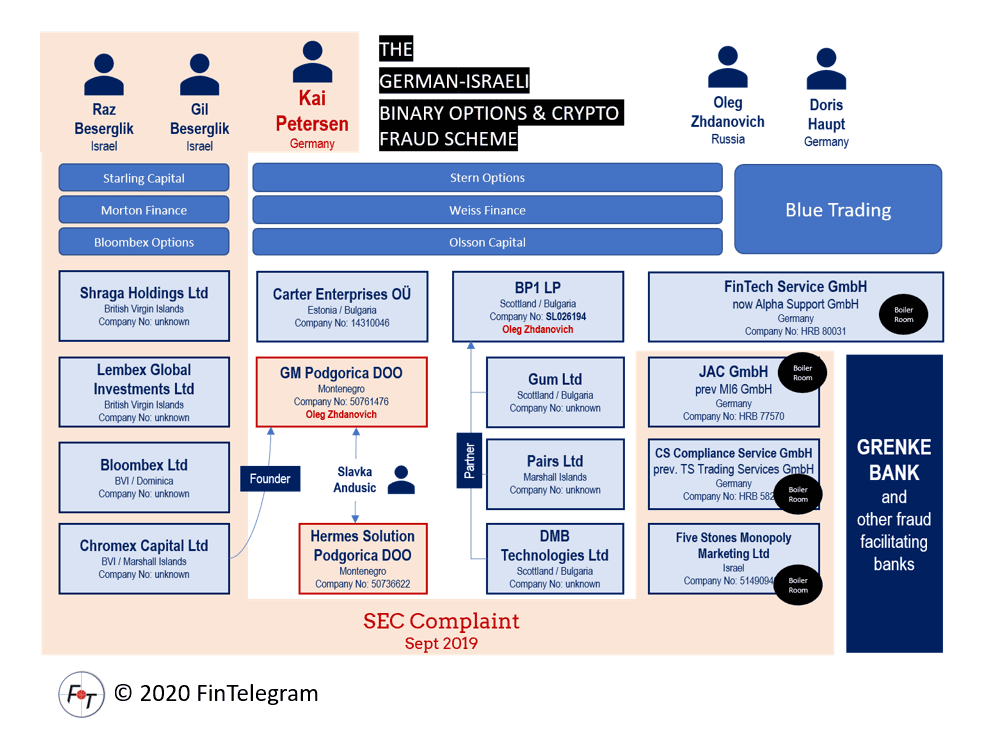

53-year-old Kai Christian Petersen, who lives in Düsseldorf, Germany, has been a major player in the binary options and forex fraud industry between 2014 and 2020, directly or indirectly controlling a number of companies through which scams and boiler rooms were operated and tens of thousands of retail investors were defrauded of hundreds of millions of Euros. The SEC claims that with the three scams, Bloombex Options, Morton Finance, and Starling Capital, Petersen and his accomplices ripped off $100 million. And these were only three of many other scams. Here is the story in a nutshell.

The European Cases

The following European scams by Kai Petersen and his partners have not been charged to date. Although there have been numerous warnings issued by the German financial market authority BaFin in 2018, the responsible law enforcement agency has not yet brought charges. This is quite remarkable and incomprehensible because the fraud case has been known at least since the U.S. SEC filed the suit (see below) and BaFin itself issued warnings and cease-and-desist orders.

Olssen Capital (www.olssencapital.com), Stern Options (www.sternoptions.com), and Weiss Finance (www.weissfinance.com) are scam brokers that have been operated by different legal entities over time. Among them are Carter Enterprises OÜ (Estonia) and GM Management DOO (Montenegro). The GM Management DOO was registered in May 2016 by Chromex Capital Ltd, a company that has already been identified in other scam environments. In September 2019, the U.S. Securities Exchange Commission (SEC) filed a lawsuit against the operators of the Bloombex Options, Morton Finance, and Starling Capital scams, naming Chromex Capital Ltd as one of the operators. More on this SEC complaint below.

Olsson Capital and Weiss Finance, which is still online, are reportedly operated in Sofia, Bulgaria. Stern Options is now offline and disappeared.

Other entities associated with the operation of the scams and controlled by and/or related to Kai Petersen are

- Pairs Ltd, allegedly registered in the Marshall Islands, against which the German BaFin issued several warnings in August 2018;

- Gum Ltd allegedly registered in the Marshall Islands, against which the German BaFin issued a warning in August 2018;

- DMD Technologies Ltd allegedly registered in the Marshall Islands;

- BP1 LP registered in Scotland with Pairs, Gum, and DMD Technologies as its partners and controlled by the Russian Oleg Zhdanovich (UK Companies House).

- GM Management DOO registered in Montenegro and controlled by the Russian Oleg Zhdanovich who also controls the UK BP1 LP (see above).

- several companies registered in Düsseldorf, Germany:

- Premier Infra GmbH (previously CS Compliance Service GmbH, TS Trading Service GmbH, and Finexo Service GmbH)

- JAC GmbH (previously MI6 GmbH), and the

- Alpha Support GmbH (previously FinTech Service GmbH)

The German regulator BaFin issued Cease and Desist Orders against all three companies in August 2018.

Only a few days after the BaFin Cease and Desist Orders the German companies of Kai Petersen started to substantially change.

- FinTech Services GmbH and JAC GmbH were merged into Alpha Support GmbH in August 2018 and the German citizen Doris Haupt was appointed managing director instead of Kai Petersen. On the same day as this merger,

- CS Compliance Service GmbH was renamed Premier Infra GmbH. Doris Haupt was also appointed as managing director.

The Blue Trading Connection to Grenke Bank

Sometime in 2017 many scam brokers have started to bet on cryptocurrencies. One of the biggest crypto scams in the dawning crypto era was Blue Trading. This was a highly professional scam that, thanks to the crypto, left little trace when it suddenly disappeared in early 2019. Even the domain www.bluetrading.com was bought with Bitcoins (BTC). One of these rare traces leads to Kai Petersen and his FinTech Service GmbH.

A company with the almost identical name FinTechServices GmbH also registered in Dusseldorf, Germany, had an account at the German Grenke Bank and through this account victims of Blue Trading have made deposits. Although this is a different legal entity we believe that it is related to Kai Petersen. What are the odds that another legal entity in Dusseldorf with a Dusseldorf-based director may be involved in the very same type of scams?

So Kai Petersen must know the scammers behind Blue Trading. He laundered the money for them via FinTech Service. Therefore Petersen must know the names of the scammers, their companies, and bank accounts. Via Grenke Bank, the law enforcement agents can follow the money trail.

The U.S. Fraud Complaint

When the BaFin issued the Cease and Desist Orders against Kai Petersen‘s companies in August 2018, the U.S. Securities Exchange Commission (SEC) was already investigating fraud on “big style” binary options. At that time, Petersen’s German companies had already changed their names for the first time.

In September 2019, Kai Petersen and the Israeli Gil Beserglik, 64, and his son Raz Beserglik, 34, were sued by the SEC for $100 million in binary options fraud. The SEC refers to the brands Bloombex Options (www.bloombex-options.com), Morton Finance (www.mortonfinance.com), and Starling Capital (www.startlingcapital.com).

The Securities and Exchange Commission today charged three foreign individuals, Gil Beserglik, Raz Beserglik and Kai Christian Petersen, with deceiving U.S. investors, including vulnerable retirees, and causing them to lose tens of millions of dollars through fraudulent, online sales of high-risk securities known as binary options.

SEC press release Sept 26, 2019

The SEC’s complaint alleges that Kai Petersen operated boiler rooms and thus defrauded investors through CS Compliance Trading Service GmbH (previously TS Trading Services GmbH), JAC GmbH (previously MI6 GmbH), and Five Stones Monopoly Marketing Ltd (now renamed into Silverpop Media Ltd) in Israel.

Real estate it is

According to the Times of Israel, several members of the Beserglik family are involved in the real estate industry. When Gil Beserglik opened a bank account for his Shraga Holdings Ltd in October 2015, he told the bank “he now invests in real estate and is the owner of Bloombex Options with his son Raz Beserglik.”

Public records show Gil Beserglik owns several real estate related companies in Germany (see German companies register intel here). Meanwhile, his brother, Yishai Beserglik, owns Beserland Properties, an Israeli company that advertises high-end luxury apartments in Tel Aviv.

The Israeli Gal Barak, convicted in Austria in early September 2020 for his broker scams, has also invested a significant portion of the stolen funds in real estate. These properties of Barak, as well as those of the Beserglik family, belong to the victims of their fraud schemes. The good news is that real estate cannot disappear. In the event of an indictment, they can be confiscated by the authorities.