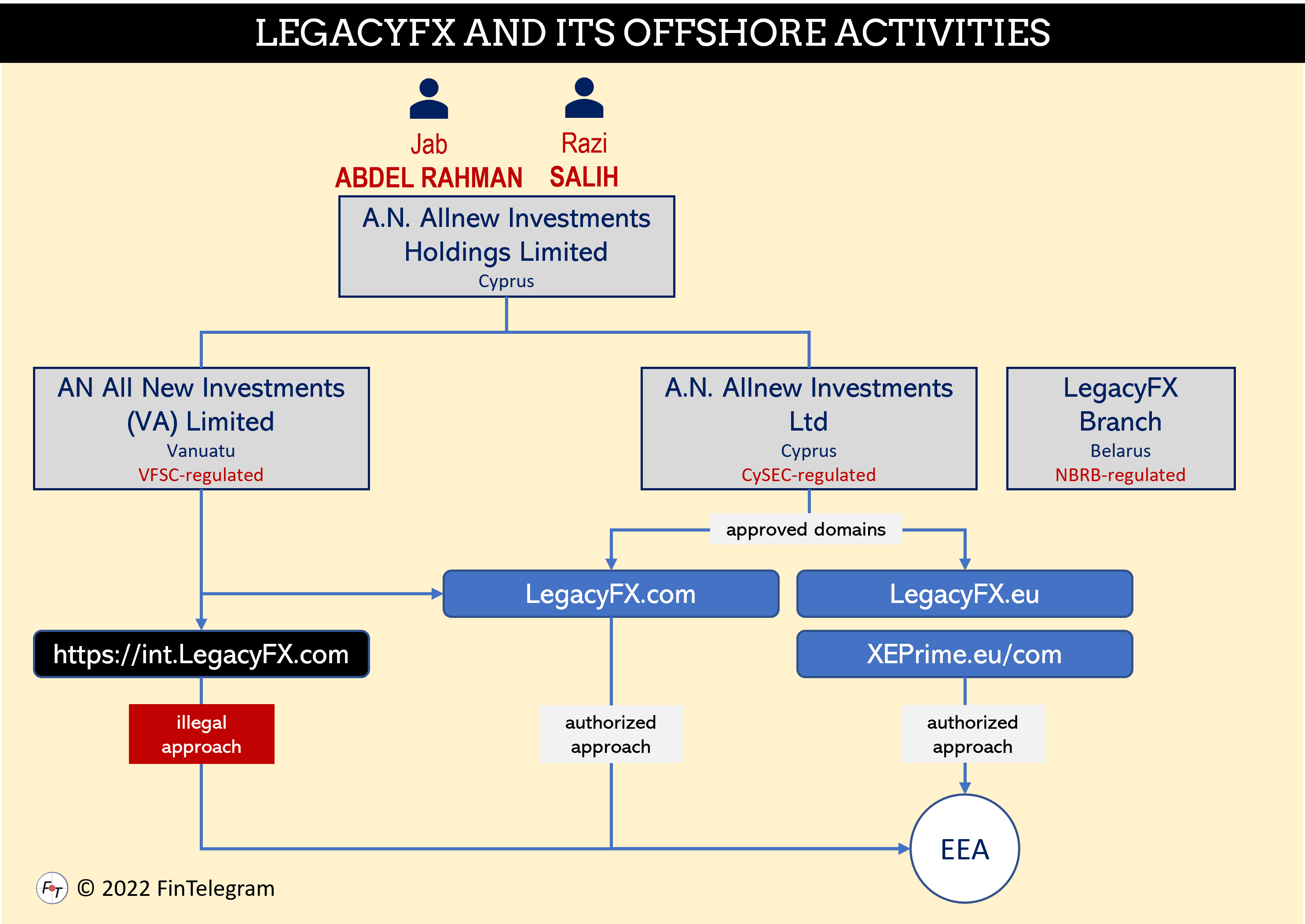

Offshore onboarding to circumvent ESMA and FCA guidelines is still a big issue for European regulators. Especially CySEC has had a problem with this approach for years, as FinTelegram has pointed out repeatedly. Most recently, in a new review of CYSEC-regulated FXORO, we found that the CIF continues with offshore onboarding of European retail investors systematically in violation of regulatory requirements, as does LegacyFX. We published our first LegacyFX review in March 2021 and exposed its offshore approach, which it runs until today. Here is our updated review.

Key data

| Trading name | LegacyFX XE Prime |

| Domains | https://legacyfx.eu (CySEC approved) https://legacyfx.com (CySEc approved) https://int.legacyfx.com (Vanuatu) www.xeprime.eu (CySEC approved) www.xeprime.com (CySEC approved) |

| Legal entities | A.N. Allnew Investments Ltd regulated by the CySEC with the license number 344/17 AN All New Investments (VA) Limited regulated by the Vanuatu Financial Services Commission (VFSC) under license number 14579 LegacyFX BY (Belarus) regulated by NBRB |

| Related individuals | Jab Abdel Rahman, Razi Sahli |

| Regulators | CySEC, VFSC, NBRB (National Bank of Belarus) |

| Jurisdictions | Cyprus, Vanuatu, Belarus |

| Payment processors | Praxis Cashier (old), BridgerPay (new) Perfect Money, Sofort, Volt, Jeton, Finrax, Xentum, Trust Payments |

The narrative

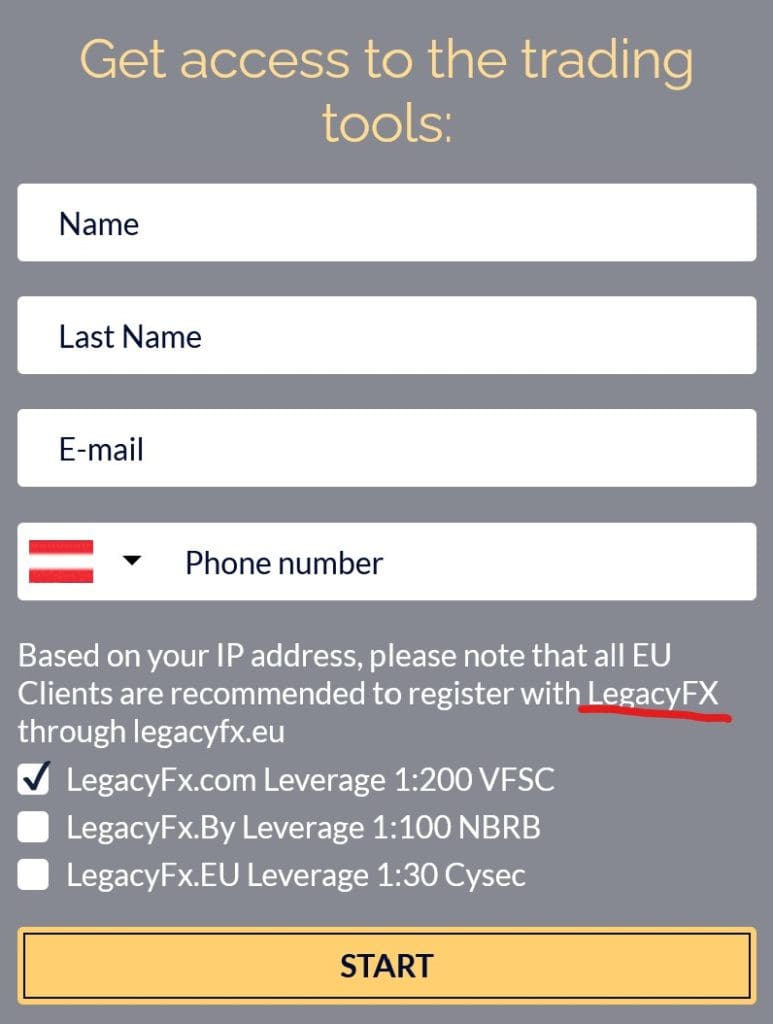

EU residents, when registering on the offshore site of LegacyFX.com, are asked which leverage they want to have and with which regulator – VFSC, NBRB, or CySEC – they want to register. When selecting the leverage 1:200 and VFSC, one still receives the hint that ESMA is not responsible for this site and therefore, registration is at your own risk.

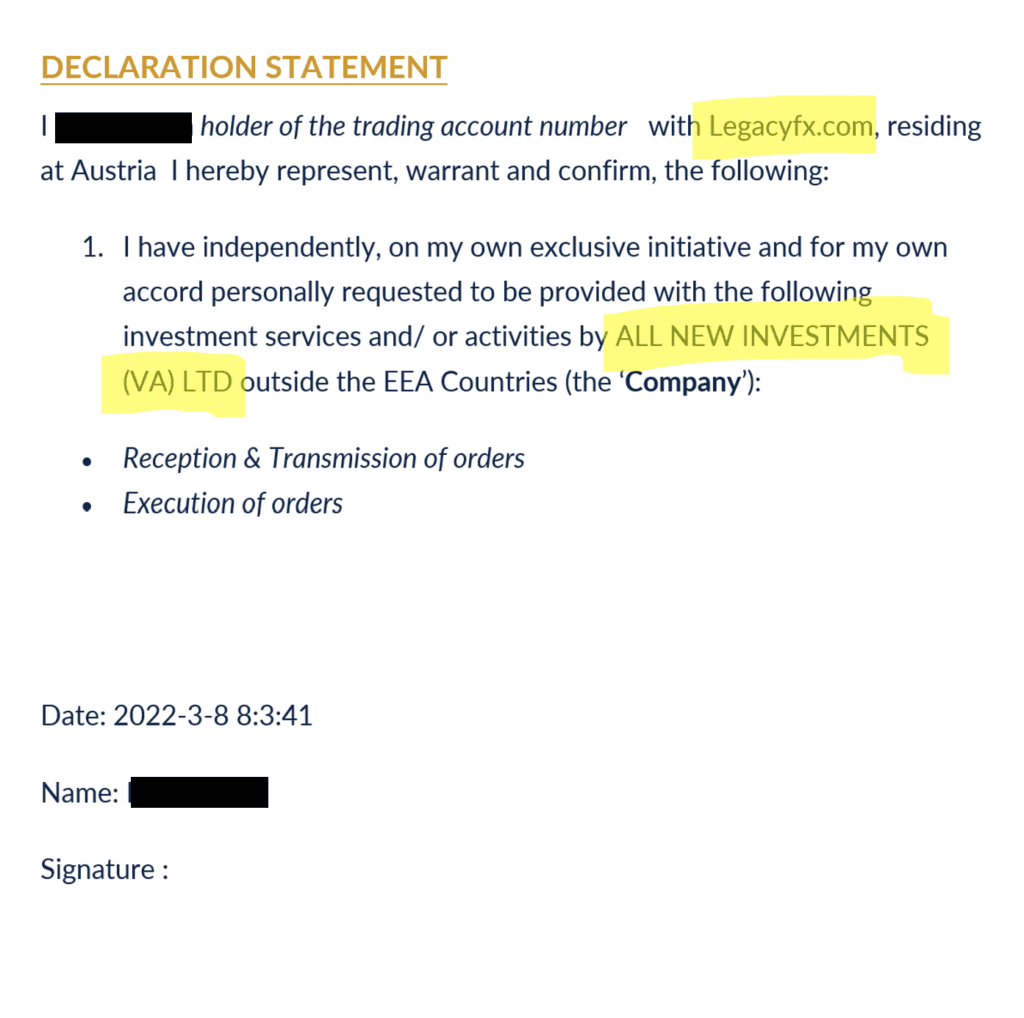

In addition, you will receive a declaration statement by email, which you should sign. In this statement, the new offshore client confirms that he has decided to register on his own initiative. This Declaration Statement should be signed.

In our review on 8 Feb 2022, we have registered for the 1:200 leverage broker with the VFSC-regulated AN All New Investments (VA) Ltd. Although we did not sign this Declaration Statement, did not verify our ID or address, we could have theoretically made unlimited deposits.

Unlimited pre-KYC deposits

In particular, the following limits have been stated with the different payment options:

- unlimited deposits via bank transfer through Volt or by credit and debit card.

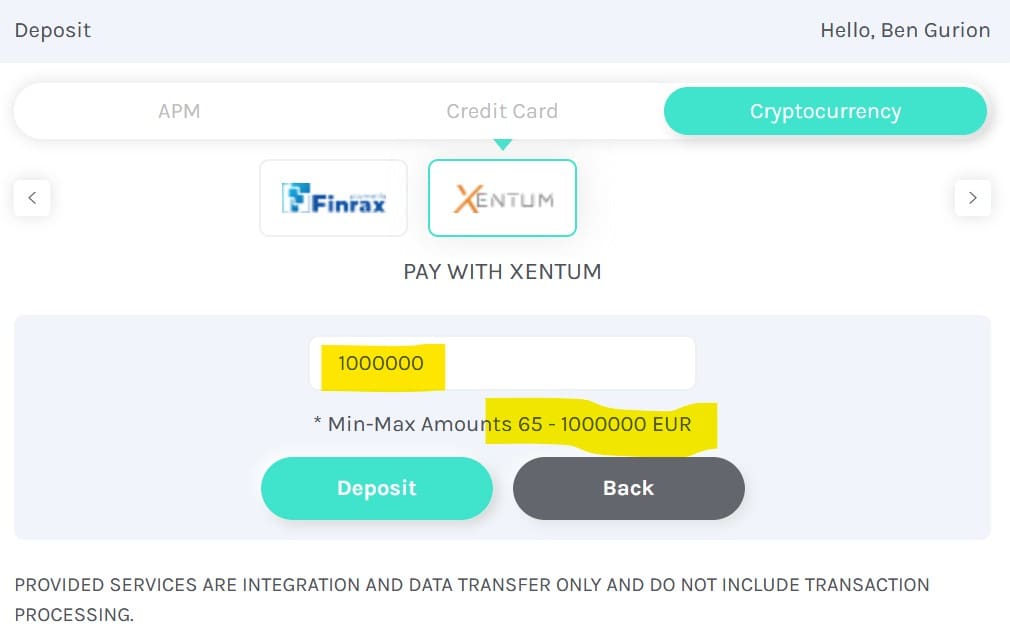

- up to €200,000 via Swiss payment processor Xentum

- up to €200,000 via crypto exchange Finrax

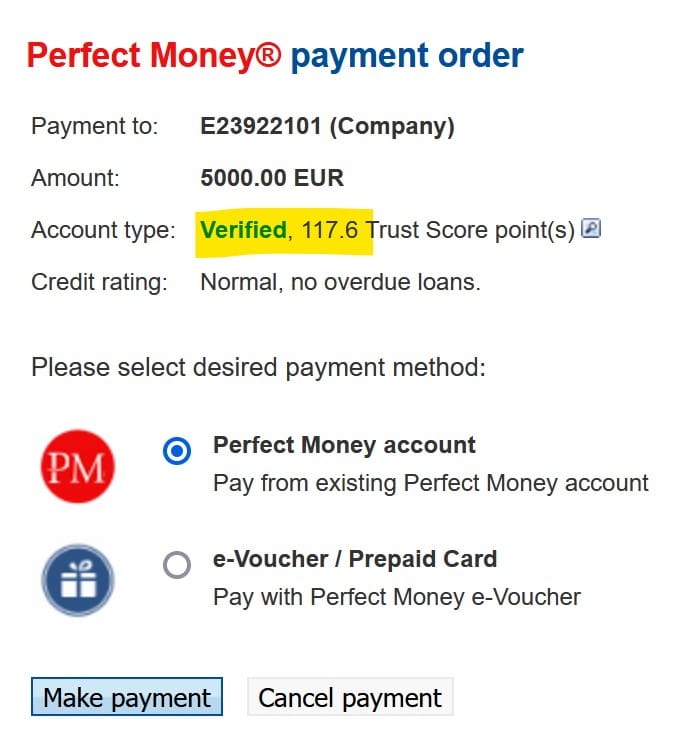

- up to €100,000 with the Russian Perfect Money

- up to €50,000 with Jeton

Payment services for credit and debit cards and bank transfers go through BridgerPay Cashier. Bank transfers are processed through Volt (https://volt.io). In addition to BridgerPay, there is also the option to make deposits with credit cards through Trust Payments.

Conclusion

LegaxyFX, as well as other CySEC CIFs, systematically use offshore onboarding to circumvent and violate ESMA and CySEC regulatory requirements. Neither the onboarding procedure (without proper KYC/AML) nor the offered leverage of up to 1:200 complies regulatory requirements in UK and EU. The reference that the customer does as at their own risk is ineffectual. How many minutes do you think it would take a LegacyFX call center to convince the client of the benefits of the offshore broker?

It would be very easy for LegacyFX, FXORO, IC Markets, and the other CIFs to apply algorithmic procedures to prevent UK or EU clients from registering with the offshore entity. The truth, however, is that this offshore onboarding is done wilfully and knowingly. The payment options are designed for European customers with SEPA transfers and accounts in the UK or EU.

Clients of offshore entities are not entitled to investor compensation schemes or other ESMA intervention measures. They are also not entitled to assistance from Financial Ombudsman institutions.

Share information

If you have any information about LegacyFX, its operators and partners, please share it with us through our whistleblower system, Whistle42.

I have fallen into this LegacyFX trap and lost a significant of money after they intentionally provided me with poor trades, im now in the process of trying to revocer some of it – what are the legal implications of this strategy used by LegacyFX. Would it be viewed as breaking laws in court?