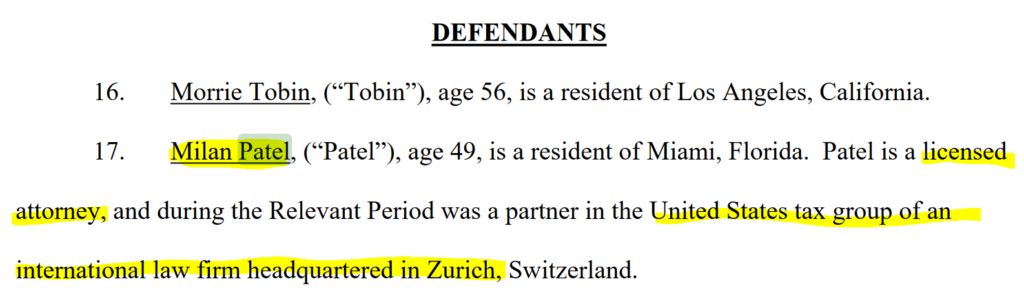

On January 13, 2020, the U.S. Department of Justice announced that the British citizen Roger “Rocket” Knox, 49, founder and operator of Swiss asset management firm Wintercap pleaded guilty to securities fraud and conspiracy to commit securities fraud before U.S. District Court Judge Nathaniel M. Gorton. The respective sentencing was scheduled for April 2020. His co-conspirators Matthew Ledvina, Milan Patel and Morrie Tobin have also pleaded guilty and await sentencing. According to the U.S. regulator SEC, Knox’s scheme used Michael Gastauer‘s Black Banx (previosly “WB21“) group of companies to launder the scheme’s illicit proceeds. Knox was arrested in October 2018 and remains in custody until the scheduled sentencing the court ordered.

Securities manipulation scheme with WB21 and Michael Gastauer

Roger Knox and his co-conspirators operated a purported asset management firm based in Switzerland called Silverton (later renamed Wintercap). Through his Swiss-based companies, Knox operated a pump-and-dump and other market manipulation schemes. The scheme sold massive quantities of microcap securities on behalf of so-called “control groups” who secretly owned the stock through nominee shareholders, and who simultaneously orchestrated promotional campaigns and other efforts to artificially inflate the price and trading volume of those shares. Knox then laundered the proceeds of the securities fraud—totaling an estimated $164 million over the last three years—to his co-conspirators in the United States, and elsewhere, through a complex money-laundering system that disguised the source and nature of the funds.

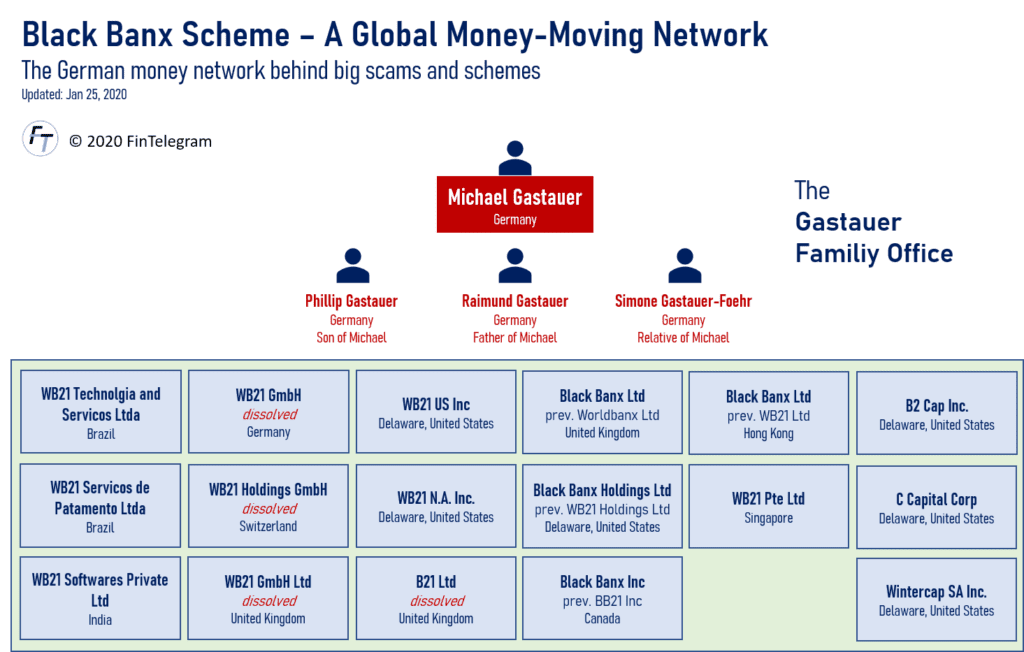

According to the findings of the U.S Securities and Exchange Commission (SEC), Knox laundered the illicit proceeds of his scheme through the WB21 Group of the German Michael Gastauer and his WB21 Group. As reported by FinTelegram, the SEC filed a complaint against Roger Knox, Michael Gastauer and their respective legal entities in October 2018. Allegedly, Gastauer via his U.S. companies alone controlled more than 20 bank accounts for the purpose of facilitating Knox’s securities manipulation scheme. Gastauer allegedly transferred millions of dollars of illicit scheme proceeds to his family office members.

According to Amy Castor’s latest article on the case on Modern Consensus, Judge Richard Stearns of the District Court of Massachusetts ordered an asset freeze on more than 100 accounts in 33 banks around the globe three weeks after the SEC complaint.

In March 2019, Amy Castor, a senior editor with Modern Consensus and an investigative blogger, published a worthwhile reading article on Michael Gastauer, his WB21, their involvement in QuadrigaCX, and the Gastauer’s dark or colorful past. On Twitter, Amy has reported that she and other critical journalists have been threatened after the reports. FinTelegram has also received reports that critical people have been threatened by WB21 and hired people.

It may or may not be a coincidence that the “Global Head of Litigation” of WB21 who threatened Amy Castor with legal proceedings is a certain person called Amish Patel. One of the co-conspirators that pleaded guilty goes by the name Milan Patel. This 49-years old guys is a licensed attorney in Florida and also one of the Defendants in the SEC complaint.

WB21, Black Banx, and the Canadian Quadriga connection

In Q1 2019, WB21 was rebranded into Black Banx (www.blackbanx.co). The group’s Canadian Black Banx Inc. has been operating as a registered Money Service Business (MBS) in Toronto since June 2018. Gastauer’s payment processing network not only supported Knox’s securities manipulation scheme but was also involved in the strange case of the Canadian crypto-exchange QuadrigaCX.

The crypto-exchange collapsed after the mysterious death of its founder and CEO Gerald Cotten in December 2018. Allegedly, QuadrigaCX owes its customers roughly $250 million CAD ($190 million) in both crypto and fiat. Two-thirds of those funds are cryptocurrencies stuck in cold wallets that allegedly only the company’s dead Gerald “Gerry” Cotten held the keys to.

The founder seemingly had sole control or knowledge of QuadrigaCX’s cold storage solution. Most of the users’ deposited crypto-funds became unavailable with Cotten’s death and some of it may be lost for good. Moreover, the exchange’s access to its fiat holdings has also been severely compromised. QuadrigaCX used payment processors to send and receive Fiat funds.

The company filed for creditor protection. A Canadian court-appointed EY as bankruptcy Trustee and Monitor.

WB21 (n/k/a Black BanX) was one of QuadrigaCX‘s payment processors and accepted wire transfers on behalf of QuadrgaCX. According to an affidavit of Cotten’s widow Jennifer Robertson, WB21 holds roughly US$9 million of QuadtigaCX’s Fiat funds but is refusing to release them or respond to communications from Quadriga.

In it’s Fifth Report, EY explained that WB21/Black Banx purportedly was holding approximately some US$9 million on behalf of QuadrigaCX. WB21/Black Banx, however, claimed it was holding only $11.77 and US$5.53 on behalf of collapsed exchange. Furthermorе, the group claimed that the Canadian WB21/Black Banx was not involved with QuadrigaCX at all. They have yet refused to provide any supporting documentation to the Trustee.

EY has also become aware that User Fiat funds were wired to bank accounts of different companies of the former WB21 Group. The appointed QuadrigaCX Trustee is considering steps that could be taken against WB21/Black Banx to recover these Fiat funds.

In January 3030, the U.S. FBI announced that it is investigating the circumstances around the crypto exchange’s collapse. According to an email sent to multiple users of the exchange and shared with CoinDesk, Valerie Gauthier, a victim specialist with the FBI, has been reaching out to former users of the exchange to alert them of a new FBI portal containing information about the case, confirming that the investigation continues.

Preliminary conclusion

It is a fact that Black Banx is not a bank and the WB21 Group was not a bank either. Never! This fact, however, contradicts the many public statements of the beneficial owner and manager Michael Gastauer. From the SEC complaint but also from descriptions of lawyers involved in the OneCoin scam it is perfectly clear that the Black Banx or WB21 is a network of companies and bank accounts distributed over different continents and jurisdictions under the central management of Gastauer and his family. Gastauer provided this network to scams such as OneCoin or securities fraudsters such as Roger Knox or to Gerry Cotten and his QuadrigerCX in order to process legally and/or regulatory questionable payments.

In reality, WB21 Group was not a registered bank, and Gastauer’s ‘solution’ was actually a circumvention of banking regulations designed to disguise his clients’ … identities. In account opening forms, Gastauer made false statements to banks, describing WB21 US Inc. as a software company that had Appleand Google as “major suppliers.

[…] the primary source of funds in the WB21 US Inc. bank accounts were deposits from Wintercap SA’s bank accounts in Latvia and Mauritius. Indeed, Gastauer enabled Knox to move millions of dollars throughGastauer’s U.S. bank accounts under the false pretense that the money was generated throughWB21 US Inc.’s purported venture capital business.

Securities and Exchange Commission v. Roger Knox et al., No. 18-cv-12058

Up until today, we are not aware of any criminal charges or convictions related to WB21 and/or Michael Gastauer and/or the Gastauer Family Office. The SEC complaint, however, charges WB21 and Michael Gastauer with money-laundering activities. Claims that WB21 is withholding QuadrigaCX money are currently only allegations raised by involved parties.