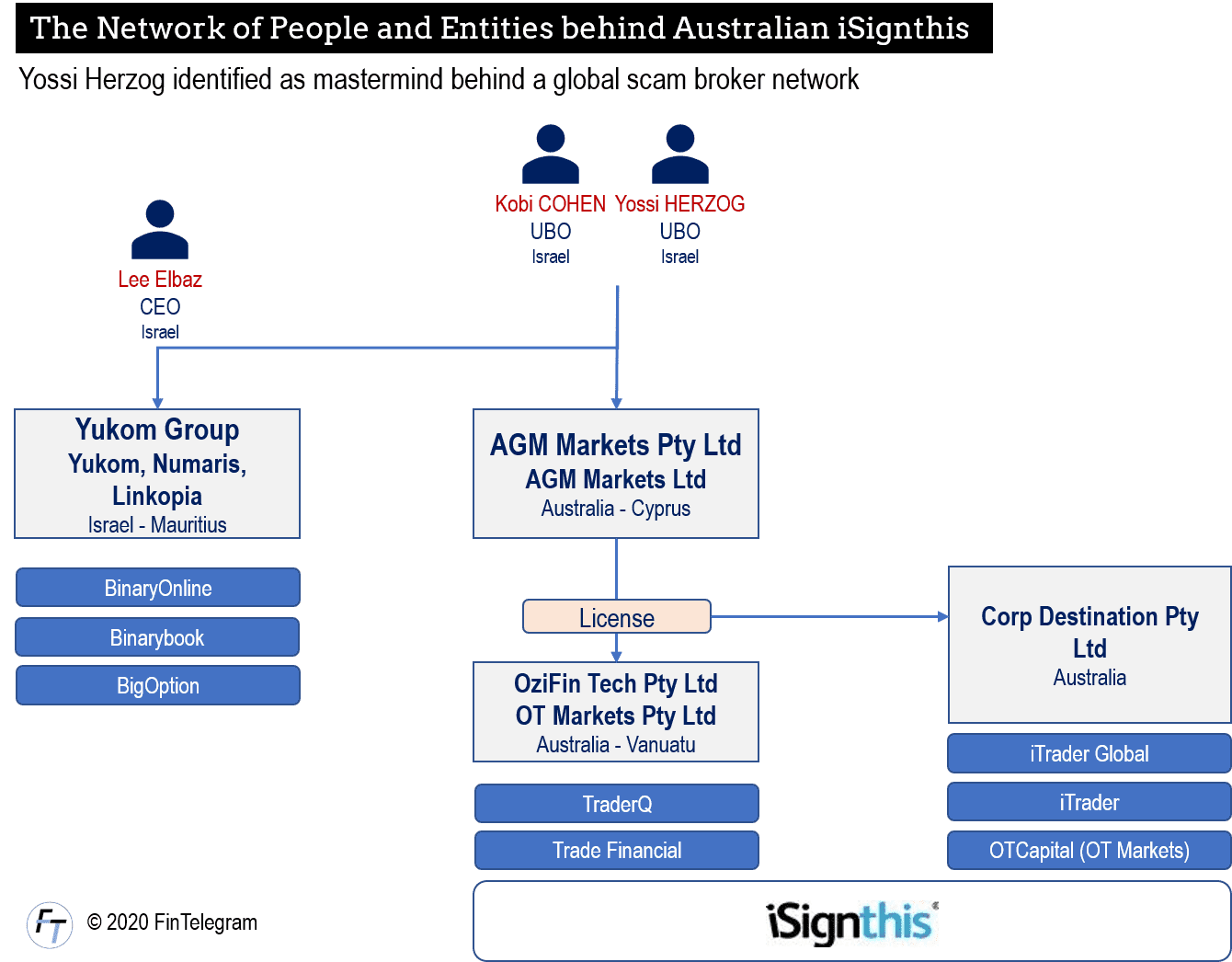

Since the collapse of the Israeli-controlled binary options industry, legal processing has taken place from the USA to Europe to Australia. The U.S. authorities and courts have taken on the pioneering role. The conviction of the former CEO of the Israeli Yukom Communications Ltd, the Israeli Lee Elbaz, was a worldwide precedent. A total of 20 people have been charged in the Yukom case in the United States. Besides Lee Elbaz, five other persons of the Yukom scheme have pleaded guilty of fraud with binary options. First prison sentences and fines were already imposed. Behind Lee Elbaz and Yukom, however, stood the Israeli Yossi Herzog and his junior partner Kobi Cohen. The two have now also been indicted in the USA. It is currently questionable, however, whether the two will voluntarily surrender to the U.S. authorities.

The Global Broker Scam Network

Yossi Herzog is also the economic owner of other broker scams on other continents. It seems that between 2014 and 2018 he set up a worldwide network of broker scams and acquired the corresponding companies and front persons.

In Australia, Yossi Herzog and Kobi Cohen were identified as the beneficial owners of AGM Markets Pty Ltd by ASX. This company originally received a broker license from ASIC, the Australian Financial Markets Authority. Under the AGM license umbrella, the Australian Corp Destination Pty Ltd, for example, operated broker scam schemes. The scam sites Oinvest and Global.iTrader were operated via this Corp Destination. Two Israelis acted as front men for the Corp Destination in Australia.

The iSignthis involvement

The Australian broker scams of AGM Markets and their licensees have processed their payments via the public-listed Australian iSignthis Ltd (ISX). ISX is something like the Australian WireCard – the listed fintech superstar. However, as with WireCard, massive criticism has recently been voiced.

The managers of iSX wanted to treat themselves to a $500 million bonus share package. The stock exchange supervisory authority ASX took this as an opportunity to investigate the ISX. Many questionable transactions have already been uncovered. ISX managers led by founder John Karantzis have a number of questions to answer.

ASX’s investigations have in turn brought a number of new findings related to the activities of Yossi Herzog and Kobi Cohen. The points can now be connected.

The Netherlands Connection

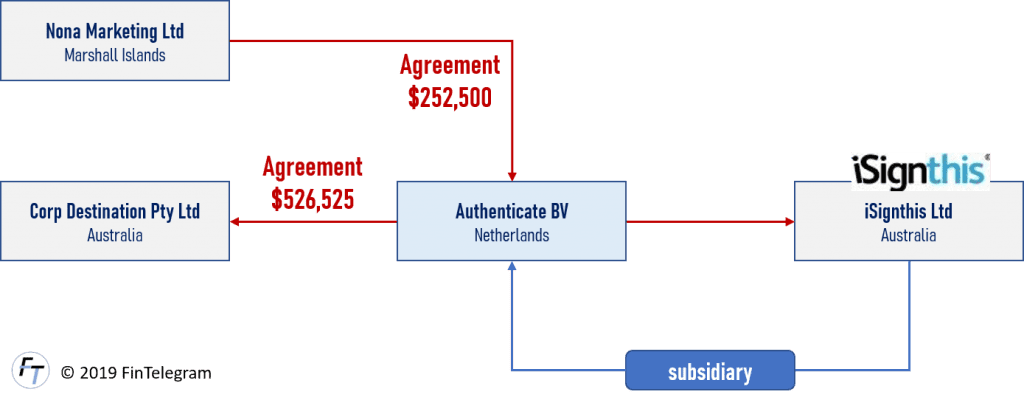

The connections of the Australian ISX extend as far as Europe. Subsidiaries in the Netherlands and Cyprus and the corresponding contracts have become known. The ASX research has also shown that by June 2018 most of ISX’s binary options and CFDs revenues will have passed through the Netherlands, where ISX had its subsidiary Authenticate BV. Through this subsidiary, ISX recorded revenues of $526,525 in the June quarter of 2018 which derived from a contract with Corp Destination Pty Ltd. Interesting, isn’t it? Two Australian companies do business through the Netherlands. The ASX apparently also finds this questionable (find ASX Query letter and answers here).

Authenticate BV was also instrumental in the conclusion of other interesting contracts such as those with Nona Marketing Ltd, Marshall Islands, which were publicly questioned by ASX. This agreement generated $252,500 in April 2018 alone. Nona Marketing is in turn associated with broker scams such as FTO Capital (see FCA investor warning).

The Australian ASIC and supervisory authorities of other jurisdictional regimes have issued numerous investor warnings against ISX’s largest clients such as OziFin, OT Markets, and their broker scams (see this ASCI warning published Feb 2018).

The ASX details that ISX’s forex and CFD revenue derived entirely through the Netherlands and plunged from $1.86 million in June to just $34,166 in July 2018 (read also The Sidney Morning Herald). ISX’s explanation is very interesting – they blame this on the collapse of its Danish partner KBH Andelskasse which has been shut down because of money laundering issues. But this is another story. Stay tuned.

will be continued

[…] Read the story of AGM Markets and Yossi Herzog […]