For disappointed or deceived clients, there is the option of a chargeback as a last hope when paying by credit card or bank transfer. A chargeback reverses a money transfer from the client’s bank account or credit card and is ordered by the card-issuing bank. However, the dispute initiated by clients against the seller (merchant) is not straightforward and, unfortunately, far too often unsuccessful. In the case of payments or deposits via cryptocurrencies, even the chance of chargeback is zero. Many high-risk merchants require deposits via credit card through crypto exchanges like Binance. We strictly advise you not to do that!

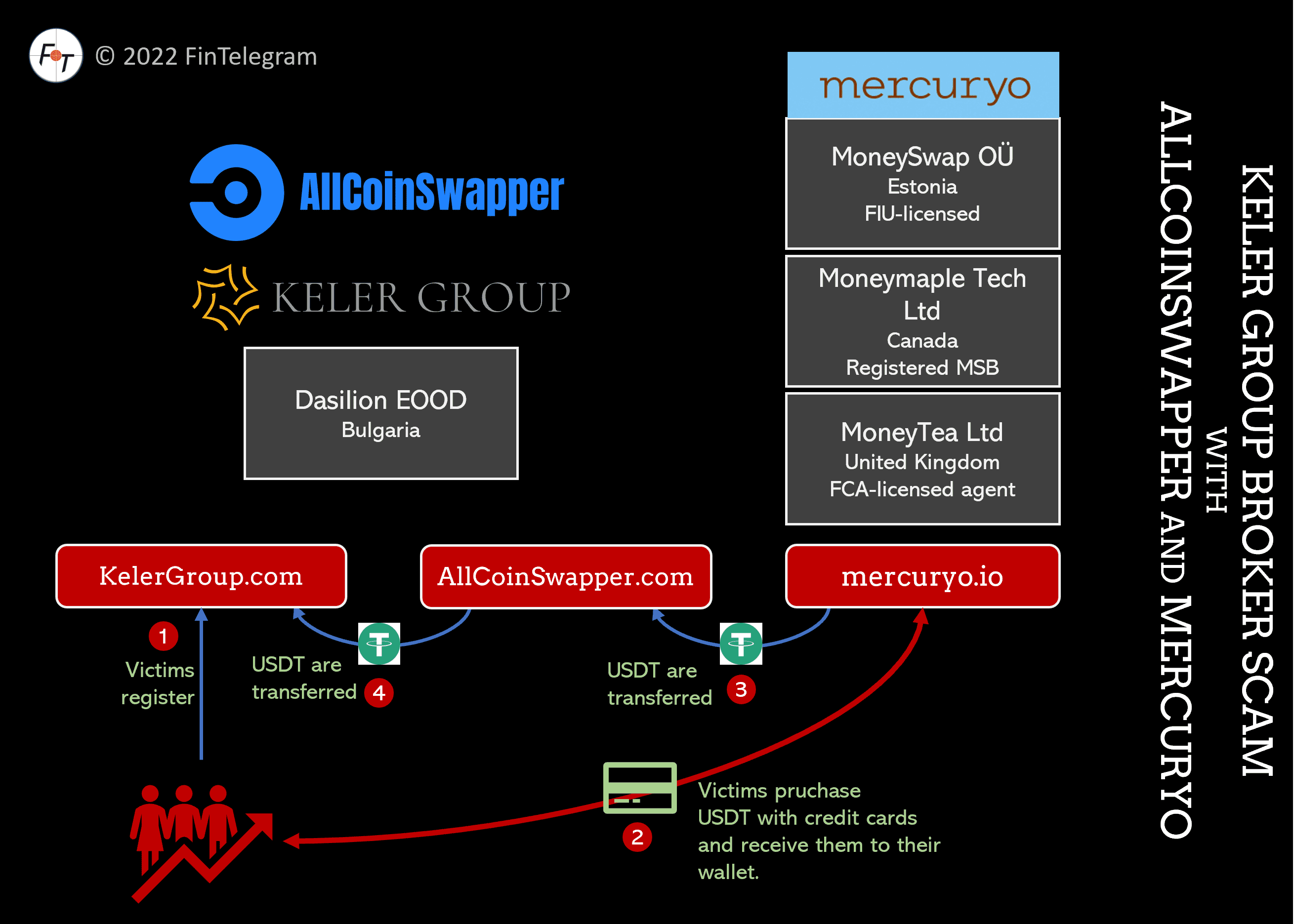

We last reported at the broker scam Keler Group how deposits via credit and debit cards work:

- Clients register with the scam broker (in that case Keler Group) and are asked to make deposits via credit and debit cards

- For credit card deposits, clients are then redirected to a regulated or unregulated crypto exchange such a mercuryo where cryptocurrencies are purchased with the card. From the credit card company’s perspective, the crypto exchange is then the merchant.

- The purchased cryptocurrencies are then transferred to the client’s wallet, meaning that the merchant has properly delivered to the cardholder and fulfilled the respective order by the book.

- The cryptos are then transferred to the broker’s wallet (in this case to Keler Group) and away they go. Forever!

If the client starts a chargeback dispute, he has no chance. Because the card accepting merchant, the crypto exchange, can prove that it has properly delivered the cryptos. The chargeback dispute has almost no chance.

Under any circumstances, avoid depositing via cryptocurrencies at high-risk merchants such as online brokers, online casinos, or adult entertainment at all costs. You are giving away your chargeback parachute!