S&K: A German Ponzi Scheme and Its Consequences

Jonas Koeller and Stephan Christoph Schaefer, founders of the S&K Group, are at the center of one of Germany’s largest real estate fraud cases. Between 2008 and 2013, they collected over €240 million from around 11,000 investors. Their business model: purchasing properties from foreclosures, artificially inflating their value, and reselling them multiple times through a network of funds. Glossy brochures, TÜV seals, and supposed securities created an illusion of legitimacy, but in reality, it was a Ponzi scheme—new investor funds were used to pay out returns and finance the founders’ lavish lifestyle.

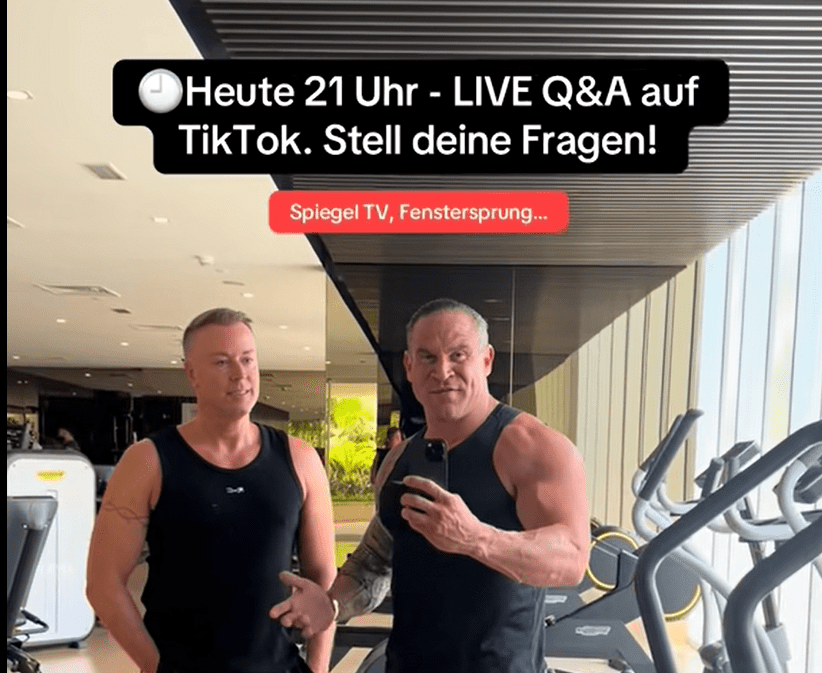

The scandal ended with prison sentences for Koeller and Schaefer, who were each sentenced to eight and a half years in 2017. Despite the official loss figure of €240 million, insiders believe the real losses were significantly higher. Large sums of money remain missing. Today, both men reportedly live in Dubai, presenting themselves once again as real estate experts on social media and offering tips for getting rich quick—a slap in the face for their victims.

Signa and René Benko: The Next Billion-Euro Disaster

The recent revelations surrounding the Signa Group and its founder René Benko show that the real estate sector remains a gateway for large-scale fraud and embezzlement. Benko, once celebrated as a model entrepreneur, built an opaque network of companies that spectacularly collapsed with the downfall of the Signa Group at the end of 2023. The damage: at least €2.4 billion in claims, with numerous creditors and investors facing total losses.

Read our reports on Rene Benko here.

As with S&K, huge sums disappeared within the labyrinth of Signa’s corporate structures. Investigators in several countries are examining whether funds from real estate projects were misappropriated, diverted, or even transferred abroad. Allegations include serious fraud, embezzlement, money laundering, and forming a criminal organization. Particularly alarming: at Signa, investor and bank funds were apparently not invested as promised in specific projects, but instead used to plug financial holes within the group or disappeared into private foundations and trust accounts.

Comparison: S&K and Signa – Patterns, Methods, Consequences

| Aspect | S&K (Köller/Schäfer) | Signa (Benko) |

|---|---|---|

| Period | 2008–2013 | 2000s–2023 |

| Damage | €240 million (insiders: much more) | >€2.4 billion |

| Method | Ponzi scheme, overvaluation, false prospectuses | Misappropriation, corporate maze, fund diversion |

| Investigations | Fraud, embezzlement, Ponzi scheme | Fraud, embezzlement, money laundering, criminal organization |

| Where’s the money? | Largely disappeared, luxury life in Dubai | Billions missing, investigations ongoing |

| Consequences | Prison, personal bankruptcy, comeback as social media coaches | Arrest, international investigations, personal bankruptcy |

| Victims | 11,000 investors | Banks, investors, funds, public sector |

Critical Analysis: Systemic Weaknesses and Lessons Unlearned

Both cases show striking parallels: opaque structures, lack of oversight, the calculated exploitation of investor trust, and a judiciary often overwhelmed by complexity. While S&K’s funds fueled luxury and excess, Signa’s money vanished into an international corporate labyrinth that remains barely penetrable. In both cases, victims have little hope of recovering their losses.

Remarkably, the Koeller and Schaefer quickly returned to the public eye after their legal reckoning as social media coaches (S&K Comeback).For June 13, 2025, for example, the two have announced a live session from their luxury yacht in Dubai on TikTok (link). It is easy to imagine what the next few years will look like for Benko. Dubai and luxury yachts will not be on the agenda anytime soon. But it is definitely a long-term prospect.

Oversight failed in both cases; the controls of the gray capital market and real estate finance proved inadequate.

Conclusion

The scandals surrounding S&K and Signa are not isolated incidents but symptoms of a system that enables fraud on a billion-euro scale—with dramatic consequences for investors, banks, and the public sector. Despite all legal proceedings, the central question remains: Why is it repeatedly possible for such vast sums to simply vanish in the real estate sector? And how is it that the main perpetrators can return to the stage after the collapse of their empires—often with the same promises as before? As long as these questions remain unanswered, the real estate market will continue to be a dangerous terrain for investors and a paradise for fraudsters.