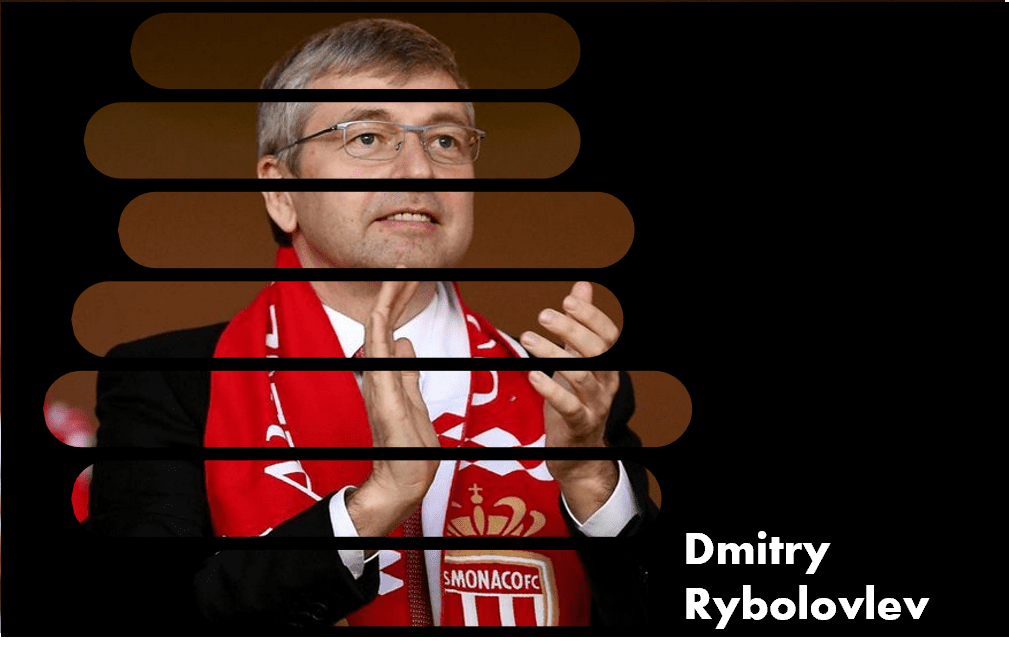

Billionaire Dmitry Rybolovlev is contemplating the sale of his majority stake in the prestigious AS Monaco football club. This move comes amidst growing interest from potential American investors. Rybolovlev, a Russian tycoon who has been residing in Monaco for over a decade and is not subject to sanctions, reportedly received at least two purchase offers from American parties last year.

According to a recent report by the French newspaper Les Echos, Rybolovlev has engaged the services of the Raine Group, an investment bank known for its expertise in major sports deals, as his exclusive financial advisor. The Raine Group‘s role is to evaluate the strategic options for Rybolovlev’s 67% stake in AS Monaco, which he acquired in 2011.

An official statement from Rybolovlev’s family office indicated that while there is interest in the club, there are no guarantees that this strategic review will lead to a transaction. The billionaire, with a fortune from the Russian potash industry, had committed to investing at least 100 million euros in the club over four years upon his acquisition. AS Monaco is celebrated for its success in France’s top league, boasting eight championship titles.

Raine Group‘s notable involvement in sports transactions includes advising on the stake sale of Manchester United to Jim Ratcliffe and facilitating the sale of Chelsea FC for Russian billionaire Roman Abramovich in 2022.

Meanwhile, in New York, Dmitry Rybolovlev faces legal challenges. He is currently suing the auction house Sotheby’s, accusing them of complicity in a scheme that led him to overpay significantly for artworks.

Sotheby’s defense argues that the billionaire did not exercise due diligence. In a recent trial session in Manhattan, Rybolovlev conceded that the meticulousness characteristic of his business dealings was lacking in his art acquisitions, which were managed through a Swiss dealer and totaled $2 billion. He commented that the performance of the aide responsible for these transactions left “room for improvement.” The ongoing trial is set to continue this week.