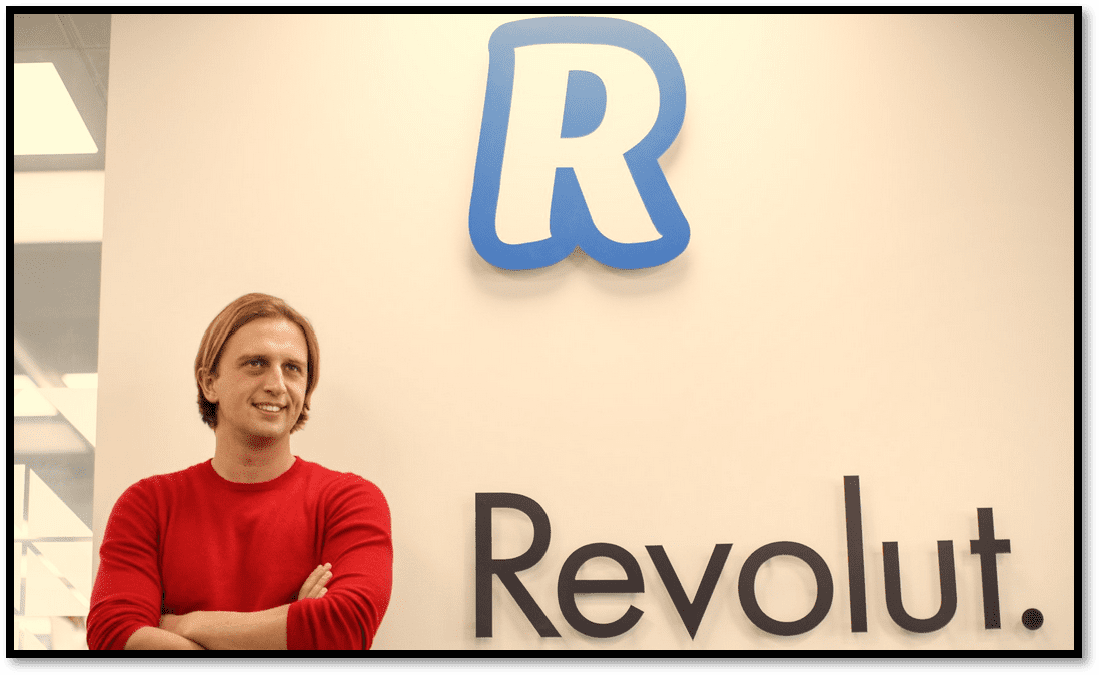

Fintech giant Revolut, founded by Russian-born Nik Storonsky and Vlad Yatsenko in 2015 in London, has urged London’s High Court to dismiss a lawsuit filed by Ildar Uzbekov, the son-in-law of the late mining tycoon Alexander Shchukin. Uzbekov claims Revolut unfairly froze his account in 2020 based on what he describes as “malicious” accusations. The lawsuit, which Revolut brands as “disproportionate,” has cast a spotlight on how UK financial institutions handle high-profile clients who could pose reputational risks.

Claims of Unlawful Account Closure

Representing Uzbekov, Patrick Green alleges Revolut unlawfully closed his client’s account based on erroneous facts and dubious claims. Uzbekov is reportedly seeking to clear his name and address the distress and inconvenience caused by the account freeze.

In response, Tony Singla, representing Revolut, argued that the company suspected Uzbekov of potential involvement in money laundering. He emphasized that Revolut was under no obligation to investigate these suspicions further, citing the firm’s adherence to anti-money laundering and financial crime regulations.

According to a Financial Times report, This case draws parallels with actions taken by other financial institutions, such as the private bank Coutts, which severed ties with Nigel Farage due to concerns over his political views. The resulting controversy led to the resignation of Dame Alison Rose and Peter Flavel, executives at Coutts’ parent company, NatWest.

The Parties Arguments

Singla highlighted a key distinction in Revolut’s approach to de-banking, differentiating it from cases involving free speech or political views, as was the case with Nigel Farage and Coutts. He also pointed out that Uzbekov is not seeking financial damages, acknowledging no financial loss due to the account closure.

Green, however, contested Revolut‘s rationale in written submissions, questioning the credibility of the sources that informed Revolut’s concerns about money laundering. He argued that the motion to dismiss Uzbekov’s claim is baseless.

The court’s decision on Revolut‘s application to dismiss the case is pending, and its outcome could have significant implications for the company’s operational practices and reputation management strategies.

Revolut’s De-Risking Strategy

These legal challenges emerge as Revolut awaits a crucial decision on its UK banking license application, submitted three years ago. The license would significantly bolster its position in its home market. The company has previously attracted scrutiny from the UK’s Financial Conduct Authority (FCA) over alleged failures to freeze funds in accounts flagged as suspicious.

As recently reported by FinTelegram, Revolut is apparently actually pursuing a de-banking or de-risking strategy and wants to get rid of customers it classifies as high-risk. This is why it is currently closing accounts and business relationships en masse. According to FinTelegram, Revolut wants to meet regulatory pressure and take an important step towards obtaining the coveted banking license in the UK.