FinTelegram constantly receives complaints and threats from scammers and their partners claiming their right to privacy. We often hear complaints that the reports on FinTelegram would violate their privacy rights and the laws that protect them. Typically these threats and complaints are accompanied by a threat involving a lawyer or the complaint comes directly from a lawyer. Mostly expensive lawyers are involved.

Do scammers have a right to privacy in principle?

A difficult question and yet again not. The right to privacy is a fundamental good in today’s digital environment. Facebook, Google, and their alikes are already collecting enough data to make u completely transparent. In fact, there is virtually no privacy online at the moment. People’s data is collected, stored and evaluated at all times. In the civilized world, however, citizens are entitled to request the state to protect their privacy.

However, this right must not be understood as a protective mechanism to maintain criminal activities in the dark of the web and behind anonymous cross-jurisdictional offshore constructions. The Panama Papers have demonstrated how privacy and data protection rights can be abused. They directly led to tax evasion and fraud.

The right of the individual in a community ends where the specific individual violates the right of another individual. Scammers knowingly and intentionally violate their victims’ right to privacy in order to enrich themselves at the victims´ expense. The scammers do not adhere to any legal requirements in approaching and ripping off European victims. The scammers also do not adhere to any code of ethics, they spam, make cold callings constantly, lie, stalk and threaten unrestraindly all the time.

Scammers abuse clients, data and laws

Scammers hide behind complicated company structures and deploy so-called nominee directors and nominee shareholders. Their employees use so-called stage names when communicating with clients victims. At no time are clients victims treated with the necessary honesty. Clients are then spammed and stalked via phone calls, WhatsApp and emails and asked to send money with false pretenses.

Victims must disclose their private and confidential data. Often they tell the employees of the boiler rooms a lot of details about their private life and their family. These so-called boiler room agents are psychologically trained to get money and data from people.

Worse still, client data is regularly sold or leased to other scammers. The privacy of these scammers’ clients is being intentionally destroyed and/or exploited. Victims’ money and their data are stolen from perpetrators protected by the dark of the web, the anonymity of offshore constructions, as well as willfully and knowingly cooperating lawyers.

One of the great challenges of digitalization and the age of social media is the seriousness and trustworthiness of the providers. Scammers are the burglars, muggers and marriage swindlers of the digital generation. Scammers are a direct threat to digital civil society. We need new ways to fight them. In our opinion, this also includes the loss of the right to privacy for them.

Stolen Millions for lawyers

The last time it showed up was with Konstantin Ingnatov. The Bulgarian and his sister Ruja Ignatova are regarded as the masterminds behind the OneCoin scheme. According to the U.S. indictment against the two, millions of investors worldwide are said to have paid several billion dollars into the system, turning the operators into billionaires. A good part of this money is now used by these scammers for their defense (article here on FinTelegram International). With the best lawyers, the payment of bribes and protection money and bought media reports one wants to avoid prison and punishment or at least keep it low.

Konstantin Ignatov, arrested in the U.S., for example, offered the US court a 20 million bail for his release until the court hearing. The court refused after the prosecutors objected. The danger of flight would be too great and the Ignatovs would have too much money not to be able to seek protection in other states. The money for Ignatov’s bail most probably have come from the money previously paid in by the cheated investors. So first they steal the money and afterwords they use the stolen money to defend themselves in the criminal proceedings. And the more they stole, the better lawyers can be paid.

White letters from lawyers

Global fraud against retail investors through offshore companies, nominee directors and trustees is also readily encouraged by lawyers. However, this does not protect the privacy of the scammers, but conceals the criminal nature of these activities.

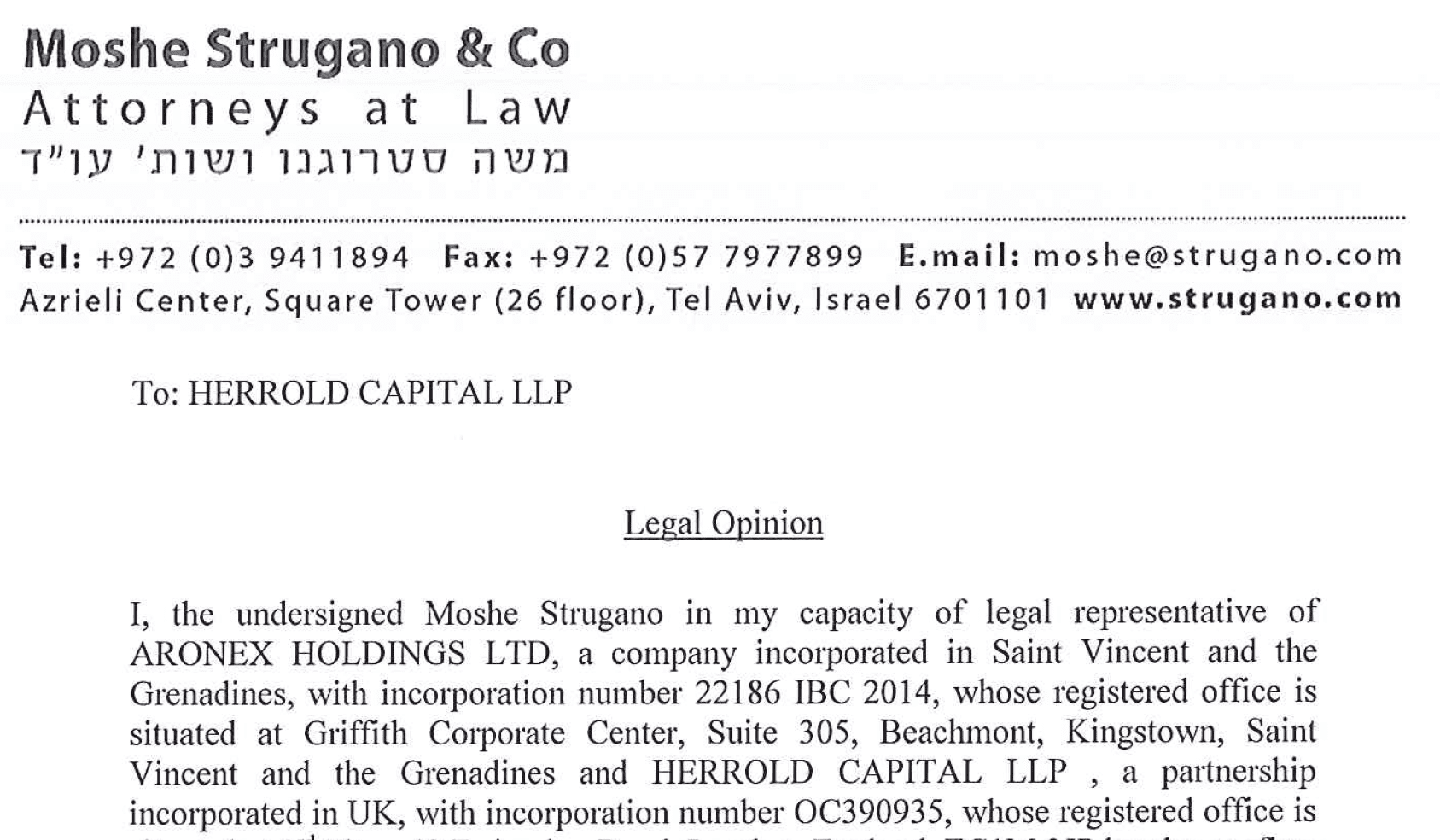

Israeli lawyers, for example, readily issue friendly legal opinions for any jurisdiction wanted to the Israeli scammers and confirm the proper conduct of their business. This is what makes fraud possible in the first place. Thus the identification of the perpetrators requires the removal of protecting privacy.

Shame on the involved lawyers

The remarkable thing about these lawyers is that they usually know exactly

As a matter of fact, these lawyers are legally obliged to undertake KYC and AM examinations for any customers. Especially when their clients’ scams are on the blacklists of financial market regulators and if there are other hints that they money they receive for their service could be victims` money gained from fraud.

Shame on the the involved lawyers who take the victims´money for their shabby services to protect and to support known fraudsters.

Bank secrecy, money laundering and privacy

Privacy used to be the most important asset when it came to money transactions. The right of people to the protection of their financial privacy was accepted until 20 years ago as the most important one. More and more people have used this financial privacy, however, to cheat tax authorities, launder illegal funds and finance terrorism. The KYC/AML guidelines in force today are nothing more than the result of a weighing of interests. What is more important – the protection of the community against criminal or terrorist activities or the protection of privacy?

Today’s AML guidelines reflect the position that community protection takes precedence over financial privacy. We have accepted this removal in the interest of the common good. There is no tax justice if we allow tax avoidance in the name of financial privacy.

Cybercrime requires the protection of the privacy of the perpetrators. This privacy is achieved through technology and offshore constructions. It’s never been easier for perps to hide than it is today. Encrypted email services such as Protonmail and online buyable offshore constructions for just a few thousand euros. Seasoned with some cryptocurrency, the perpetrators are virtually invisible and inaccessible to the authorities.

No privacy for scammers but protection for investors

That answers the question, doesn’t it? Anyone who does not handle the rights granted to him by community and state responsibly has lost the right to this right. Scammers and their accomplices constantly violate the privacy of their victims and steal their money and their data.

Anyone who steals money and data from retail investors or facilitates such schemes does not deserve privacy. Anyone who cheats the state and thus his fellow citizens lose the right to be protected by privacy. The only chance for cheated retail investors and authorities is to pull the scammer in front of the curtain and speak their names out loud. As did the Panama Papers.

The Panama Paper Legacy

The Panama Papers have clearly shown that the abolition of the privacy of people acting illegally can be of highest interest to the community. In this respect, the disclosure of concealed illegal constructions is in the higher interest of the digital society in general and of retail investors in particular. It is a morally and legally justified approach.

So guys, as long as you go on to rip off unexperienced European retail investors and to steal their life savings you lose your right for data protection.