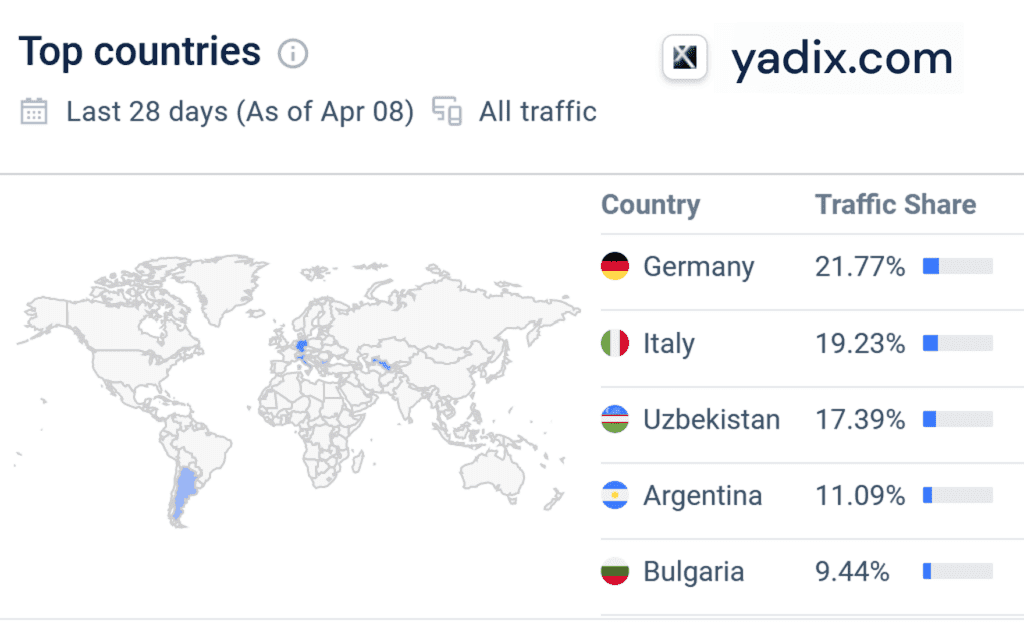

The offshore broker schemes Yadix and Kridex are operated by Quantix FS Limited, registered with the FSA Seychelles. This small broker scheme has no authorization to offer its financial products in the regulatory regimes of the EEA. According to Similarweb, almost 22% of visitors to the Yadix website in the last 28 days came from Germany and 20% from Italy. We have assigned Yadix and Kridex a Red Compliance rating. Read our compliance review.

Key Data

| Trading name | Yadix Kridex |

| Activity | Multi-asset broker |

| Domains | QuantixFS.com Yadix.com Kridex.com |

| Social media | |

| Legal entity | Quantix FS Limited (Seychelles) |

| Jurisdictions | Seychelles |

| Authorization | FSA Seychelles with license no C112010690 |

| Contact | +44 (0) 203 239 6117 +44 207 193 2760 +248 4325215 support@yadix.com support@kridex.com info@quantixfs.com |

| Leverage | up to 1:500 |

| Payment options | Credit/debit card, bank wire, e-wallets, crypto |

| Payment processors | Skrill, Neteller, fasapay, PayTrust88 Virtual Pay, BitWallet, B2BPay |

| Related individuals | Grace Erima (LinkedIn) |

| Trustpilot | 4.1 stars with a Great trust level |

| Compliance rating | Red |

Compliance Check

Yadix is a minor broker scheme. In the last 28 days, the website has had less than 5,000 visitors, with a downward trend.

FSA-registered Quantix FS Limited also operates the offshore broker Kridex. Both are essentially identical in look, feel, and functionality.

In our review on April 11, 2023, we registered as an EEA resident with Yadix and Kridex without any problems. The EEA countries, Australia, and most other jurisdictions worldwide are included in the drop-down menu, suggesting that these are target markets.

Pre-KYC deposits: Before the KYC check with identity and address verification, we could theoretically deposit unlimited amounts via crypto. Pre-KYC deposits are also possible via credit/debit cards or e-wallets. As payment processors, we again found the usual suspects, such as Virtual Pay, Skrill, Neteller, FasaPay, or Bitwallet for crypto.

By registering with Yadix, EEA customers also have an account with a leverage of up to 1:500. Retail brokers in most Western regulatory regimes are allowed to offer retail clients a maximum of 1:30 leverage. In this respect, Yadix also violates the regulatory provisions.

Most recently, Yadix on Trustpilot changed its name from Yadix to Forex. This is not a trust-inspiring process either.

Overall, we see the Red Compliance status to Yadix and Kridex as justified. We advise retail traders not to work with offshore brokers, even if they are not a scam, especially in high-risk segments like CFD, forex, or crypto. As a client of an offshore broker, traders are not eligible for investor compensation schemes or financial aid from Financial Ombudsman Services. Stay away!

Share Information

If you have information about Yadix, its operators, and its facilitators, please share it via our whistleblower system, Whistle42.