The Israeli Police arrested the notorious crypto scheme operator Moshe Hogeg, who also owns the Beiter Jerusalem soccer club, and seven other people on suspicion of involvement in alleged massive fraud related to cryptocurrencies. Law enforcement said that Hogeg and the other suspects stole millions of dollars. In addition, Hogeg is also suspected of sexual offenses. Most recently, a model had claimed that she was raped by him at the age of 17, The Times of Israel reported.

Among the criminal offenses of which Moshe Hogeg is suspected is a conspiracy to commit a crime, theft, aggravated fraud, intentional concealment of income, fraudulent record-keeping, and drug offenses, Haaretz reported.

Read the full Moshe Hogeg crypto story here!

The Super Angel Investor Singulariteam

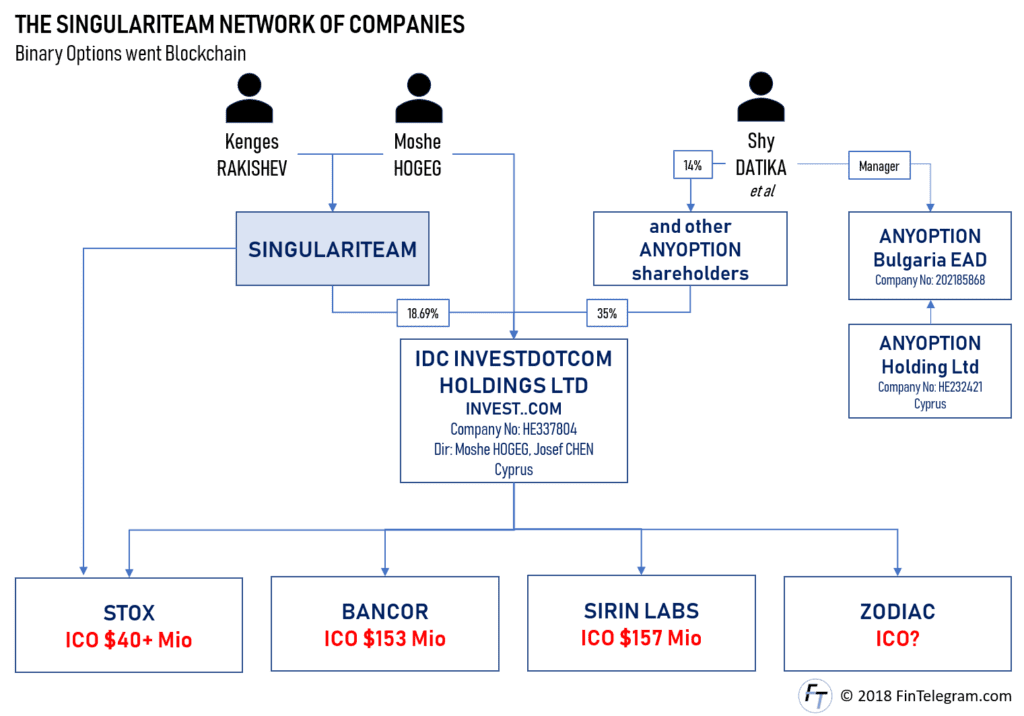

In 2012 HOGEG and the Kazhak entrepreneur Kenges RAKISHEV established the VC fund SINGULARITEAM in Israel. It billed itself as a “super angel investor” focused on new and disruptive technologies with a focus on Israeli tech startups and raised $152 million across three funds mainly from Asian investors eager to tap into the startup nation Israel.

The Million-Dollar Domain

Moshe HOGEG entered the online trading business in 2014. He and his venture capital vehicle SINGULARITEAM allegedly paid over $5 million to buy the domain Invest.com with the intention to make it a global online investment brand. The goal was to penetrate the forex industry with an all assets brokerage site.

The website was finally launched in 2016 after its operating entity IDC INVESTDOTCOM HOLDINGS LTD (“IDC“), registered in Cyprus, secured $20 million in funding. Until March 2019, the Invest.com domain was operated by the CySEC-regulated GS Sharestocks Ltd. However, the company has renounced the license and ceased business. The website with the vanity domain vanished, the ambitious project collapsed. However, Hogeg used IDC for his many crypto schemes back then.

Starting the ICO Machine

Moshe Hogeg has conducted a series of Initial Coin Offerings (ICO) starting in the crypto hype 2017. Via Singulariteam, IDC, and other entities, Hogeg raised more than $350 million from investors, according to FinTelegram calculations (see chart above). However, the companies and projects did not perform as promised afterward, or in some cases disappeared. Former employees and partners have repeatedly sued Hogeg in recent years for alleged fraud and non-payment.

The AnyOption Deal

In June 2017, IDC acquired binary options provider AnyOption and its affiliated network of companies. The binary options business was merged into Invest.com with allegedly 3 million binary option retail investors. AnyOption was co-founded in 2008 by the Israeli Shy Datika who also ran the company as CEO at the time of the merger. He was one of the most knowledgeable people in the binary options industry as he has been part of it since its very beginning.

Later Shy Datika and Moshe Hogeg had a fall-out, insider reporter. The merger evidently did not turn out to be what they intended it to be.

Stay tuned for a more detailed report.