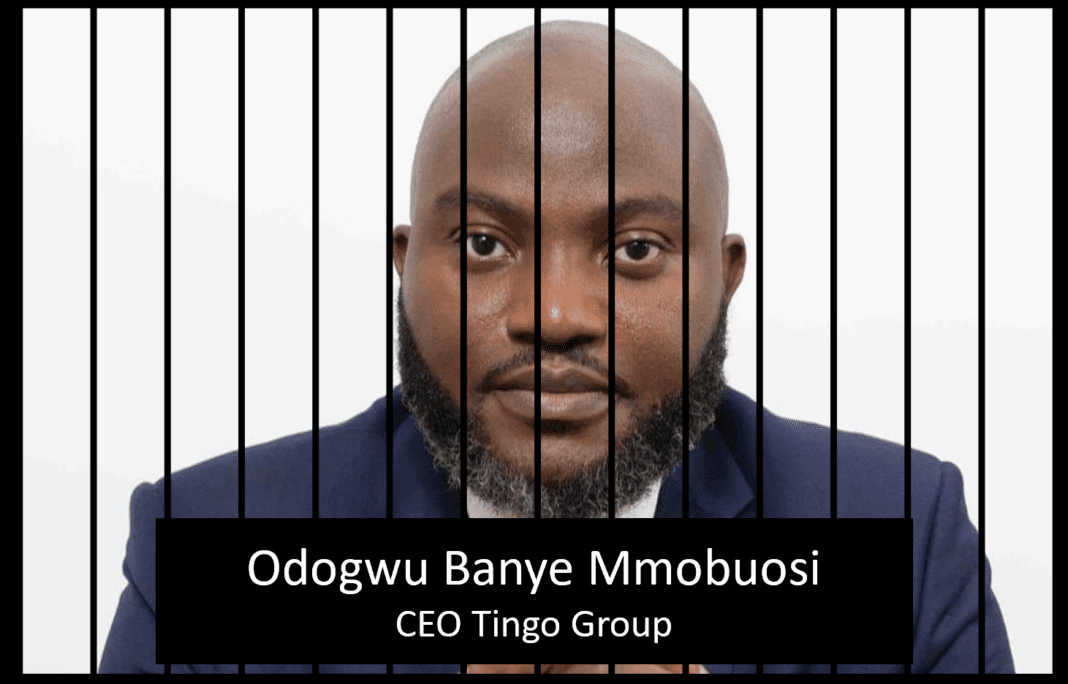

Nasdaq-listed Tingo Group (NASDAQ: TIO), a Nigerian holding company, has found itself at the center of a complex financial scandal, resulting in charges from both the U.S. Securities and Exchange Commission (SEC) and the Department of Justice (DOJ). The company’s founder and CEO, Odogwu Banye Mmobuosi, faces serious allegations of orchestrating a fraudulent scheme that involves fabricating financial statements, misleading investors, and misappropriating funds.

Background: Tingo Group’s Dubious Journey to Nasdaq

Tingo Group went public in August 2021 through a reverse merger on the OTC market, initially intending to acquire a third-tier crypto exchange. Later, in December 2022, the company underwent another reverse merger with a Chinese fintech firm, entering the Nasdaq and rebranding as Tingo Group Inc. This move significantly boosted its market capitalization, reaching a peak value of approximately $3 billion by May 2023.

Founded in 2001 by Odogwu Banye Mmobuosi, Tingo Group claims to operate in various business segments, including food processing, mobile handset sales, leasing, and an online food marketplace named “Nwassa.” Mmobuosi gained international attention, appearing on the cover of GQ Africa in December 2022.

However, red flags started emerging when Tingo‘s auditor, Friedman LLP, resigned in October 2022, and Deloitte Israel took its place. The choice of an Israeli-based audit office raised eyebrows, considering Tingo‘s purported lack of substantive operations in Israel. Despite these concerns, Deloitte Israel provided an unqualified audit opinion in 2022.

In June 2023, short-seller Hindenburg Research published a damning report alleging that Tingo Group was an “exceptionally obvious scam” with fabricated financials. This report marked the beginning of the company’s downward spiral.

SEC Charges: Alleged Massive Fraud Unveiled

A few months after the Hindenburg report, on December 18, 2023, the SEC filed charges against Mmobuosi and Tingo Group, outlining a multi-year scheme to inflate financial metrics and defraud investors globally. The complaint alleges that Mmobuosi fabricated financial statements and misrepresented business operations, leading to the issuance of materially false information to investors. The SEC seeks emergency relief to prevent further dissemination of false information and protect corporate and investor assets.

Among the SEC’s accusations are fabricated cash balances, nonexistent customer relationships, and fraudulent schemes resulting in the misappropriation of funds. The complaint further details Mmobuosi’s personal benefits, including luxury purchases and an unsuccessful attempt to acquire an English Football Club Premier League team.

The SEC’s charges include violations of anti-fraud provisions, reporting, books and records, and internal controls violations. Mmobuosi faces additional charges such as lying to auditors, insider trading, and failure to file Forms 4 disclosing stock sales.

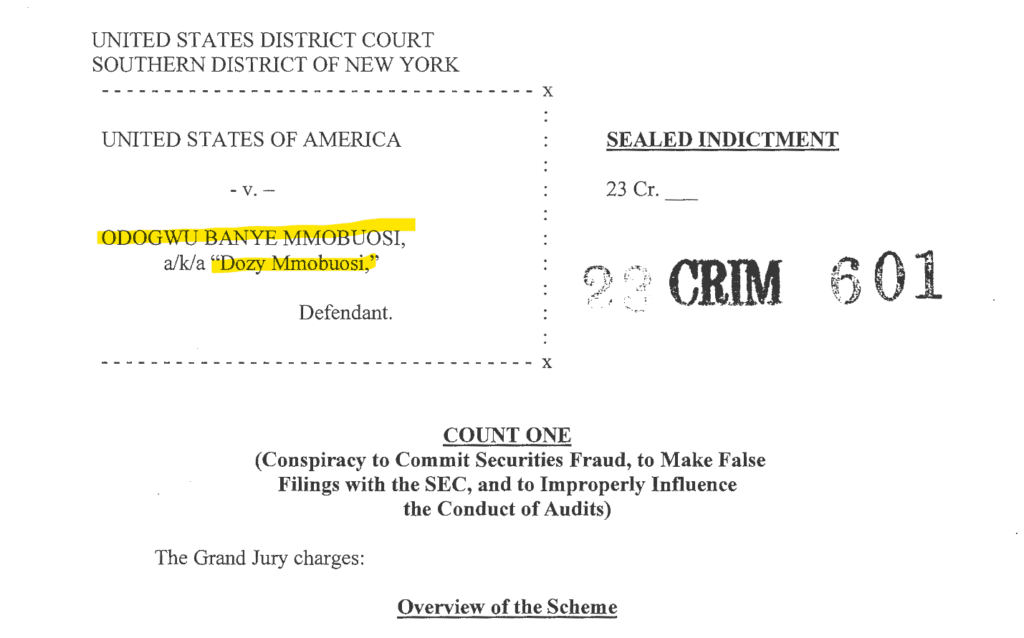

DOJ Charges: Criminal Indictment Unsealed

On January 2, 2024, the DOJ unsealed an indictment that mirrors the SEC’s allegations, charging Mmobuosi with securities fraud, making false filings with the SEC, and conspiracy. The indictment covers the period from at least 2019 through 2023, detailing a scheme to falsely represent Tingo Mobile and Tingo Foods as profitable entities, leading to their sale to U.S.-listed companies.

Mmobuosi is accused of causing Tingo Group and Agri-Fintech to issue false financial statements, portraying the companies as cash-rich, revenue-generating entities. The indictment further alleges misappropriation of cash and well-timed sales of shares at inflated prices, resulting in substantial profits.

Potential Impact and Future Developments

The charges against Mmobuosi and Tingo Group are severe and encompass a broad range of financial misconduct. If proven true, the consequences could be devastating for investors and the reputation of Nasdaq-listed Tingo Group. The ongoing legal proceedings will likely shed light on the extent of the alleged fraud, and the SEC’s emergency relief seeks to prevent further harm to investors.

Investors and financial analysts will closely monitor developments in this case, as it highlights the importance of due diligence and regulatory oversight in the financial markets. Tingo Group’s downfall serves as a cautionary tale for companies seeking to go public through reverse mergers and the potential risks associated with complex corporate structures.