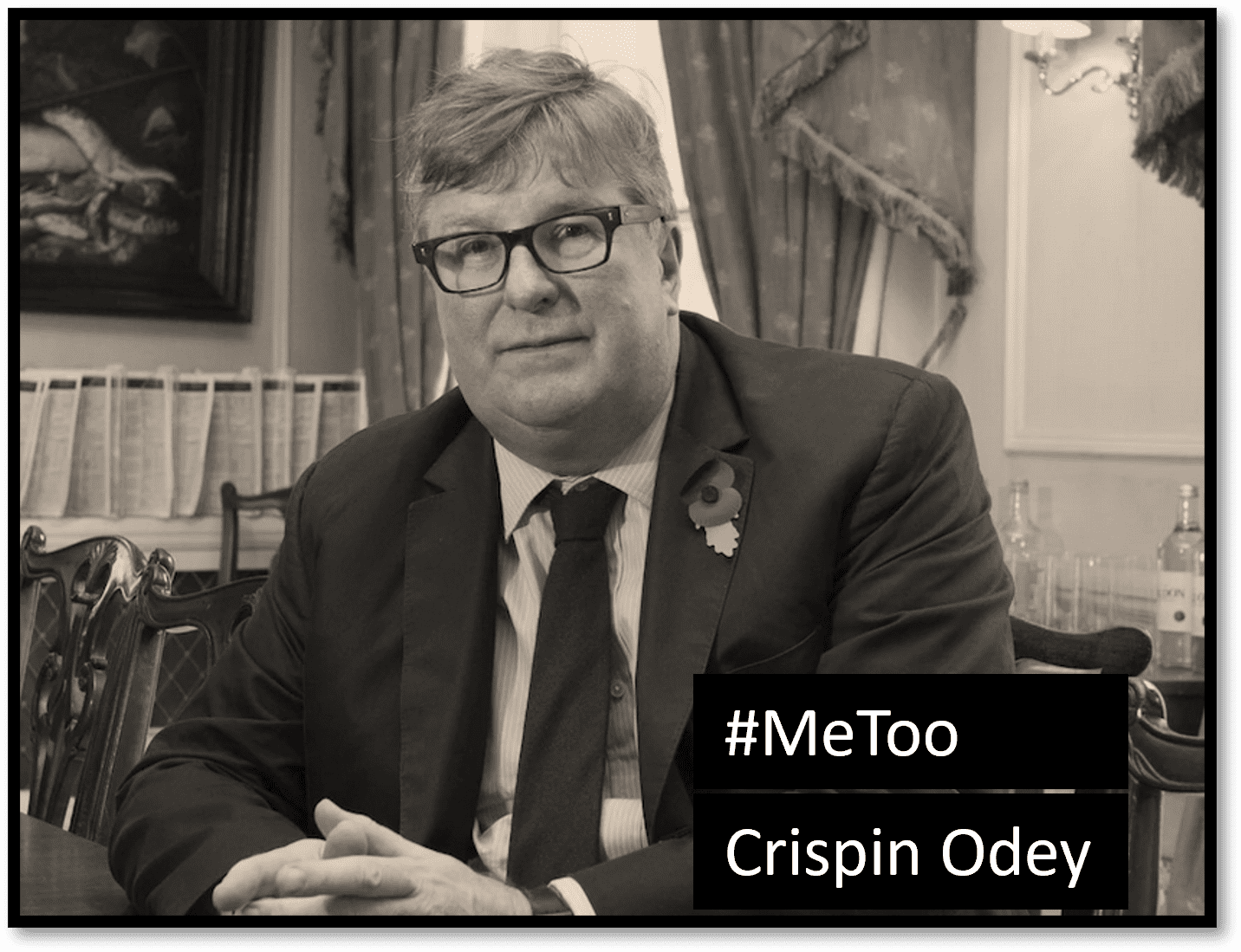

Crispin Odey, the hedge fund manager facing #MeToo allegations of sexual misconduct, threatened to take legal action against the UK Financial Conduct Authority (FCA) in an attempt to halt its investigation into the matter. However, his threats did not prevent the FCA from opening the probe in 2021. Fresh #MeToo allegations have led his hedge fund firm to remove him from the business, but he has indicated that he intends to fight this decision.

The FCA’s investigation has expanded following Financial Times (FT) reports that revealed multiple incidents of alleged sexual assault or harassment by Crispin Odey against 13 women over a span of 25 years. Odey’s lawyers strongly disputed these accusations. In his challenge against the FCA, Odey’s legal team argued that the investigation was unlawful and claimed that the regulator had not demonstrated how the allegations of sexual misconduct posed a risk to the integrity of financial markets, which is within the FCA’s mandate to protect.

Odey’s lawyers also claimed that the FCA was exceeding its statutory authority. However, Odey eventually dropped his legal challenge. The FCA initiated its investigation several months earlier to examine potential misconduct at Odey Asset Management, spanning 18 years, from 2003 to 2021. The probe included complaints of sexual misconduct made by employees against Odey as far back as 2004 and 2005, as well as more recent complaints in 2020.

The FCA, which is set to face questioning from Members of Parliament regarding its investigation into Odey Asset Management, has a history of investigating various types of misconduct when evaluating an individual’s fitness to work in the financial services industry. The regulator has imposed lifetime bans in cases such as a fund manager who repeatedly evaded train fares and a financial adviser convicted of attempting to meet a minor he had groomed.

Crispin Odey emphasized that none of the allegations against him have been substantiated in a court of law or through an investigation.