The Mercuryo case is taking an interesting development. As reported, the Russian-controlled crypto payment processor has retained Viennese law firm Binder Groesswang to implement a SLAPP action against the European Fund Recovery Initiative (EFRI) and FinTelegram with the intention to silence FinTelegram. The court dismissed the preliminary injunction last Friday with extensive justification.

Complaint With Bar Association

It should be noted that the court decision is not yet final. EFRI has already filed a complaint with the Austrian bar association against Binder Groesswang during the judicial proceedings on the suspicion that the law firm supports the Russian-controlled Mercuryo, despite Western sanctions, in their illegal activities by SLAPPing critical media.

Court Findings

In justifying the dismissal of the preliminary injunction, the court essentially upheld FinTelegram’s reports. The court found that the allegation that EFRI was legally affiliated with or had control over FinTelegram was false. This allegation was the central issue in the SLAPP action. The preliminary injunction against EFRI was primarily intended to silence FinTelegram.

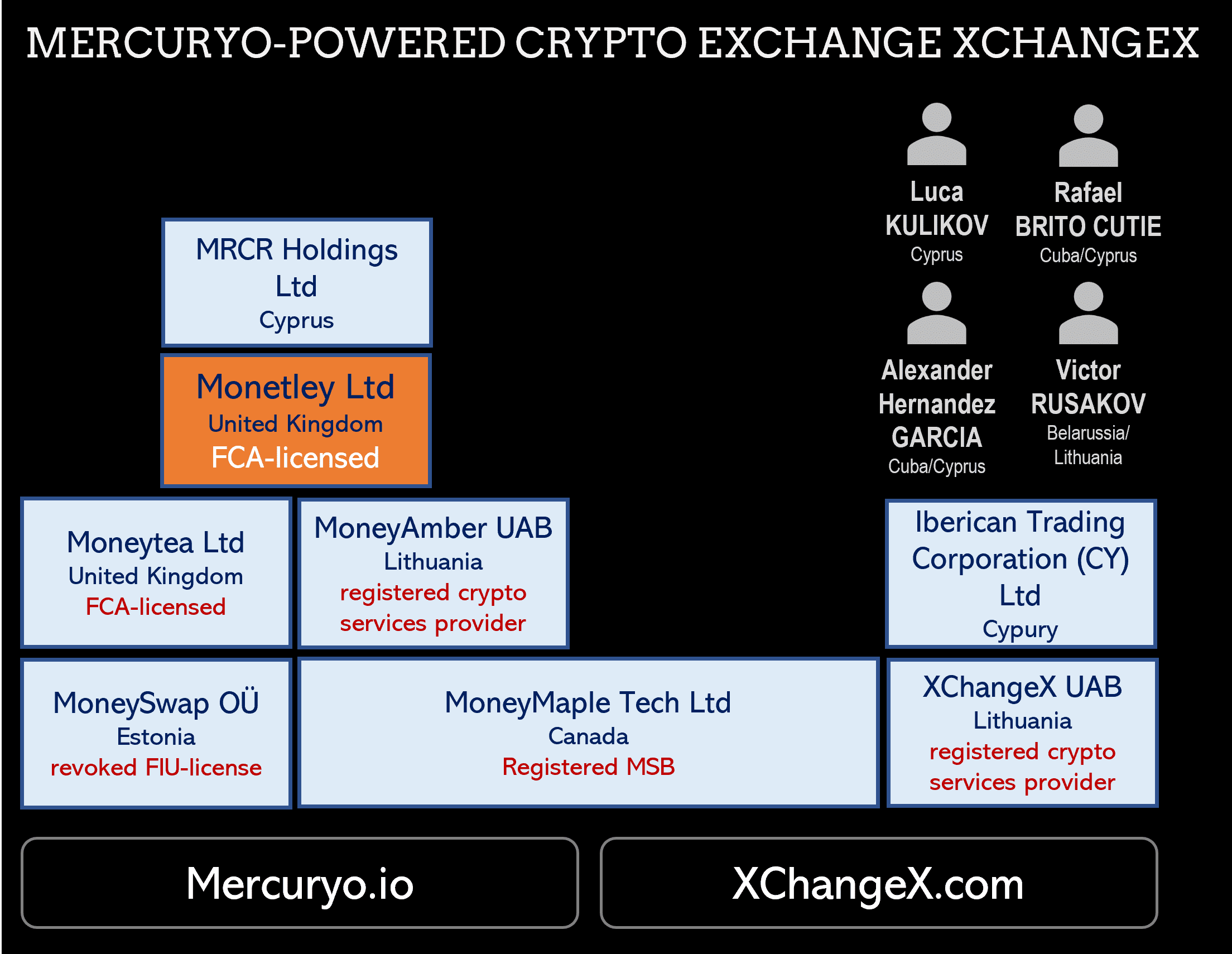

Based on the evidence presented, the court considered it proven that Russian owners control Mercuryo. Likewise, based on the documentation presented, the court considered it proven that Mercuryo was operating without proper authorization after the Estonian crypto license was revoked. Thus, the FinTelegram reports are correct.

The court also considered it proven that Mercuryo, as a crypto payment processor, should have determined what business its customers were conducting during the legally required KYC. They should have found, for example, that there were regulatory warnings against Mercuryo‘s partner ByBit and that ByBit was not complying with Western sanctions against Russia.

The court holds that Mercuryo should also have found, as part of the KYC, that online trading platforms AMarkets, Glaremarkets, and CryptoDock were offering highly speculative financial instruments, including cryptocurrencies, to European consumers without proper authorization from financial market regulators and were involved in fraudulent activities, with numerous warnings already issued by European financial regulators. The court said Mercuryo had also failed to deny these allegations substantively.

Share Information

If you have any information about Mercuryo, its partners, and its facilitators, please let us know via our whistleblower system, Whistle42.