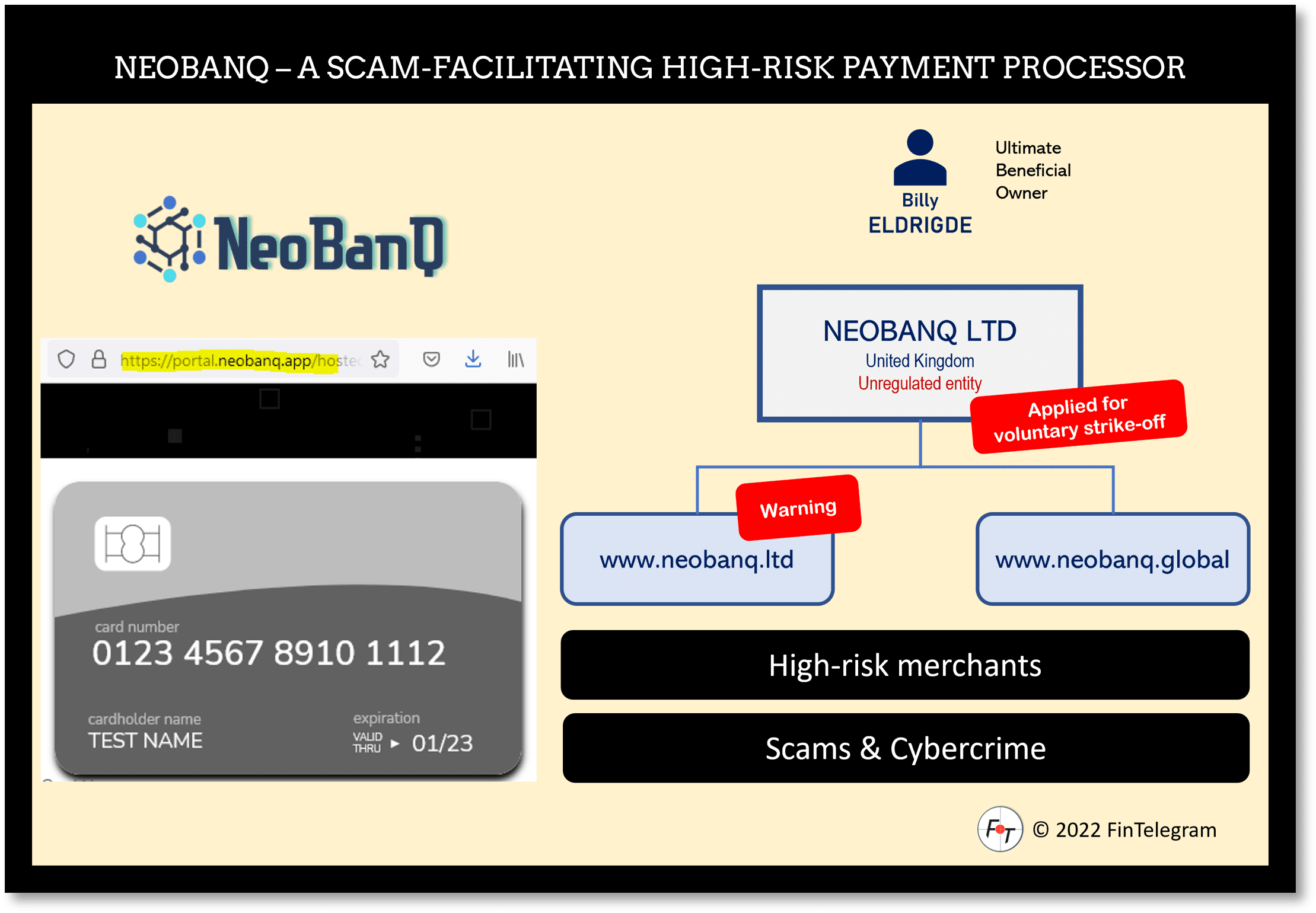

It’s no secret that high-risk payment processors like to disappear. Unfortunately, very often with their merchants’ money. This is what happened with the Indian-British iPayTotal, which filed for a voluntary strike-off in October 2020. That was suspended over the objection of a creditor. The UK High Court of Justice subsequently ordered insolvency and liquidation. Merchants’ money was long gone by then. Billy Eldridge‘s NeoBanQ filed a Voluntary Strike Off application in Oct 2021 which was suspended due to a creditor’s objection in Nov 2021. Extreme caution is in order for merchants.

Key Data

| Trading name | NeoBanQ |

| Domains | https://neobanq.ltd https://neobanq.global |

| Legal entity | Neobanq Ltd |

| Jurisdiction | United Kingdom |

| Related individual | Billy Eldridge |

| Regulated | No |

| Status | Applied for voluntary strike-off, which is suspended due to an objection |

Short Update

NeoBanQ is a notorious scam and cybercrime facilitator. FinTelegram has reported on it many times. According to our reports, founder and owner Billy Eldridge (pictured left) has deleted his profile picture on LinkedIn and made NeoBanQ disappear from his experience bar. Visiting NeoBanQ‘s website connected to the domain https://neobanq.ltd initially generates a warning about an SSL certificate error and recommends staying away.

Read our introduction of NeoBanQ here.

We conclude that NeoBanQ wants to disappear. Apparently, however, creditors object to this. Merchants should avoid the payment processor at all costs. You don’t need to be a rocket scientist to see that problems arise here.

Share Information

If you have any information about NeoBanQ, Billy Eldridge, and the background, please let us know via our whistleblower system, Whistle42.