A penalty is usually not an occasion for gratitude. That would also make the purpose of a punishment absurd. Usually, one is grateful for a received punishment only if one is aware that one has gotten away well with this punishment and should actually have been punished much worse. A driver who is speeding while massively impaired by alcohol or other drugs certainly grateful is grateful if he is punished by the police only for speeding and not for the offense of driving under the influence (DUI). Similarly, GlobalNetInt (GNI) shows itself grateful for the penalization by the Bank of Lithuania.

The penalization

On June 25, 2021, the Bank of Lithuania announced that it had fined GNI €350,000 for systematic violations of money laundering guidelines and local financial laws, as well as other offenses, following an audit of the e-Money Institution (read our report here). In addition, GNI‘s business will be restricted until the apparent systemic problems are resolved. Thus, no new high-risk customers may be accepted, and no business may be done in certain regions.

Liudvikas Kulikauskas, General Manager of GNI, is not surprised that the Bank of Lithuania has done the audit because GNI would be one of the fastest-growing financial institutions in Lithuania. Both in terms of the number of customers and turnover. Mistakes could happen, and therefore Kulikauskas is also grateful for the “cooperation” of the Bank of Lithuania and the chance to make improvements finally:

We are grateful to the Bank of Lithuania for its close cooperation, which has helped us to pay more attention to areas for improvement and to prioritize actions.

Liudvikas Kulikauskas, General Manager GlobalNetInt (press release)

Driving under the influence, it is!

Both Liudvikas “Liudas” Kulikauskas and the Bank of Lithuania do not mention in their statements that GNI’s rapid growth comes primarily from high-risk and illegal businesses. GNI‘s client list at the time of the audit in 2020 reads like a “who’s who” of the Estonian crypto payment scene, global scammer scene, and (illegal) gambling ecosphere. In fact, money laundering was GNI’s very business model. That’s why the compliance team left the company in 2020 and filed charges. GNI is a part of the FCA-regulated MoneyNetint Group and its global high-risk payment network. The MoneyNetint Group is controlled by the four Israeli payment veterans Raphael Golan, Gil Trif, Nissan Trif, and Yishai Trif (read this report here).

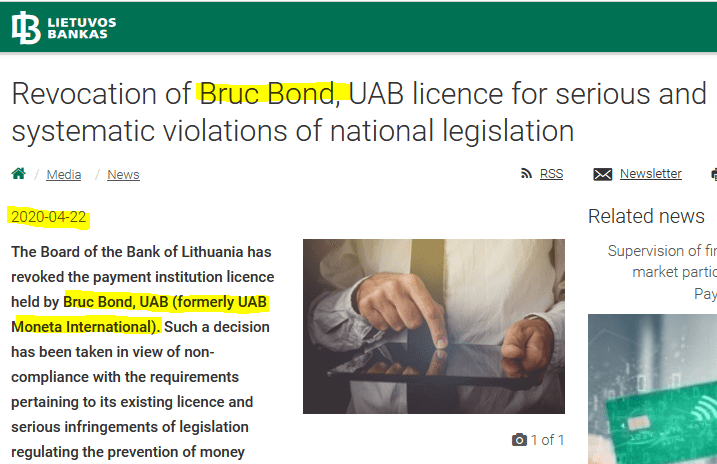

Oh yes, GNI can be thankful that its license was not revoked. In the Bruc Bond (formerly Moneta International) case, the regulator revoked EMI’s license in April 2020 following an audit. As with GNI, the regulator found systematic and serious violations of money-laundering regulations and compliance in the Bruc Bond audit. Like GNI, Bruc Bond was controlled by also controlled by Israelis (Eyal Nachum and Tamir Zoltovski). The business models of both EMIs GNI and Bruc Bond were or are identical.

Given the information we have, we would assume that GNI was penalized for speeding, although the actual offense was DUI. GNI is actually intentionally facilitating illegal businesses with its services and systematically laundered money for its clients.

The Findiban issue

There is, in fact, another issue that has not been addressed by Kulikauskas or the Bank of Lithuania. We call it the Findiban issue. Ifind, MB d/b/a Findiban (www.findiban.com) is or mayby was a sort of private payment venture of the GNI CEO Liudvikas Kulikauskas and his wife Egle Kulikauskiene. Please read our report here.

The venture was established in the summer of 2020 as a non-licensed financial services provider brokering high-risk merchant accounts or IBAN bank accounts. Its services addressed Forex, Gambling, or Porn. Moreover, Findiban offered the creation of white-label EMIs or PSPs. Findiban‘s website has been in maintenance mode for days, making the services unavailable.

What happened to Findiban, and is the (temporary?) suspension of the service a result of the regulator’s audit? We don’t know because there are no statements on this yet. The Bank of Lithuania should make clear statements in this regard.

The Wirecard approach

The Bank of Lithuania‘s soft punishment and leniency is reminiscent of the German BaFin‘s approach to Wirecard. For years, there have been so many warning signals that something was wrong at Wirecard. BaFin ignored this and, on the contrary, even filed charges against the people who made the irregularities public. When will the regulators finally learn that the brakes have to be applied much sooner in the regulation of FinTechs like Wirecard or GNI?

Stay tuned!