The financial intelligence platform FinTelegram issued another urgent warning against the REAL-TOK crypto scheme, which recently issued a real estate token, symbolized as RLTO, and currently listed on the P2B crypto exchange. Reports from whistleblowers indicate the RLTO price is artificially sustained slightly above its issue price of €1, using manipulative strategies.

The REAL-TOK Narrative

The REALTO Group, an Austrian entity, is orchestrating this scheme. The group’s initial objective was to amass about €1.2 billion from investors through the REAL-TOK (RLTO) Initial Coin Offering (ICO). Despite claims of revolutionizing the real estate sector, they have only achieved a negligible portion of this target.

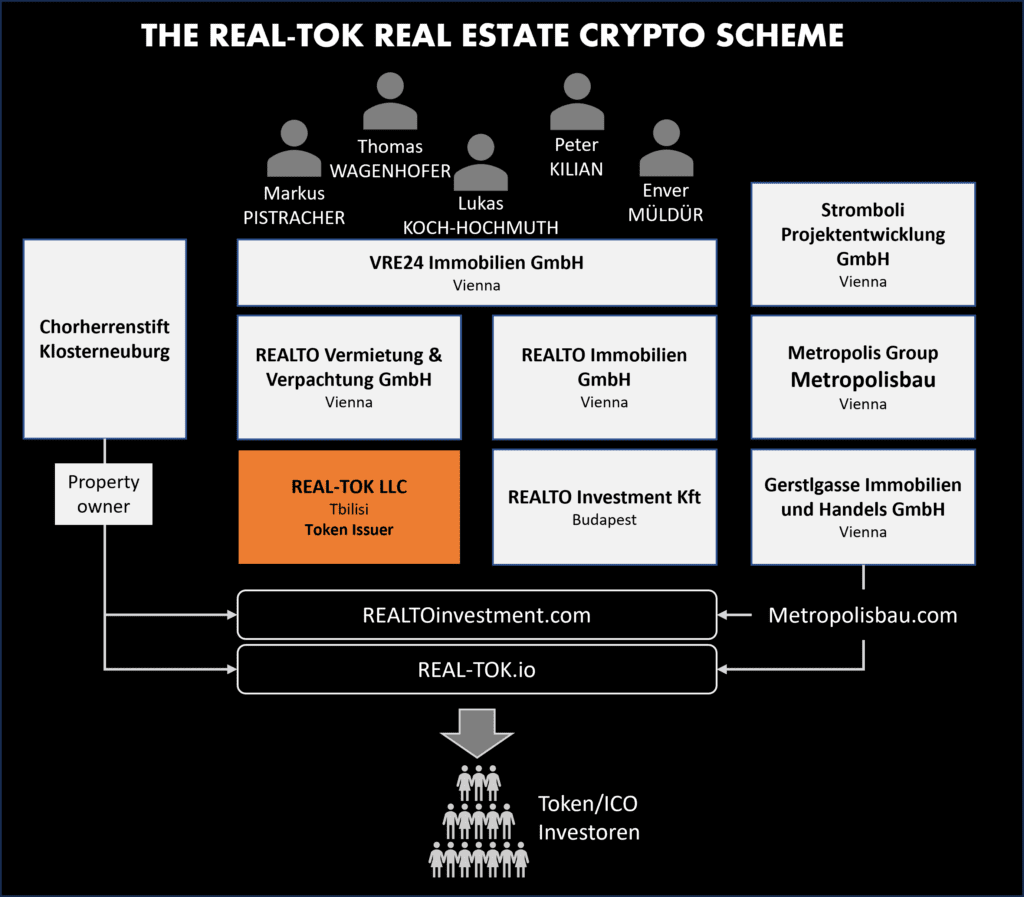

Key figures of the REALTO Group include the Austrian nationals Peter Kilian, Thomas Wagenhofer, and Lukas Koch-Hochmuth. Additionally, Envor Müldür, a Kurdish Turk and a notable usurer involved in money laundering via real estate projects, is connected with REAL-TOK.

The REAL-TOK project intriguingly involves Klosterneuburg Abbey, a Catholic monastery with significant real estate assets. Many of the real estate projects linked to REAL-TOK are associated with land owned by this monastery, which the REALTO Group does not possess. The monastery’s official endorsement for this project remains unconfirmed, and it is conspicuously absent from the project’s whitepaper.

Investor Advisory

Cryptocurrencies, known for their speculative nature, often harbor schemes that are fraudulent. REAL-TOK, identified as a security token, should have acquired regulatory approval for its ICO, which it notably lacks. The exchange P2B, facilitating RLTO trades, is also operating without the requisite regulatory permissions. The ICO’s execution through REAL TOK LLC in Georgia suggests an attempt to circumvent regulatory supervisory despite the operators’ primary base in Vienna and their targeting of EU investors.

REAL-TOK‘s promotional materials promise unrealistic rapid token value increases, which is characteristic of fraudulent crypto operations. Claims of a proprietary REAL-TOK blockchain and real estate NFT in 2024 further accentuate these dubious assertions.

Key Concerns

- Regulatory Non-Compliance: REAL-TOK’s issuance lacks the necessary regulatory approval essential for security tokens.

- Misrepresented Collateral: The whitepaper inadequately clarifies the role of real estate projects as token collateral. These properties are owned by an Austrian monastery, not the issuers.

- Criminal Associations: Several individuals involved in the ICO possess criminal records related to fraud and tax evasion and are known for aggressive financial dealings.

- Unrealistic Promises: REAL-TOK’s guarantees of risk-free wealth are indicative of Ponzi schemes and fraudulent activities, incompatible with legitimate crypto practices.

- Questionable Issuer Stability: REAL-TOK LLC, based in Tbilisi, Georgia, and linked to financially unstable entities like REALTO Immobilien GmbH in Vienna and REALTO KFT in Hungary, raises concerns about the issuer’s credibility.

Austrian Real Estate and Questionable Practices:

Austria’s real estate sector has recently been marred by dubious schemes, such as the downfall of Rene Benko‘s Signa Group. The REALTO Group‘s attempt to address their financial difficulties through the REAL-TOK project seems unlikely to succeed, as per current information.

Investors are strongly advised to exercise extreme caution and conduct thorough due diligence before considering any involvement with the REAL-TOK scheme or similar cryptocurrency ventures.