The sharp increase in investment scams has prompted financial market supervisory and consumer protection authorities such as the UK Financial Conduct Authority (FCA) or the Australian Competition and Consumer Commission to set up their own scam protection units. UK FCA ScamSmart, for example, informs and warns investors via its website, Facebook and Twitter about scams and tries to raise awareness among investors.

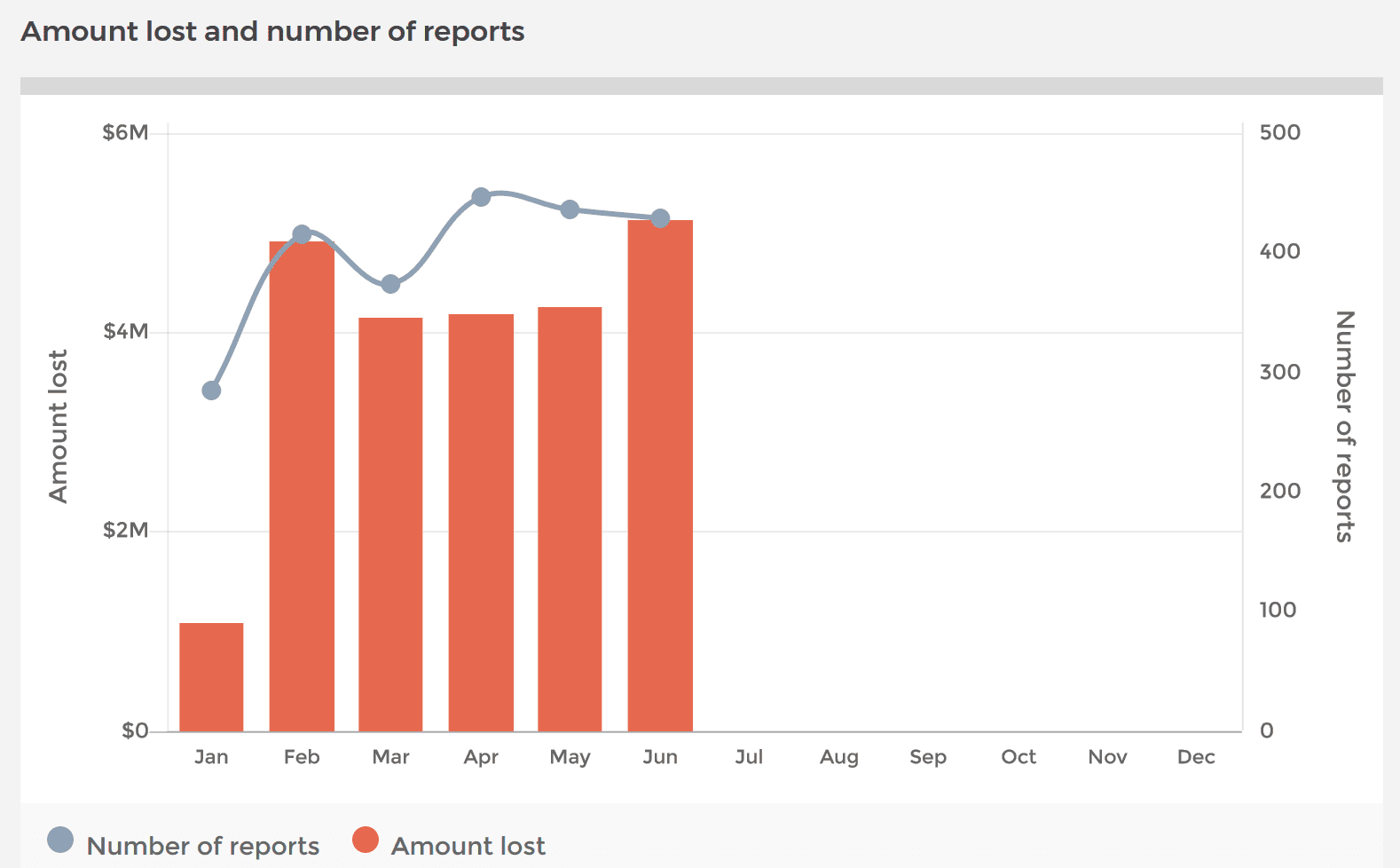

Scamwatch, the body operated by the Australian Competition and Consumer Commission (ACCC), updated its investment scams statistics. Australians reported having lost $5,119,883 with investment fraud schemes in June 2019 amounting to $23,690,077 for the first 6 months of the year.

The FCA recently published its Enforcement Performance Report 2018/19 stating that investment scams via crypto and forex more than tripled last year to over 1,800. Fraudsters promise high returns from investments in crypto and forex, with victims losing over £27 million in total in 2018/19. The UK watchdog issued 265 Final Notices of which 243 have been issued against firms and individuals trading as firms and 22 against individuals. The agency launched 276 regulatory proceedings and 12 criminal proceedings. In total, FCA imposed 16 financial penalties with a total volume of £227.3 million.

There is no end in sight to the growth of the global cybercrime. On the contrary, it can be expected that cybercrime will become the big topic of the digital society in the coming years.