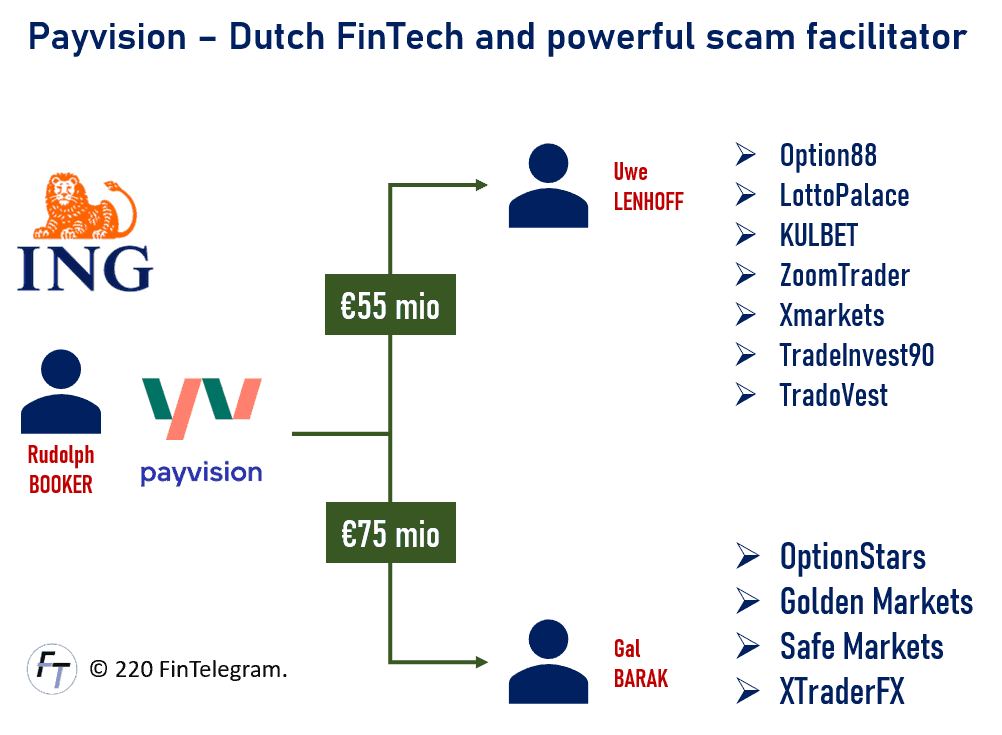

The importance of FinTechs for the “success” of scams in defrauding retail investors cannot be overestimated. The US prosecutors outlined this fact time and again in their respective indictments against online fraudsters and perpetrators. It’s a fact that without facilitating FinTechs, most online scams would not be able to operate at all. It would not be possible to receive deposits from client-victims. The extent of the damage caused by these participating FinTechs is very clearly shown by the ING subsidiary Payvision. The Dutch Fintech processes some €130 million just for the scams of the two now-imprisoned Uwe Lenhoff (Germany) and Gal Barak (Israel). Thanks to the investigations many sad hypothesis around FinTechs and their role as cybercrime facilitators have been proved by facts and evidence.

The Payvision lesson

The Dutch ING subsidiary and FinTech Payvision (www.payvision.com) was an important payment processor for the German Uwe Lenhoff and the Israeli Gal Barak, but not the only one. On the other hand, Lenhoff and Barak’s scams such as Option888, XMarkets, TradoVest, OptionStars, XTraderFX, SafeMarkets or GoldenMarkets (just to name a few) were only a part of the many scam clients that handled their payment processes via Payvision. Hence, the now identified €130 million is therefore probably only a fraction of the illegal payments that were processed via Payvision. We can justifiably assume that the volume of illegal payments via Payvision will be above the billion euro threshold in the years between 2016 and 2019.

The files show that Payvision has processed these €130 million in the almost 3 years between 2016 and 2019. Payvision has apparently accepted the offshore companies of Uwe Lenhoff and Gal Barak as “merchants” without proper Know-Your-Customer (KYC) checks. Moreover, Payvision processes thousands of suspicious transactions without appropriate Anti-Money-Laundering (AML) procedures. And Payvision did so until the very end. Only a few days before the arrest of Lenhoff and Barak, millions of dollars were transferred by Payvision to the perpetrators’ offshore companies.

Knowing and willful facilitators

Law enforcement questioned Payvision and its CEO Rudolph Booker. In a written statement, Payvision said that it submitted 273 suspicious activities reports (SARS) between mid-2018 and 2019 regarding Lenhoff and Barak. Nevertheless, Payvision was happy to continue to process payments for the reported suspects and simply changed the fee structure. How can this be? That cannot be! This means that Payvision already had sufficient suspicion but still continued to earn high fees from the fraudulent transactions.

This is nothing short of a schizophrenic and cynical approach. Why didn’t the Dutch regulators do anything?

FinTelegram and the questions to Rudolph Booker

As a matter of fact, Payvision founder and CEO Rudolph Booker were fully aware of the illicit businesses of Lenhoff and Barak’s business. This is proven from the documents in the files and wiretap protocols. In this respect, Rudolph Booker must probably be qualified as knowingly and willfully acting co-conspirator and scam facilitator. It is therefore incomprehensible that Rudolph Booker has not yet been listed as a suspect in the criminal case against Lenhoff and Barak. Not yet, we hope.

After reading the articles on the Website the Fintelegram for the first time on the24 of September 2018 Payvision started to be concerned about the businesses of Uwe Lenhoff and Gal Barak.

Rudolph Booker and Payvision statement to law enforcement

Although financial market supervisory authorities had issued warnings against Lenhoff and Barak platforms since mid-2017 at the latest, the business relationship was not questioned. Booker states in a statement that only the FinTelegram reports in September 2018 had led to concern. Despite subsequent suspicious activity reports (SARS), Payvision did not terminate the business relationship or closed individual accounts only very selectively. Until shortly before the arrest of Lenhoff and Barak in early 2019, millions were transferred to their offshore vehicle.

In the interest of the thousands of aggrieved retail investors, it is a conditio sine qua non to hold Payvision, its parent company ING, as well as, Rudolph Booker legal responsible as facilitators for the damage of retail investors. Only in this way can the aggrieved retail investors get their money.