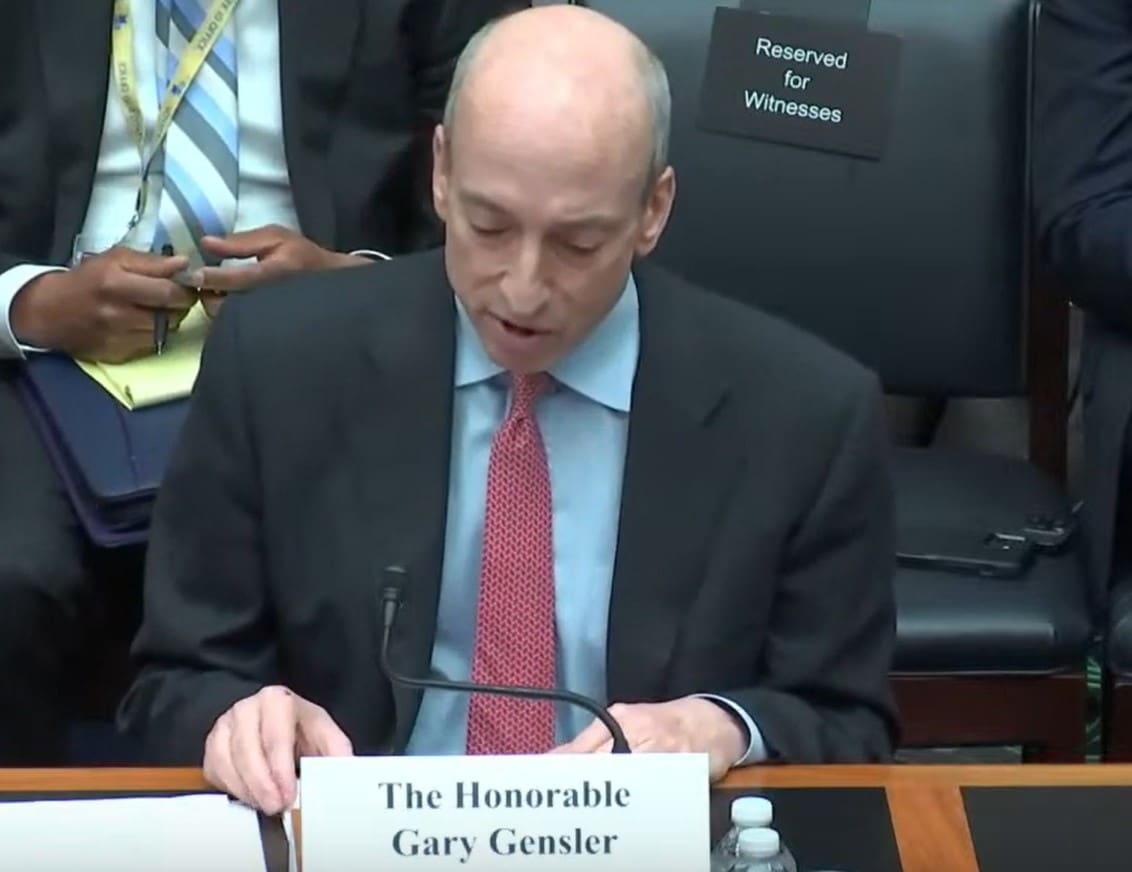

In a House hearing, Gary Gensler, the U.S. Securities and Exchange Commission (SEC) Chair, defended his agency’s crackdown on crypto markets, saying that he had never seen an industry so routinely break securities laws. Gensler’s approach has been called “regulation by enforcement,” which would not be sufficient nor sustainable. His approach would drive innovation overseas and endanger the U.S. competitiveness, one Republican said.

I’ve been around finance for 40 years, in one way or the other. I’ve never seen a field that is so noncompliant with laws written by Congress and confirmed over and over again by the courts.

Gary Gensler

Since he became SEC Chair in 2021, Gary Gensler has focused the SEC’s enforcement efforts on crypto trading platforms. A few days ago, the SEC filed a lawsuit against crypto exchange Bittrex for operating an unregistered exchange and brokerage. In March, the SEC notified Coinbase of a potential lawsuit over violations of securities laws.

However, Gensler is not without controversy. He and his agency stood by or even turned a blind eye to the collapse of Sam Bankman-Fried‘s FTX, according to allegations. Regulators coddled Sam Bankman-Fried (SBF), who has long been seen as the great American crypto hope and the answer to China’s Binance.

Crypto firms say that it isn’t clear how those laws apply to them and that they don’t know which cryptocurrencies the SEC considers securities, the category of assets that includes stocks and bonds. They have lobbied the agency and Congress to write new regulations exempting crypto from the SEC’s rules. Gensler rejected the notion that crypto trading platforms don’t know how to interpret U.S. securities laws.