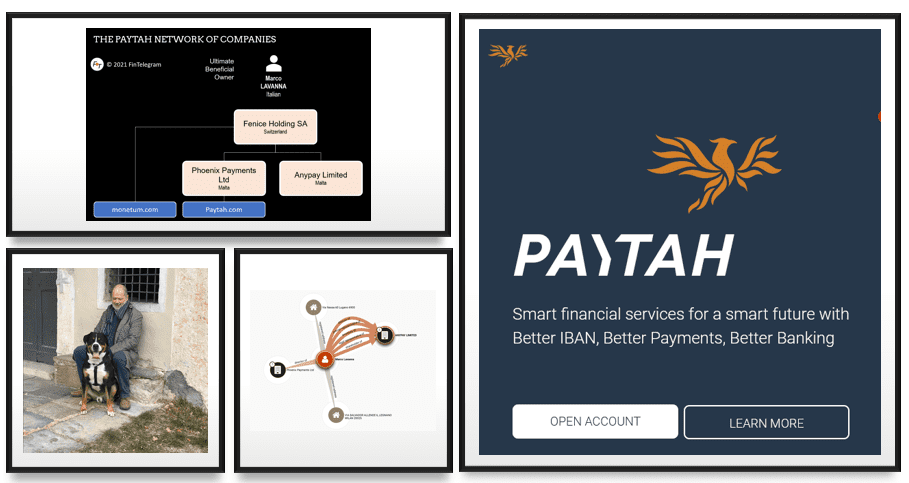

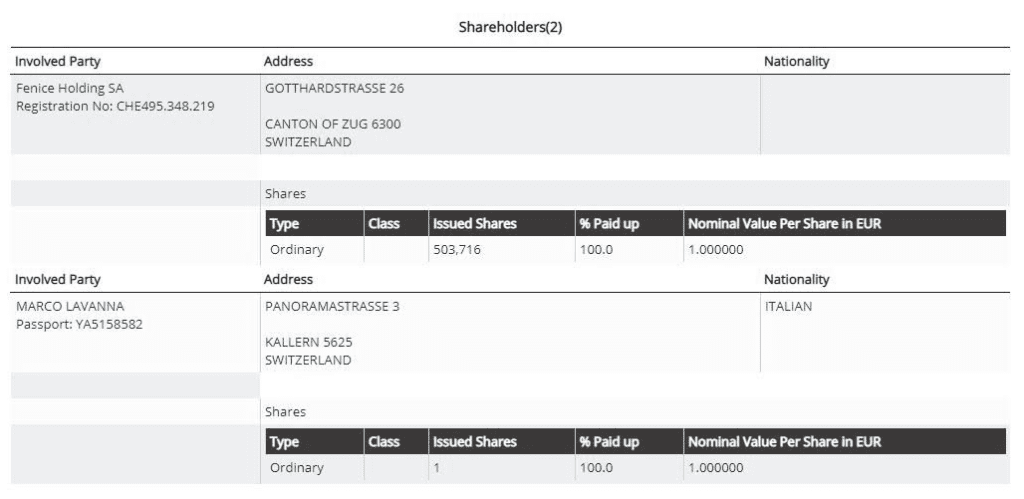

Phoenix Payments Ltd, registered in Malta and authorized by the Malta Financial Services Authority (MFSA) to provide payments services d/b/a as Paytah. Between 2019 and 2020, the payment processor has been processing hundreds of thousands of euros from victims of LincolnFX, RoyalsFX, CodexFX, and other scams. The legal entities behind these scams have been clients of Paytah. The company directors are the Italian Marco Lavanna, the Maltese Keith Farrugia, and Spaniard Francesc Xavier Alabart Lopez. The payment processor’s beneficial owner is payment veteran Marco Lavanna through his Swiss-registered firm named Fenice Holding SA.

The Ultimate Beneficial Owner

Italian Marco Lavanna, who lives in Milan, describes himself on his LinkedIn profile as the founder of Paytah (www.paytah.com). He is the ultimate beneficial owner of PayTah and the founder of Monetum (www.monetum.com), a payment and trading platform also operated by Fenice Holding SA, based in Zug, Switzerland.

This is the very same Fenice Holding through which Marco Lavanna owns and controls Paytah. The information from OffshoreLeaks suggests that Lavanna is also the beneficial owner of Anypay Limited, a company registered in Malta.

Playing dead man

Victims of the above-mentioned scams have been trying to reach Paytah directly or through their lawyers for a while now. Without any luck. Apparently, no one ever picks up the phone at Paytah. Emails sent to their official email addresses registered with the Maltese authorities have also not been replied to by Paytah. Letters sent by post to Phoenix Payments Ltd and/or its directors have been consequently ignored.

Paytah boasts of offering personalized IBANs and SEPA Instant Credit transfers to its corporate and individual customers. The Bank of Lithuania has allowed Paytah to integrate with its CENTROlink and thus get SEPA access (see press statement).

The NGO European Fund Recovery Initiative (EFRI) has filed a complaint with the Malta Financial Services Authority through its Maltese legal representative. Following the complaint, Paytah has finally come alive. However, the payment processor refused to refund the victims and referred the victims to their banks, a move considered typical by scammers’ facilitators.

Rather than investigating the scam and reporting their scam-clients to the authorities whilst seeking to return the funds to the victims, Paytah brushed off the complaint by simply ignoring the pain that such victims go through. It is not yet known whether the Maltese authorities will be acting against Paytah.