Andreas Koufkis is for sure an honorable businessman. He is one of the seven members of the Board of Directors of The Financial Ombudsman of the Republic of Cyprus. By his business genes, Koufkis is not on the consumer side. Being the General Manager of Atlantis Securities Ltd, a company registered in Cyprus and licensed by CySEC (CIF 005/03) he can not be regarded as a consumer advocate. Only one director, Loucas Aristodemou, is representing consumers as President of the CyprusConsumers Union and Quality of Life. One of seven. Accordingly are the odds of complaining victims.

Financial services export industry

The Board of Directors of the Financial Ombudsman Cyprus consists of seven honorable persons according to the national law. Of these, only one person is a consumer rights representative. The other six represent directly or indirectly the interests of CySEC providers. By law, this agency is obliged to deal with cross-border disputes, i.e. with complaints of consumers outside Cyprus. Accordingly, the agency’s website has to offer the necessary dispute services at least in English. Especially in a country that exports almost all of the financial services of its registered financial services providers.

The Blank Pages Approach

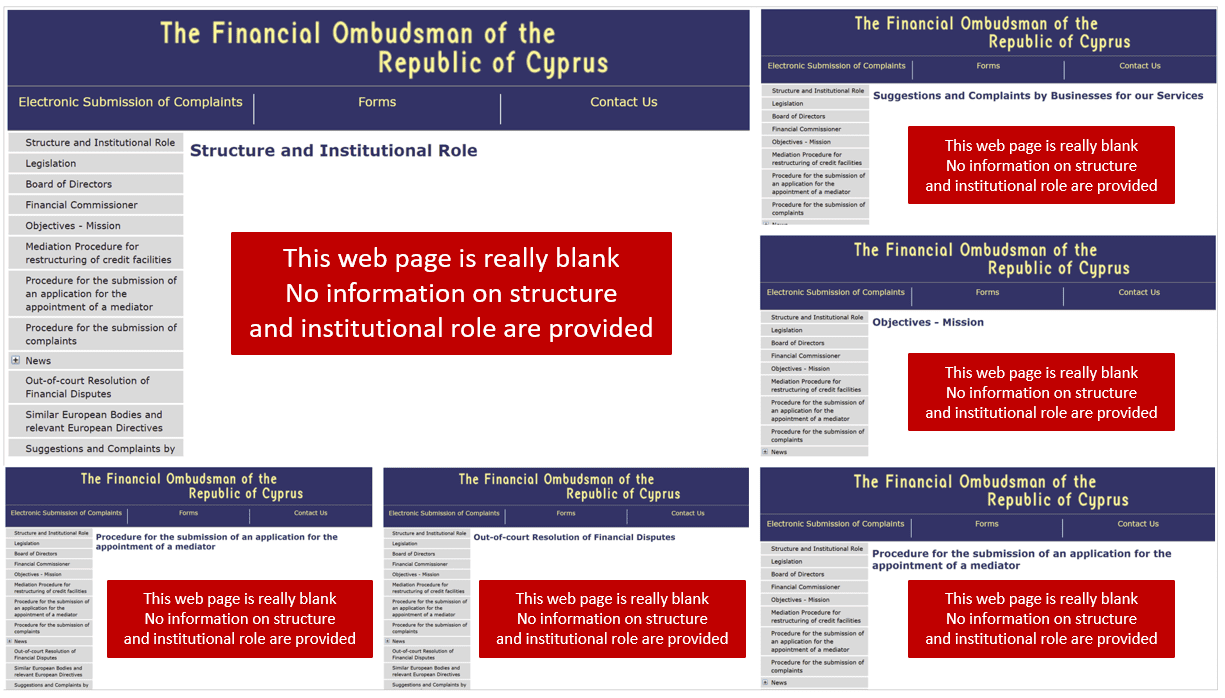

The hypothesis that the role of the Financial Ombudsman in Cyprus is not really taken seriously and complaints is dealt with rather negligently is also supported by the authority’s English website. If you click on the menu item “Structure and Institutional Role” you will be directed to a white page. No information provided. Many other menu items also lead to empty pages.

This Blank Pages Approach on its English website is rather remarkable because it can be assumed that more than 95% of all complaints to the Financial Ombudsman Office come from EU citizens outside Cyprus. EU license passporting makes it easy for CySEC-regulated investment companies to address citizens of the other 26 member states.

Cyprus has less than 1.2 million inhabitants but about 250 CySEC-regulated investment companies (Status October 2019). These can address approximately 447 million EU citizens via the EU license passporting. Most recently, the UK FCA and the Italian CONSOB have banned CySEC-regulated investment firms over their illegal and/or non-compliant business practices they applied to attack their citizens.

The Financial Ombudsman Cypris is not a member of EU FIN-NET but it is forced by national law to comply with the Commission Recommendation 98/257/EC. This means that the Financial Ombudsman Cyprus must operate within the regulatory framework of the EU. Whether a blank page approach is compliant with the EU rules is highly doubtful.

Call to Action for ESMA and EU

The Brexit will probably also be bad news for the EU regulatory scene and consumers because with the FCA the EU will lose one of the most active regulators in the fight against scams. Given the obvious inactivity of CySEC and the overall very relaxed approach of the Cypriot government and authorities to the issue of cybercrime, these are not good prospects for the EU.

If the EU is really serious about creating a common internal market for financial services, then there is an urgent need for action on the regulatory side. There must be a central EU authority like ESMA, which can create standards, make regulations binding and monitor the regulatory authorities in the individual member states. At present, the EU Licence Passporting is a massive threat for all EU citizens. This can be seen in the examples of Cyprus or Estonia.