FinTelegram has reported on 21 July 2020 that Rodeler Ltd is voluntarily renouncing its CySEC license. Consequently, 24option, the trading style of the broker will also be terminated. On the website of 24option (www.24option.com) customers are informed that the operation will be closed as of August 20, 2020, the “Termination Date.” Customers will receive their credit balance paid out to a bank account to be announced. The CySEC announcement states that this license renouncement has already been decided as of July 6, 2020.

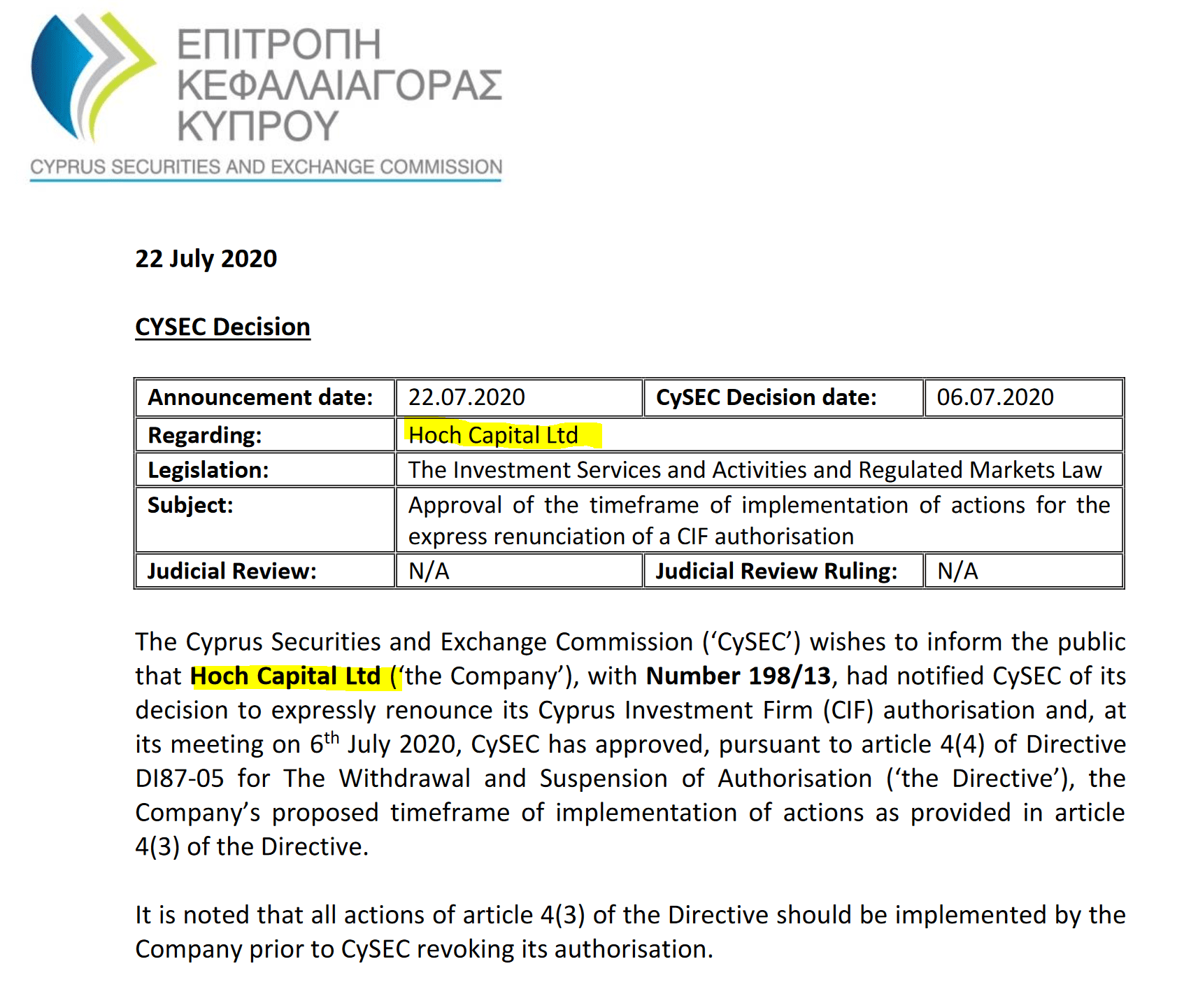

Not only the Rodeler is resigning the CySEC license, but also Hoch Capital Ltd which was active with the brands iTrader and most recently TradeATF. On the Hoch Capital website (www.hochcapital.com) the 14th August 2020 is stated as “cut-off time.” By that date, customers must have closed their positions and applied for payment of the balances.

With the withdrawal of Rodeler and Hoch Capital, the forex retail industry looses two pioneers. They were not without controversy during the many years of their activity. After the collapse of the Golden Era of binary options and the uncovering of the total extent of the damage this Israeli-born fraud industry caused to retail investors around the globe, the entire retail forex market collapsed.

While the industry had hope that CFD and Crypto could compensate the binary options shut-down, the ever-increasing stream of broker scams is creating a toxic environment for both serious traders and investors. Hence, the closing-down of Rodeler and Hoch Capital seems to be a rather rational approach.

In the interest of the clients of both companies, we hope that there will be no problems with processing and payment. We will closely monitor the closing.