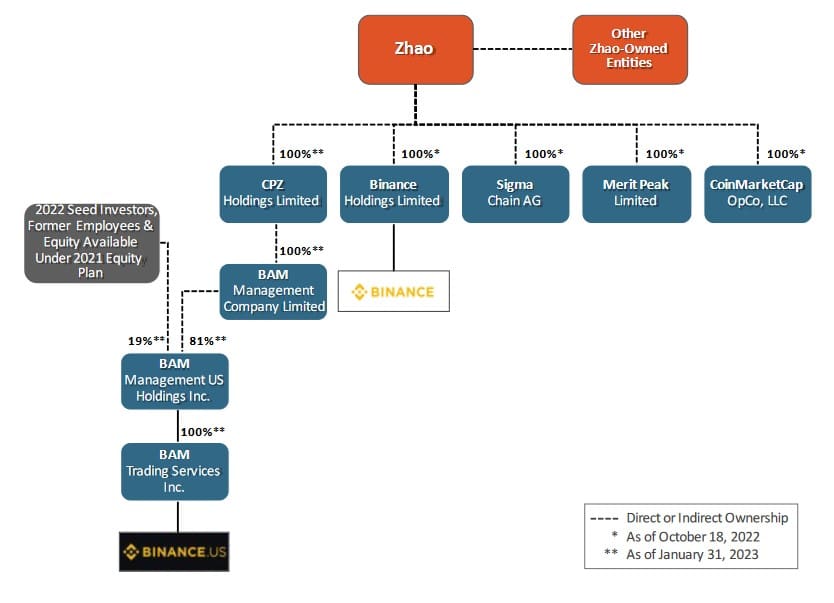

It was expected, but still, Bitcoin slipped to below $26,000 after the U.S. Securities and Exchange Commission (SEC) charged Binance, which operates the world’s largest crypto asset trading platform. The charges name several entities and their founder, Changpeng Zhao (CZ), as defendants. They are charged with various securities law violations. in 136 pages, the SEC describes in great detail the Binance structure and has also identified CZ as the beneficial owner behind the Legal Entities.

Lacking regulatory oversight, Defendants were free to and did transfer investors’ crypto and fiat assets as Defendants pleased, at times commingling and diverting them in ways that properly registered brokers, dealers, exchanges, and clearing agencies would not have been able to do.

SEC Complaint

The SEC alleges that, while Changpeng Zhao and Binance publicly claimed that U.S. customers were restricted from transacting on Binance.com, CZ, and Binance, in reality, subverted their own controls to secretly allow high-value U.S. customers to continue trading on the Binance.com platform. Further, the SEC alleges that while Zhao and Binance publicly claimed that Binance.US was created as a separate, independent trading platform for U.S. investors, CZ and Binance secretly controlled the Binance.US platform’s operations behind the scenes.

The SEC also alleges that CZ and Binance exercise control of the platforms’ customers’ assets, permitting them to commingle customer assets or divert them as they please, including to an entity CZ owned and controlled called Sigma Chain. The SEC’s complaint further alleges that BAM Trading and BAM Management US Holdings, Inc. (BAM Management) misled investors about non-existent trading controls over the Binance.US platform. At the same time, Sigma Chain engaged in manipulative trading that artificially inflated the platform’s trading volume. Further, the Complaint alleges that the defendants concealed the fact that it was commingling billions of dollars of investor assets and sending them to a third party, Merit Peak Limited, which is also owned by CZ.

The Complaint also charges violations of critical registration-related provisions of the federal securities laws:

- Binance and BAM Trading with operating unregistered national securities exchanges, broker-dealers, and clearing agencies;

- Binance and BAM Trading with the unregistered offer and sale of Binance’s own crypto assets, including a so-called exchange token, BNB, a so-called stablecoin, Binance USD (BUSD), certain crypto-lending products, and a staking-as-a-service program; and

- CZ as a control person for Binance’s and BAM Trading’s operation of unregistered national securities exchanges, broker-dealers, and clearing agencies.

Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law.

SEC Chair Gary Gensler.

UNREGISTERED EXCHANGE, BROKER, AND CLEARING AGENCY

The SEC’s complaint alleges that, since at least July 2017, Binance.com and Binance.US, while controlled by CZ, operated as exchanges, brokers, dealers, and clearing agencies and earned at least $11.6 billion in revenue from, among other things, transaction fees from U.S. customers. The SEC’s complaint alleges that (1) with respect to Binance.com, Binance should have registered as an exchange, broker-dealer, and clearing agency; (2) with respect to Binance.US, Binance and BAM Trading should have registered as an exchange and as clearing agencies; and BAM Trading should have registered as a broker-dealer. The SEC also alleges that CZ is liable as a control person for Binance’s and BAM Trading’s respective registration violations.

UNREGISTERED OFFER AND SALE OF CRYPTO ASSETS

The SEC charged Binance for the unregistered offers and sales of BNB, BUSD, and crypto-lending products known as “Simple Earn” and “BNB Vault.” Further, the SEC charged BAM Trading with the unregistered offer and sale of Binance.US’ staking-as-a-service program. The complaint also notes that Binance secretly controls assets staked by U.S. customers in BAM’s staking program.

FAILURE TO RESTRICT U.S. INVESTORS FROM ACCESSING BINANCE.COM

The SEC’s complaint alleges that CZ and Binance created BAM Management and BAM Trading in September 2019 as part of an elaborate scheme to evade U.S. federal securities laws by claiming that BAM Trading operated the Binance.US platform independently and that U.S. customers were not able to use the Binance.com platform. The complaint alleges that, in reality, CZ and Binance maintained substantial involvement and control of the U.S. entity and that, behind the scenes, CZ directed Binance to allow and conceal many high-value U.S. customers’ continued access to Binance.com. In one instance, the Binance chief compliance officer messaged a colleague that, “[w]e are operating as a fking unlicensed securities exchange in the USA bro.”

MISLEADING INVESTORS

According to the SEC’s complaint, BAM Trading and BAM Management misled Binance.US customers and equity investors concerning the existence and adequacy of market surveillance and controls to detect and prevent manipulative trading on the Binance.US platform’s crypto asset trading volumes. The complaint further alleges that the strategic and targeted wash trading largely perpetrated by the Binance.US platform’s primary undisclosed “market making” trading firm Sigma Chain, also owned by CZ, demonstrates the falsity of statements BAM Trading made about its market surveillance and controls.