According to The Block, crypto assets worth more than $4.2 billion at today’s prices have been seized in Chinese law enforcement actions in the PlusToken Ponzi scheme. The seized cryptos will be forfeited to the national treasury. The scammers allegedly cheated more than 2 million people out of more than $7.6 billion. So far, 16 people have been convicted and received prison-terms between two to 11 years as well as fines between $100,000 to $1 million.

The PlusToken allegedly operated between May 2018 and June 27, 2019, acquiring 2.6 million members. During this period, the pyramid scheme absorbed more than 314,000 BTC, 117,450 BCH, 96,023 DASH, 11 billion DOGE, 1.84 million LTC, 9 million ETH, 51 million EOS, and 928 million XRP. The scheme promoted a non-existent crypto arbitrage trading platform and promised attractive daily payouts if users would deposit at least $500 worth of crypto assets in order to participate. According to a court ruling made public on Nov. 26, and shared by The Block, law enforcement confiscated a total of 194,775 bitcoin (BTC), 833,083 ether (ETH), 1.4 million litecoin (LTC), and 27.6 million EOS.

In July 2020, police in China arrested 109 people linked with the Plustoken Ponzi scheme. It is believed that 27 of them have been the masterminds.

On September 22, 2020, there was a first instance result: the court sentenced three masterminds for establishing and operating a pyramid scheme. Like in the OneCoin scheme of Ruja Ignatova the PlusTuken scheme created its own crypto called PlusCoin which was used to pay the members. According to the Chinese prosecutors, PlusCoin had no value, and the scheme’s masterminds controlled its issuance quantity and price.

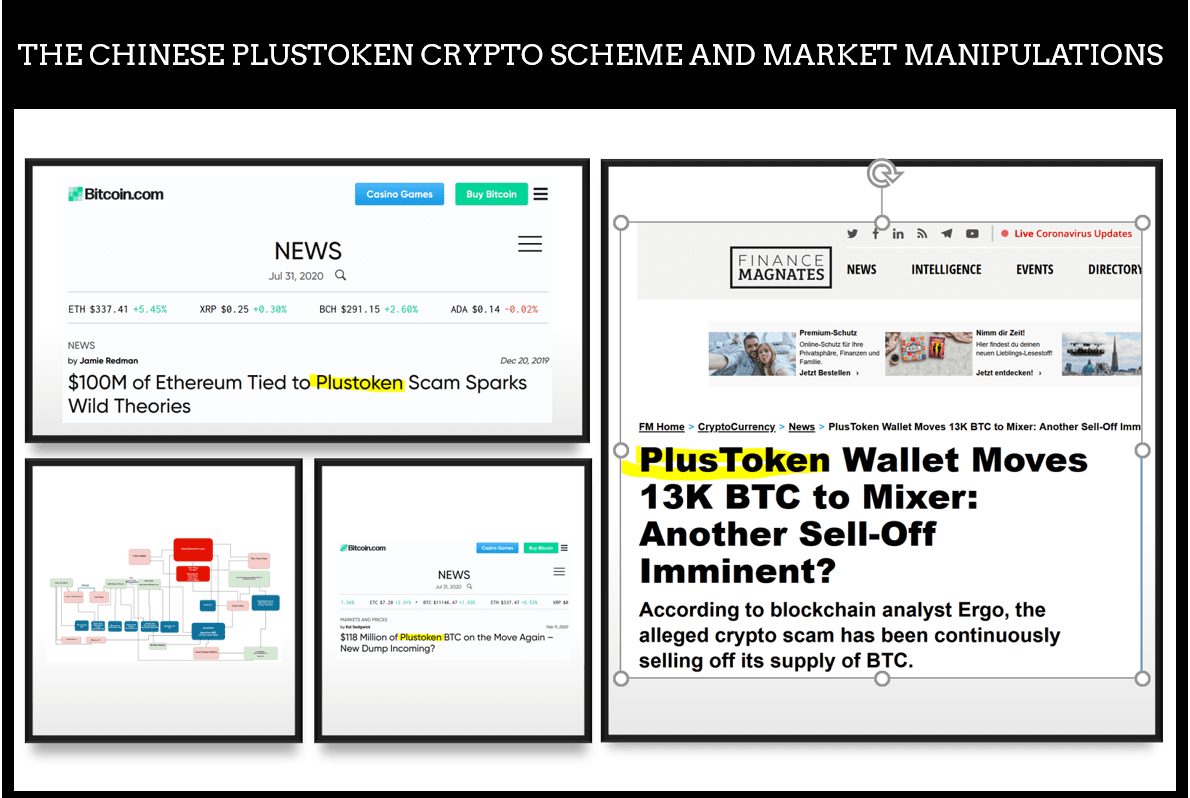

Many crypto experts also hold the PlusToken scheme and its operators responsible for many market manipulations in the crypto market. They have used the enormous amount of collected BTC, ETH etc. to speculate and manipulate prices of individual cryptos to their advantage.