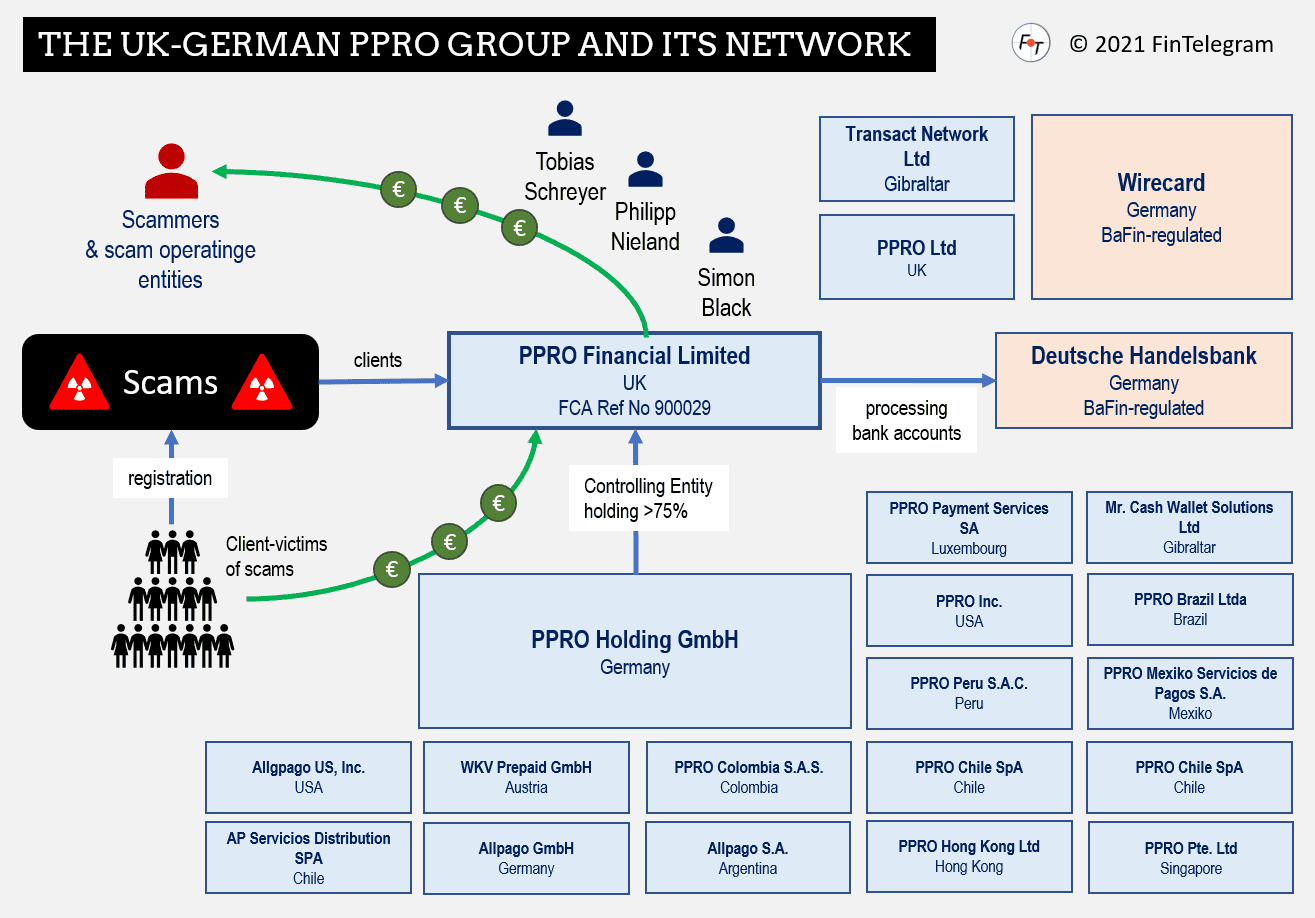

Germany has a new FinTech unicorn. FCA-regulated PPRO Financial is controlled by the German PPRO Holding GmbH and has affiliated companies in Europe, Asia, North and South America. Today, the company announced that it had received a total of $180 million in fresh money from investors based on a valuation of more than $1 billion. With this, PPRO joins the club of FinTech unicorns. However, in the past, PPRO has also attracted attention for supporting broker scams with its payment services. In this regard, the European Fund Recovery Initiative (EFRI) has filed a money laundering complaint against PPRO in Germany.

The investors in the financing round include Eurazeo Growth, Sprints Capital, and Wellington Management. Only just six months payment processor raised $50 million from Sprints Capital and Citi Ventures, and HPE Growth.

The PPRO Group was founded by former Wirecard manager Tobias Schreyer together with his partner Philipp Nieland. The group consists of more than a dozen companies in various jurisdictions. The holding company of the PPRO Group has its headquarters in Munich, Germany. PPRO also conducts its business through the FCA-regulated EMI agent Mr. Cash Wallet Solutions Ltd in Gibraltar.

In 2020, PPRO processed over $11 billion for its customers, including companies such as Citi, Mollie, PayPal, Worldpay, and many others. The company doubled its year-on-year transaction volumes in the fourth quarter of 2020.