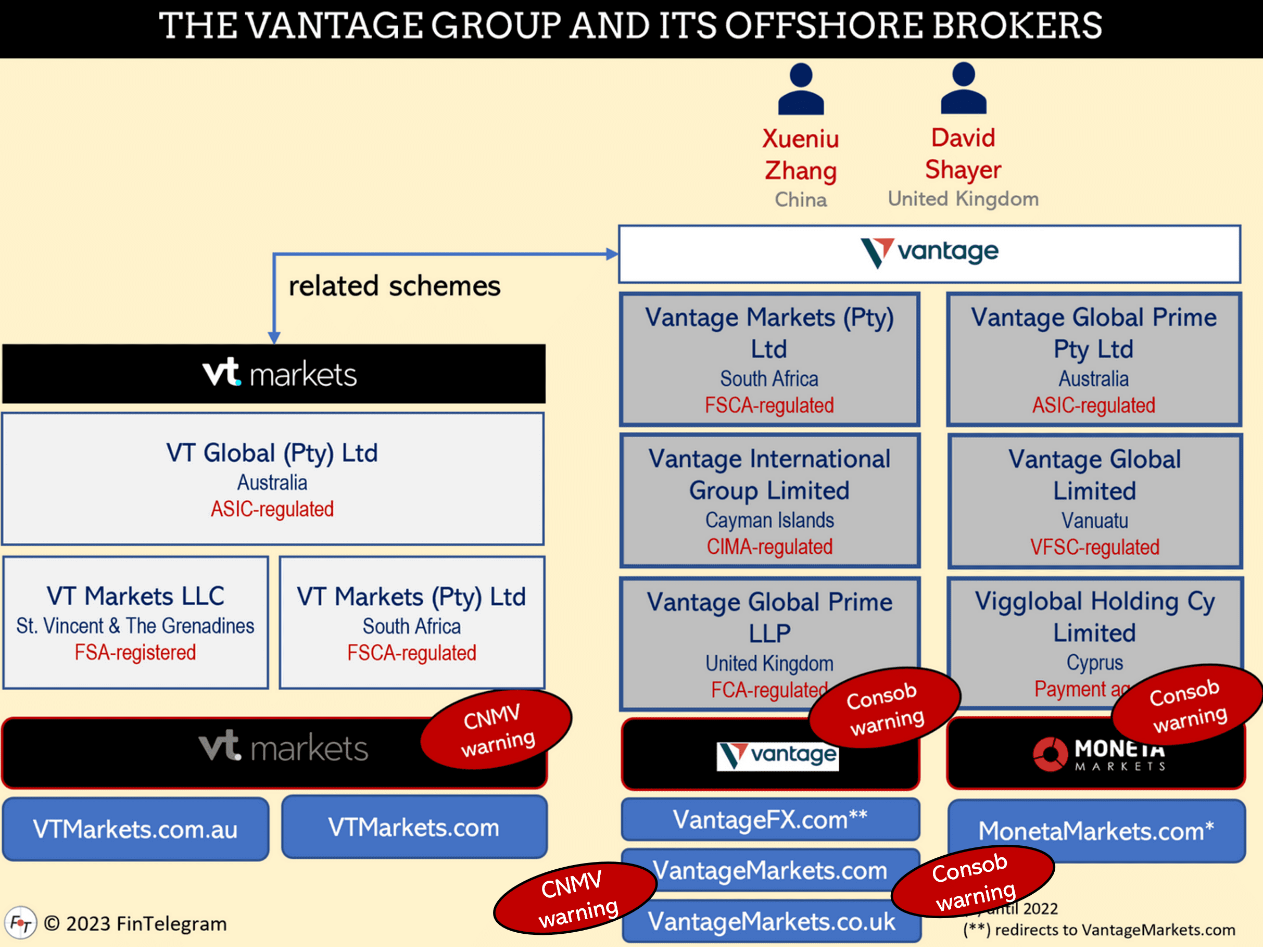

Vantage Prime Group LLC d/b/a VantageMarkets (VantageMarkets.co.uk) is regulated in the UK by the FCA. In addition, the VantageMarkets scheme runs offshore entities through which it performs onboarding of clients in the EEA region, in violation of the regulatory requirements of the FCA and ESMA regulators. Italian Consob has ordered the black-out of the VantageMarkets. Recently, Spanish CNMV issued another warning. We have assigned a Red Compliance rating to the Vantage Group.

Key Data

| Trading names | VantageFX VantageMarkets |

| Related schemes | VT Markets Moneta Markets |

| Activity | Multi-asset broker scheme |

| Domains | https://vantagefx.com https://vantagemarkets.com www.vantagemarkets.co.uk https://vantagemarkets.com.au https://vantagemarkets.com.ky |

| Legal entities | Vantage Global Limited (SVG) Vantage International Group Limited (Cayman) Vantage Global Prime LLP (UK) Vantage Global Prime Pty Ltd (Australia) Vantage Markets (Pty) Ltd (South Africa) TTMM Ltd (UK) |

| Jurisdictions | Australia, South Africa, Caymen Islands St. Vincent & The Grenadines, Cyprus |

| Authorizations | FCA for Vantage Global Prime LLP ASIC for Vantage Global Prime FSCA for Vantage Markets CIMA for Vantage International Group |

| Leverage | up to 1:500 |

| Payment processors | BridgerPay Token, FasaPay, SticPay, AstroPay Perfect Money, Advcash Bitwallet, TrustWorthyPay |

| Related individuals | David Shayer Xueniu Zhang |

| Warnings | CNMV, Consob |

Short Narrative

The partners of the FCA-regulated Vantage Global Prime LLP are David Shayer and TTMM Ltd, which controls the company, and where the Chinese Xueniu Zhang, born in January 1955, is registered as director and controlling person. David Shayer is also the FCA-approved compliance officer.

The entire VantageMarkets scheme appears designed to evade regulatory requirements and confuse customers. Until last year, VT Markets (reports here) and MonetaMarkets (reports here) were also part of this scheme. There are already regulatory warnings against these two offshore brokers as well.

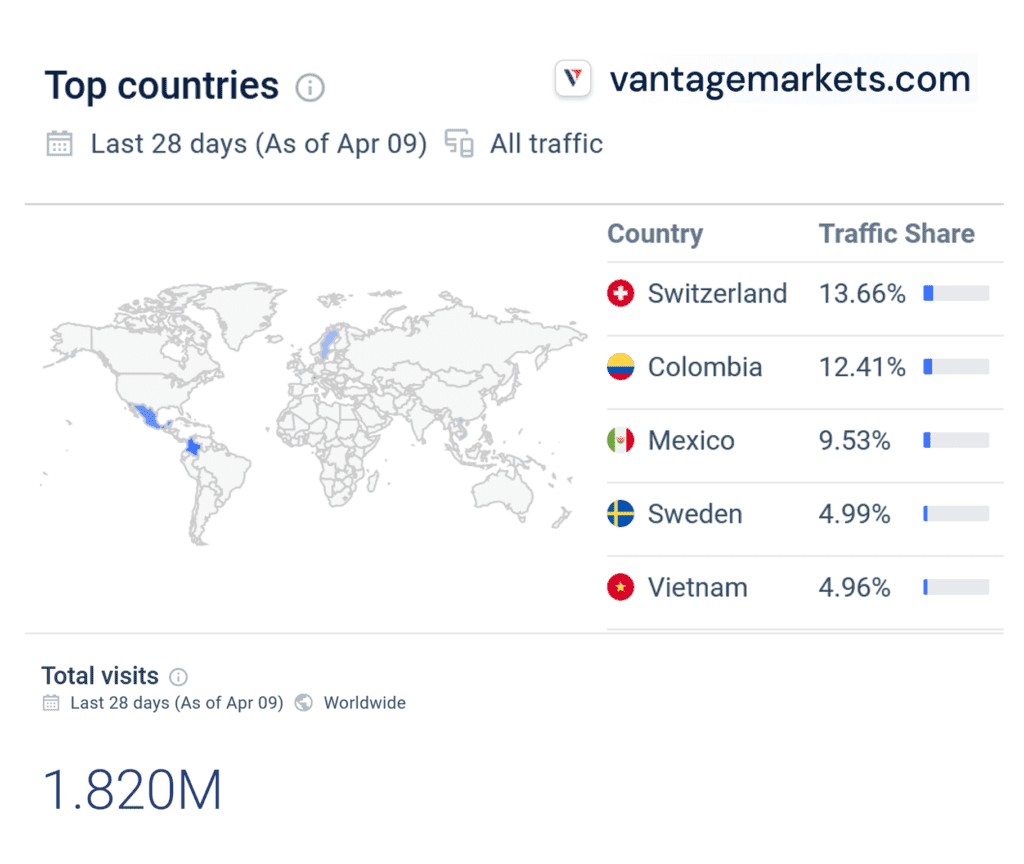

VantageMarkets is a huge broker scheme. In the last 28 days, before April 9, 2023, more than 1.8 million people have visited Vantage.com. Among the top 10 countries are Switzerland, Sweden, and other EEA countries (screenshot left).

In comparison, the website of the FCA-regulated entity VantageMarkets.co.uk has had just over 24,000 visitors in the last 28 days. This clearly shows where the VantageMarkets scheme’s focus is – offshore onboarding.

Payment Facilitators

The payment facilitator for credit/debit cards is BridgerPay for the offshore broker. Besides, the usual suspects among the payment processors at offshore broker schemas like the Russian Perfect Money and Advcash, as well as like SticPay and FasaPay, can be found.

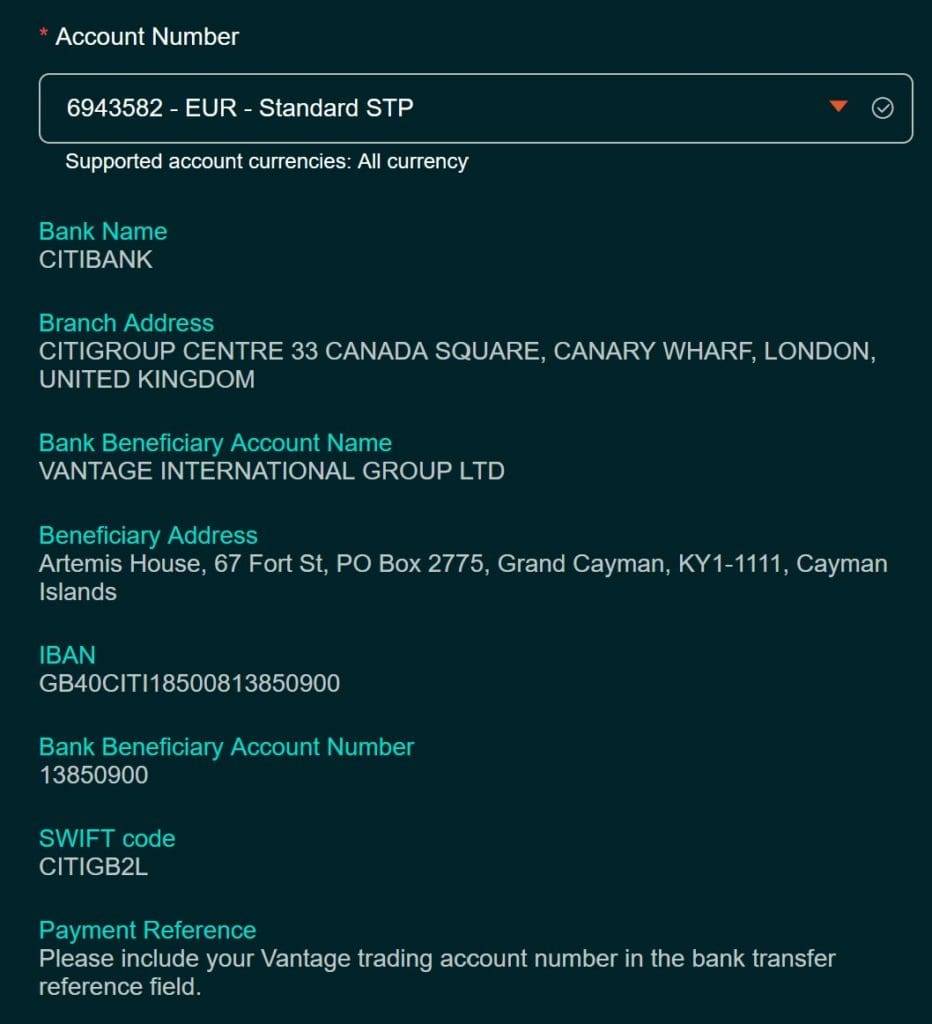

Deposits via SEPA bank transfer are processed via Token (token.io). Bank deposits via SWIFT are processed via Citibank. The payments go to the bank account of Vantage International Group Ltd.

Theoretically, unlimited crypto deposits can be made to VantageMarkets through Bitwallet or TrustWorthyPay.

The VT Markets Connection

VT Markets was part of the Australian Vantage Group until Q2 2022 when it was carved out (report here). The multi-asset and CFD broker VT Markets offers leverage of up to 1:500 in violation of regulatory requirements in EEA jurisdictions. Although VT Markets has no authorization in the EEA regions, it is no problem to register as an EEA resident. According to the latest Similarweb statistics, about 40% of VT Markets‘ website visitors come from EEA countries such as Italy, France, or Switzerland.

Compliance Check

Neither the offshore CIMA nor the Australian ASIC license entitles VantageMarkets to offer its financial services in the EEA jurisdictions. The broker is acting illegally in their regulatory regimes, the Spanish CNMV and the Italian Consob state. The offshore broker VantageMarkets accepts clients from EEA jurisdictions. EEA countries (as well as most other countries worldwide) are included in the drop-down list during registration. The payment methods are also based on EEA citizens.

After registration, you can make pre-KYC deposits in theoretically unlimited amounts via bank transfer or crypto before the KYC check and, thus, before confirmation of identity and address.

VantageMarkets also offers leverage of 1:500 for retail clients. In ESMA‘s regulatory regimes, a maximum leverage of 1:30 is allowed for retail clients. Consequently, VantageMarkets‘ offering violates regulatory requirements in most Western jurisdictions.

Given the regulatory warnings and our findings of regulatory violations, we assigned Vantage Group the Red Compliance rating.

Share Information

If you have any information about VantageMarkets, its operators, and its facilitators, please let us know through our whistleblower system, Whistle42.