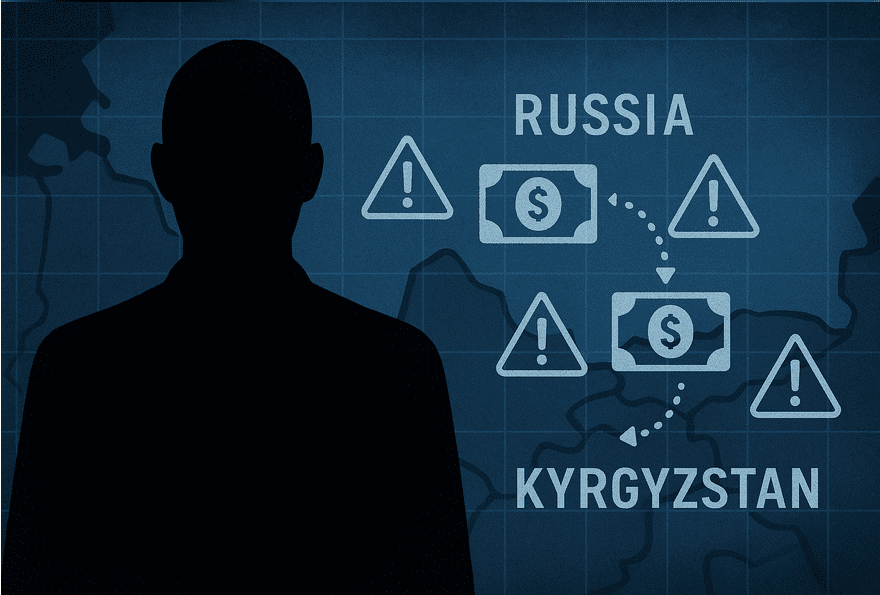

As Western sanctions tightened, Russia turned to Kyrgyzstan as a backdoor for cross-border payments, exploiting regulatory blind spots and digital finance loopholes. This case exposes urgent vulnerabilities in Eurasian financial controls and calls for a coordinated compliance response. The Diplomat magazine also questions the role of the notorious crypto money laundering platform Grinex (formerly Garantex) and its stablecoin A7A5.

KEY POINTS

- Russia rerouted financial flows via Kyrgyzstan after being cut off from SWIFT and major Western payment systems.

- Kyrgyz banks and payment platforms saw a surge in Russian-linked transactions, with suspicious spikes in cross-border transfers.

- Regulatory arbitrage exploited: Weak AML/CFT controls in Kyrgyzstan enabled Russian actors to bypass restrictions.

- Digital wallets and crypto rails played a pivotal role, complicating traceability and enforcement.

- Local facilitators and shell companies set up in Kyrgyzstan to mask Russian beneficial ownership.

- Western regulators struggle to monitor secondary jurisdictions, exposing a gap in global sanctions enforcement.

SHORT NARRATIVE

In the wake of unprecedented Western sanctions, Russia’s financial system faced isolation from global payment networks. Instead of capitulating, Russian actors leveraged Kyrgyzstan’s under-regulated banking and fintech sectors to funnel funds abroad. The influx of Russian capital into Kyrgyz payment systems—often disguised through shell companies and digital wallets—allowed sanctioned entities to regain access to international markets. This maneuver not only undermined sanctions but also highlighted the systemic risks posed by regulatory arbitrage in the Eurasian region.

EXTENDED ANALYSIS

Legal and Regulatory Dimensions:

Kyrgyzstan’s financial sector became a pressure valve for Russian capital, exploiting gaps in AML/CFT frameworks. Local banks and fintech platforms, lacking robust KYC protocols and facing limited regulatory oversight, processed a dramatic increase in Russian-origin transactions. Shell companies and nominee directors obscured the true source of funds, while digital wallets and crypto assets enabled rapid, cross-border movement with minimal scrutiny.

Operational Risks:

The case demonstrates how secondary jurisdictions can become unwitting (or complicit) facilitators of sanctions evasion. The use of digital finance rails—especially those outside the FATF’s regulatory perimeter—creates significant challenges for compliance teams and regulators. The opacity of beneficial ownership structures and the speed of digital payments further erode the effectiveness of traditional monitoring tools.

Geopolitical Implications:

The Kyrgyzstan conduit not only serves Russian interests but also exposes the entire Eurasian region to heightened scrutiny and potential secondary sanctions. The risk of regulatory “black holes” is now a central concern for global compliance professionals and policymakers.

ACTIONABLE INSIGHT

Compliance teams and regulators must:

- Intensify scrutiny of cross-border transactions involving Kyrgyzstan and similar high-risk jurisdictions.

- Demand enhanced due diligence (EDD) for clients and counterparties with exposure to Eurasian payment systems.

- Collaborate across borders to close regulatory gaps and share intelligence on emerging financial crime typologies.

- Monitor the rise of digital wallets and crypto rails as vectors for sanctions evasion.

CALL FOR INFORMATION

Have you observed suspicious transactions, new payment platforms, or shell company activity linked to Kyrgyzstan or other Eurasian states? Share intelligence, typologies, or red flags with FinCrime Observer. Your insights drive collective action.