German law and tax enforcement agencies have recently started investigating international iGaming companies operating in Germany. Several MGA-regulated Malta-based iGaming companies received letters from the German tax authorities. iGaming operators are subject to German VAT and sports betting tax if the German market is targeted. Not reporting these taxes is seen as tax evasion and thus a criminal offense and causes liability for the directors such as Iosif Galea. He was arrested!

The Latest Case

In mid-May 2022, Iosif Galea, a Maltese gaming consultant, who acted as director for Malta-licensed gaming firms, was arrested in Italy during a holiday. The German authorities had issued an EU arrest warrant more than a year ago. For some reason, the Malta authorities did not arrest Galea. However, while being on holiday in Brindisi, Italy, he was arrested and extradited to Germany. He was later released into house arrest!

According to a report in The Times of Malta, the police had been investigating Galea for financial crimes when he was granted police bail. This means that he would have had to seek the police’s permission before traveling abroad. Other well-informed sources confirmed to FinTelegram that Iosif Galea was not aware of any arrest warrant in his regard.

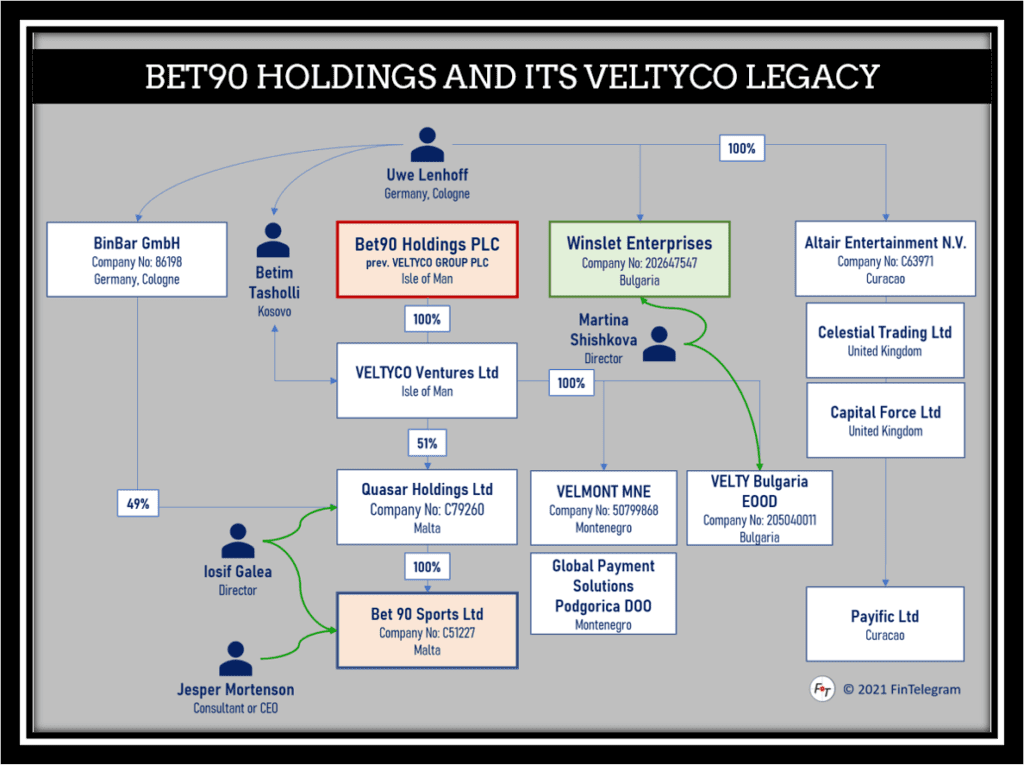

Iosif Galea, who runs his own consultancy firm was previously a compliance officer at the Malta Gaming Authority (MGA). He came to our attention as a director of Bet 90 Sports Limited d/b/a Bet90 (www.bet90.com) in Malta, regulated by the Malta Gaming Authority (MGA). Bet90 was a venture of the Veltyco cybercrime organization of alleged cybercrime mastermind Uwe Lenhoff and his partner Betim Tasholli. While Lenhoff died in pre-trial detention in the summer of 2020, Tasholli is currently being tried in Germany.

Rethinking The Approach

This arrest shocked the Malta gaming industry, with many directors of Malta-licensed gaming firms seriously thinking of their next move. It was good business for Maltese gaming consultants to act as nominee directors for MGA-regulated iGaming companies that were mostly controlled by foreign people.

A few years ago, Joerg Hofmann, an attorney at German law firm Melchers, had warned about this. German tax authorities view Malta-based iGaming operators as being subject to German VAT and sports betting tax if the German market is targeted. Not reporting these taxes to the German fiscal authorities may incur criminal liability for the directors and serious fines for companies due to tax evasion, he said.