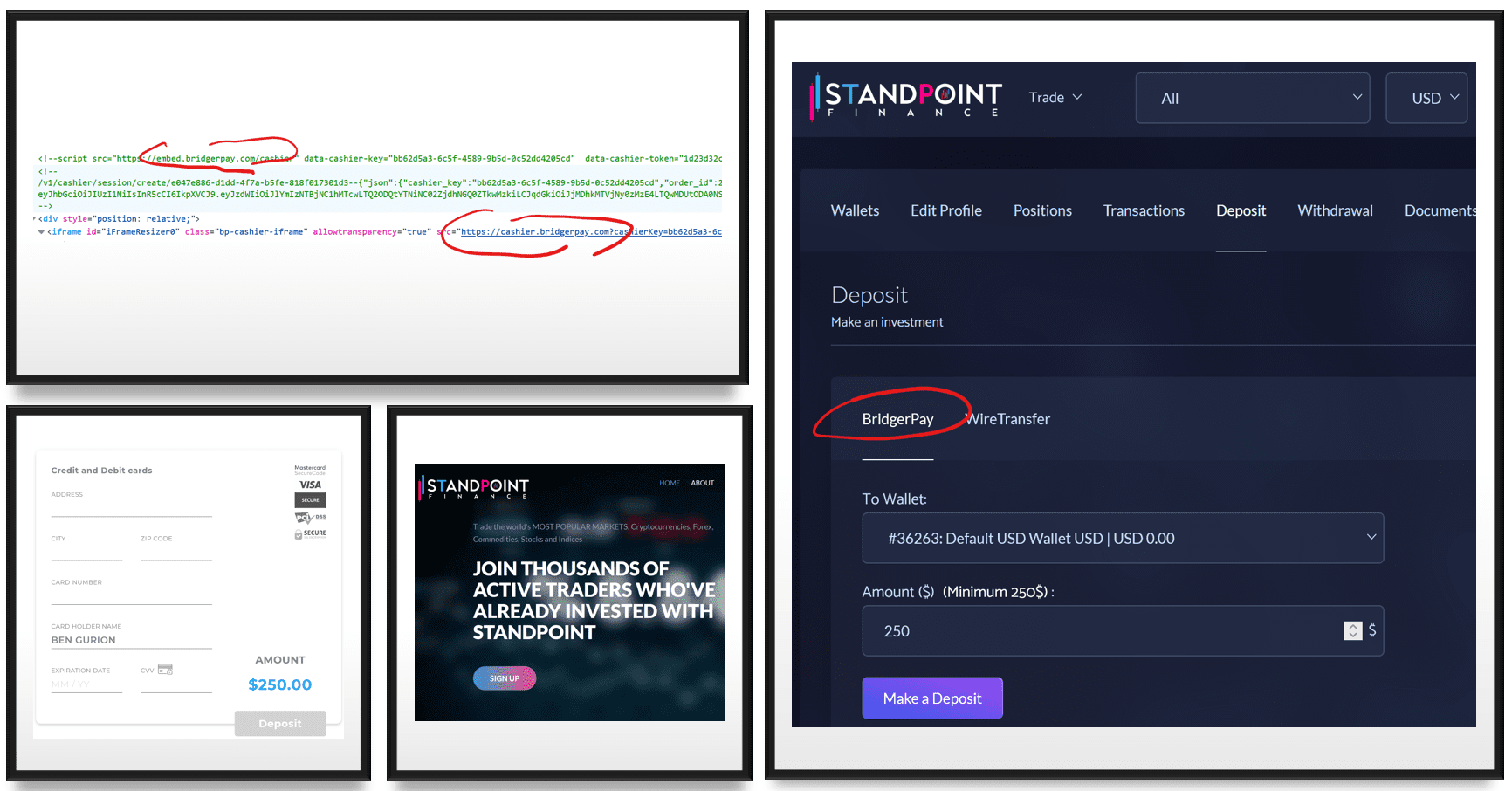

We have discovered BridgerPay as a facilitating payment processor at exactly 78 scam brokers in our reviews over the last three years. Thereby, our assessments cover maybe 10% of the existing scams. If at all. In this respect, it is easy to gauge how many of these scam brokers are supported by VISA partner BridgerPay. Today we discovered Ran Cohen‘s Israeli-Cypriot payment processor at StandPoint Finance (www.standpointfinance.com). The Spanish regulator CNMV issued a warning against this scam.

Key data

| Brand | StandPoint Financial |

| Domain | www.standpointfinance.com |

| Legal entity | Standpoint Financial Limited |

| Jurisdiction | St. Vincent & The Grenadines |

| Payment processor | BridgerPay |

| Warnings | CNMV, AMF Quebec |

Scam narrativ

StandPoint Finance has presented itself as a crypto broker via various press releases and wants to profit from the still ongoing (despite recent price drops) crypto hype. Most recently, StandPoint Finance announced its intention to open a Bitcoin mining farm in a press release on November 15, 2021.

The scam is active in several languages, attacking consumers in English, Spanish, Italian, German, and Russian. The offshore entity Standpoint Finance Limited, registered in St. Vincent & The Grenadines, is listed as the operator.

Warnings

Today, Spanish regulator CNMV issued a warning against StandPoint Finance (see our report here). Previously, the Canadian regulator AMF had already placed the scam on its warning list. As recently as October 2021, StandPoint Finance said via a press release that it would “work the Spanish-speaking market.” A dangerous threat.

The payment processor

Of course, we don’t know precisely why the high-risk payment processor BridgerPay is so intensively involved in the illegal scene and supports it. But you don’t need to be a rocket scientist to suspect that it’s about growth and profits. The dishonest customers pay a lot more. Ran Cohen and Nati Harpaz run Cyprus-based BridgerPay AI Limited d/b/a BridgerPay (www.bridgerpay.com)

With the rapid volume growth, insiders say they hope to attract investors. Former Mossad chief Tamir Pardo‘s South Israel Bridge Fund (SIFR) is said to have shown interest in investing (see report here). Most recently, BridgerPay has made a massive investment in Australia, where Nati Harpaz has entrepreneurial roots. The company plans to work the market through a subsidiary in Australia systematically.

On its website, BridgerPay only presents itself as an API provider and thus wants to reject any responsibility for scam support:

“BridgerPay is not a PSP, or an acquiring service, and we do not provide any processing merchant accounts. Bridger is a PaaS (payment-as-a-service) company that allows businesses to utilise one API to consume all payments from any method or provider that is connected within BridgerPay’s ecosystem.” Source: www.bridgerpay.com

Well, this statement is not valid. BridgerPay is a Merchant Service Provider in the VISA network in the first place. This is more than an API provider. Thus, the payment processor has to comply with the KYC/AML rules of VISA and adhere to international anti-money laundering rules. Ran Cohen claims to have no obligation to apply proper KYC or AML procedures because BridgerPay would only route traffic through its API. Of course, this is nonsense. Any scam merchant like StandPoint Finance enters into an agreement with BridgerPay and becomes its client. Thus, BridgerPay must perform KYC when onboarding and ongoing transactional AML checks. But it doesn’t want to or can’t. That would be detrimental to growth and profits.