Phoenix Payments Ltd d/b/a Paytah, registered in Malta and regulated by the MFSA, is currently at the center of regulatory and criminal investigations in several European jurisdictions. In addition, Paytah is facing claims from scam victims who made deposits to various scams through Paytah and its affiliates. The European Fund Recovery Initiative (EFRI) represented the interests of victims at an obscure Financial Ombudsman hearing in Malta. Franklin Cachia of CSB Group represented Paytah. Cachia is currently the company’s contracted compliance officer.

No compliance invented here

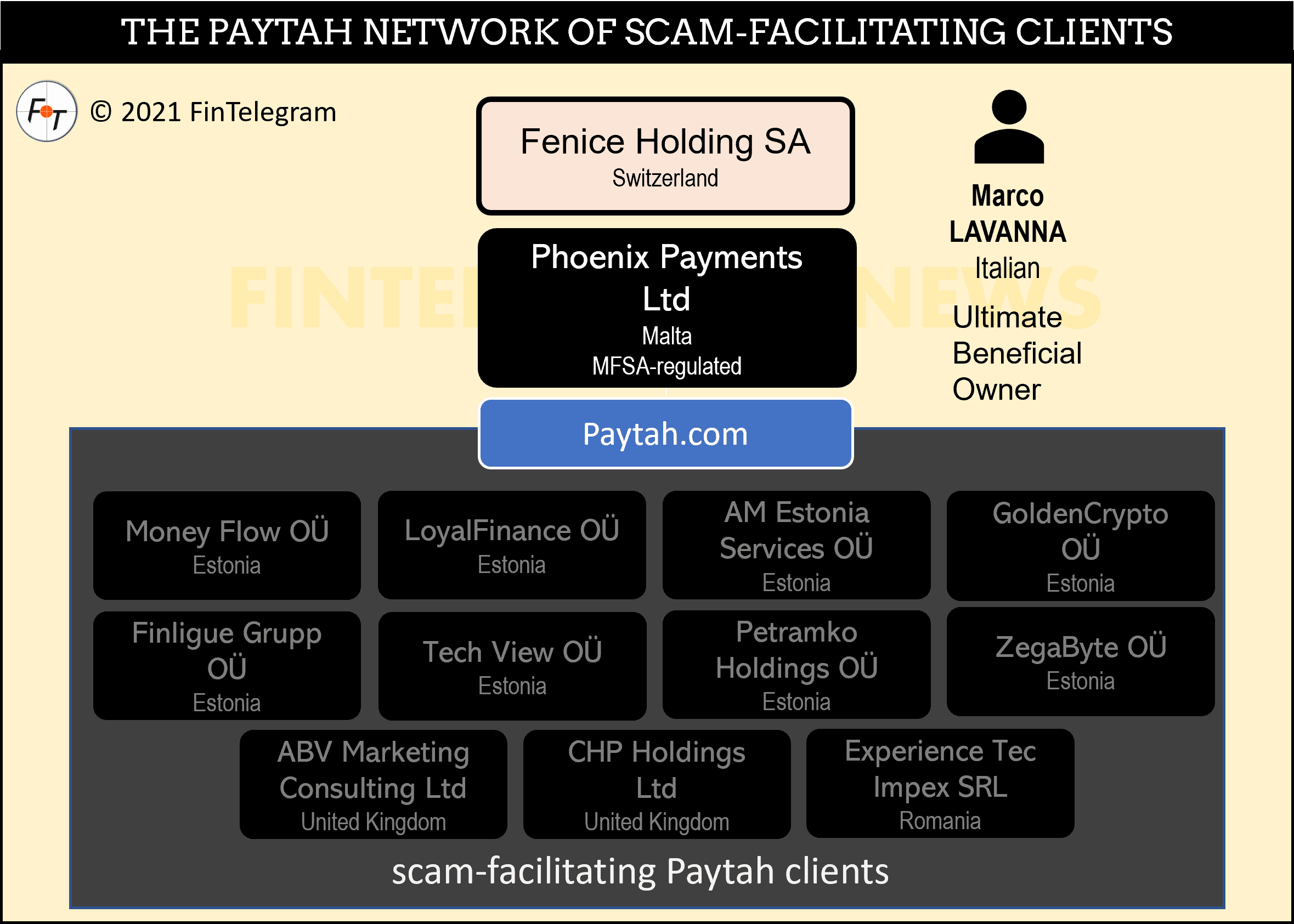

Paytah is beneficially owned and controlled by the Italian Marco Lavanna. The company’s last chief compliance officer Daniela Pesci left the company because of its alleged massive involvement in money laundering with Estonian crypto-payment processors. The resigned CCO has also informed local authorities in Malta and Interpol about this. Please read this report here for more information.

Court documents revealed that the Malta Financial Intelligence Analysis Unit (FIAU) had been provided with all evidence. However, to date, no reprimand or fine has been issued by the FIAU. The director of FIAU, Kenneth Farrugia, and his deputy Alfred Zammit have made the international headlines for the wrong reasons over the past years.

The long list of scam-faciliating Paytah clients

Paytah does not work directly with scam operators but with illegal payment providers and crypto payment processors, which facilitate scam operators. Most of these scam-facilitating payment processors are Estonian entities. Some of them have (or had) an Estonian crypto license. These crypto companies accept scam operators as customers and have their bank account with Paytah. Deposits from victims of the scams are systematically processed through these Paytah bank accounts. During the hearing with the Malta Financial Ombudsman Reno Borg, it was found that the following clients processed payments from scam victims through Paytah:

- Finligue Grupp OÜ d/b/a Crypto1

- LoyalFinance OÜ d/b/a BitofHeaven

- AM Estonia Services OÜ d/b/a Venus Exchange with Steveyx OÜ

- Petramko Holdings OÜ (in liquidation)

- ZegaByte OÜ

- CHP Holdings Ltd

- Money Flow OÜ d/b/a Bitnomics

- GoldenCrypto OÜ a/k/a LyraPro OÜ

- Tech View OÜ d/b/a TechView

- Woodstocks OÜ d/b/a Coinmond

- Experience Tec Impex SRL

- ABV Marketing Consulting Ltd

The processing of funds stolen from scam clients is also known as money laundering. This is what Paytah does knowingly and intentionally as part of its business model. This does not just happen; it is deliberate! Under MFSA supervision.

The hearings

The Maltese Financial Ombudsman, Reno Borg, is a former politician who was a candidate for the Maltese Labour Party. He was appointed by the former Finance Minister Edward Scicluna, who presently serves as Malta’s Central Bank Governor and on the Malta Financial Services Authority’s board. Scicluna had also appointed disgraced Joseph Cuschieri as MFSA’s CEO.

The ombudsman scheduled the 27 Sept 2021 for hearings of Paytah victims. There must be hundreds of victims out there, EFRI represents 12 of them with a damage of more than € 350,000,- all processed to scams via Paytah bank accounts. For most of the victims, it was the second or third hearing already as the proceedings with the victims’ claims against Paytah have been dragging on for many months.

One of the hearings scheduled for 27 September got canceled only last week as a victim a 67-year-old Greek man who had lost around €135,000 to a scam via PayTah died. His friends talk about a very bad and difficult financial and personal mental situation of the .. after he fell victim to the scam LincolnFX (he transferred money to this scam via Paytah). EFRI joined a meeting with a Belgian victim, who got scammed by Infinitrade. It was her second meeting with the ombudsman.

Unfortunately, the scheduled hearing at the Office of the Arbiter for Financial Services (OAFS) turned out to be pointless. The ombudsman declared himself not competent after Franklin Cachia explained that the same case is pending against PayTah in the United Kingdom. Thus, the UK ombudsman would be competent and not the Maltese ombudsman. End of hearing! It was ridiculous.

Another hearing for another PayTah victim on that day also ended with the decision of the ombudsman that he would not be in charge of this case after the victim assumed PayTah may be part of a fraud scheme. The ombudsman told the victim that he needs to file the crime and money-laundering complaints with the criminal authorities.

Paytah’s new compliance officer Franklin Cachia was extremely aggressive, showing no sympathy for the victims and dismissing all blame from the company. How dare they! Well, sure, what’s the problem with Paytah getting involved with scam-facilitating crypto companies? Who cares that there are apparently no proper KYC/AML procedures there. The last Chief Compliance Officer had already communicated this to the authorities in writing. Apparently, however, neither the MFSA nor the OAFS are interested in taking action against scam facilitators. Christopher Buttigieg, the Chief Officer Supervision of MFSA, has been harshly criticized by the media for his flawed promotion of Malta as a blockchain island.

Notorious scam-facilitator

In Germany, the law firm Resch reports about the involvement of Phoenix Payments Ltd a/k/a Paytah as a scam-facilitating payment processor in the 10CryptoMarket (report here) and the Prime-InvestFX (report here) scam where victims deposited to the Paytah bank accounts of ABV Marketing Consulting Ltd and Business Credit s.r.o respectively. There are dozens of major broker scams such as Finexics, Infinitrade, RoyalsFX, CodeFX, or LincolnFX processed through Paytah and its affiliates.

Phoenix Payments is also involved with regulated brokers like ForexTB, PatronFX, Trade360, or 1Market as a payment processor. Does the legitimate question arise why regulated investment firms get involved with this notorious scam facilitator?

Nobody cares!

Phoenix Payments Ltd is an MFSA-licensed payment institution (see MFSA page). The Paytah offices are less than 500 meters away from the MFSA’s headquarters, but this does not prevent the company from running its business in an evidently non-compliant way. Recent media articles revealed that MFSA is not shy to reach secret settlements with the chosen few. This has been described as blatant discrimination being carried out by the MFSA’s executive committee consisting of Christopher Buttigieg, Michelle Mizzi Buontempo, Ivan Zammit, Michael Xuereb, and Edwina Licari.