The Yukom Enterprise binary options fraud scheme, currently being prosecuted by U.S. Prosecutors and sued by the U.S. Commodity and Futures Commission (CFTC) for binary options fraud, has collected more than $100 million from retail investors worldwide through its BinaryBook, BigOption, and BinaryOnline brands. The exact numbers vary. While the U.S. prosecutors speak of about $145 million, the CFTC lawsuit mentions $103 million.

It will take months for the Yukom Enterprise scheme to be completely investigated and judged. Following the conviction of the former CEO of the scheme, the Israeli Lee Elbaz, by a U.S. jury, the trial against the beneficial owners Yossi Herzog and Kobi Cohen are next in line on the criminal channel. In addition to the scheme’s two beneficial owners, other persons from the schema are also indicted. The five former employees, Shira Uzan, Lissa Mel, Liora Welles, Austin Smith, and Yair Hadar, have already pleaded guilty and concluded a plea agreement with the U.S. prosecutors.

The stolen money and money laundering

During the Relevant Period, the Defendants have accepted at least $103,636,488 million in funds in connection with the fraudulent binary

CFTC lawsuit paragraph 89option trading scheme. In an effort to conceal the true ownership of the Yukom Enterprise and prevent customers who realized they had been defrauded from recovering funds, Defendants, often acting through one of the Related Entities, have used over 100 off-shore bank accounts to funnel deposits from U.S. customers, all of which ultimately came to be controlled by Cohen, Herzog, and Peretz, or others acting on behalf of and in concert with the Yukom Enterprise.

According to the CFTC lawsuit, the Yukom Enterprise perpetrators misappropriated a significant percentage of those customer funds by utilizing various manipulative or deceptive instruments, including so-called “bonuses” and “risk-free” trades. They prevented client-victims from withdrawing funds by artificially manipulating the results of fictitious binary option “trades” to force customer losses and ultimately prevent customers from withdrawing funds.

The CFTC found that Yossi Herzog and his partner Kobi Cohen worked with an elaborated network of companies and bank accounts to launder the money they stole from retail investors in the first place. They have used over 100 off-shore bank accounts to funnel deposits from U.S. customers, all of which ultimately came to be controlled by Cohen, Herzog, and Peretz, or others acting on behalf of and in concert with the Yukom Enterprise. The criminal term for this activity is money laundering.

Where’s the money? Much of the client-victims money was used to pay salaries and bonuses to Yukom’s boiler room agents and management. A lot of money was also paid to mostly Israeli online marketing companies for the acquisition of data of new (potential) client-victims. However, a significant portion remained with the beneficial owners and their entities. How the stolen money from the retail investors via BinaryBook, BigOption, and BinaryOnline was channeled to the beneficial owners (a process which is also called money-laundering) is certainly best known to the payment service providers involved.

Payobin and MoneyNetInt

The authorities, lawyers of defrauded retail investors and FinTelegram are still searching for the exact details of the travel route of the stolen money. It’s for sure a complex puzzle but with the much

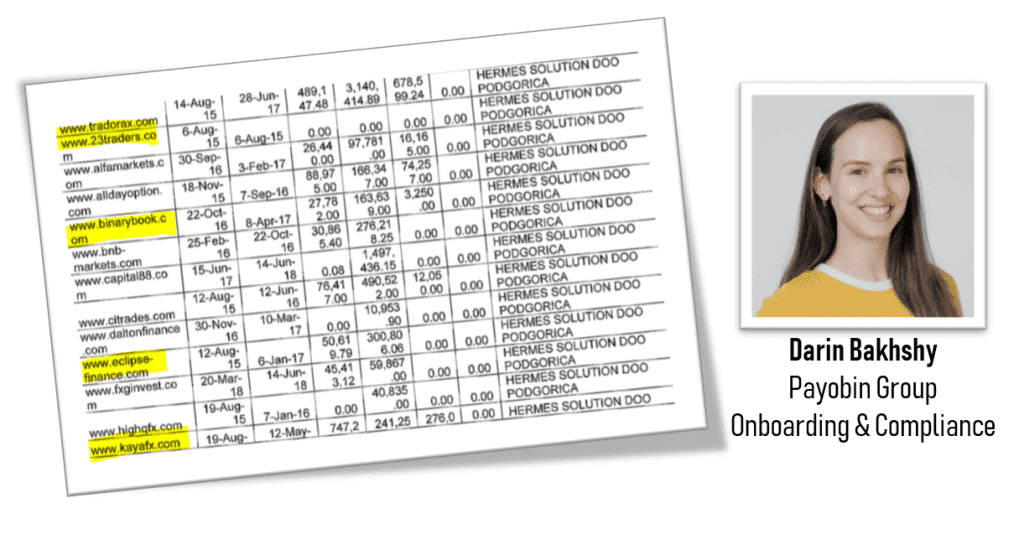

We have already uncovered in previous reports that the Israeli Payobin (operated by the Israeli Payotech Ltd) was directly involved in the payments of

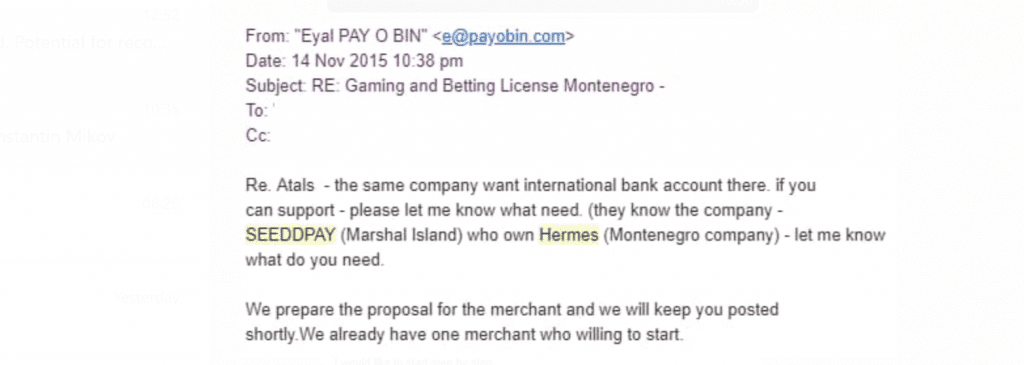

Nachum, Zoltovski, and Jeremitsky controlled Hermes Solution through SeeddPay Ltd, another offshore entity registered in the Marshall Islands. Eyal Nachum, the Payobin CEO, describes this nicely in the email above. The certified company documents are available to FinTelegram.

Payobin has engaged with other financial service providers, such as one licensed PSP mentioned in the CFTC complaint, to launder the stolen funds for Yukom Enterprise and other broker scams. The involved financial service providers are also victims of Payobin and typically had no information about the binary options fraud that was processed via Payobin. Currently, various lawsuits and criminal investigations are being conducted in several jurisdictions.

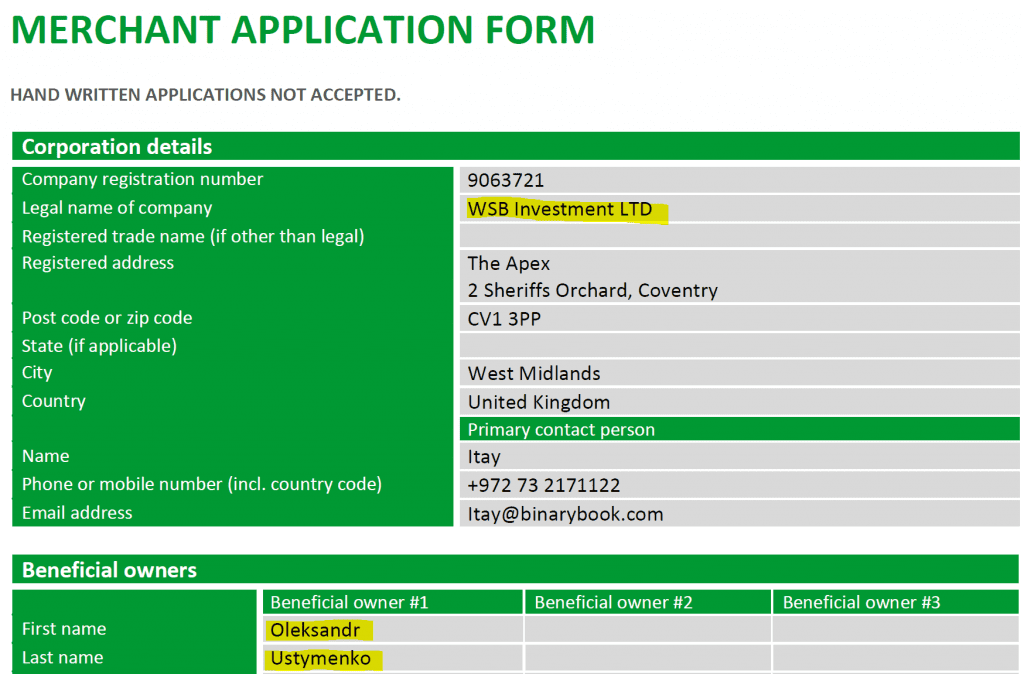

Payobin, for example, accepted WSB Investment with BinaryBook as its merchant and thus integrated the binary option scheme into the global financial system. Payobin did the KYC and AML check. A registered merchant like WSB was able to receive funds from small investors via Payobin and its correspondence partners.

In addition to Payobin, the Israeli MoneyNetInternetional acted as PSP in the Yukom Enterprise scheme. MoneyNet International, a financial service provider, licensed in the UK by the Financial Conduct Agency (FCA) with the registration No 900190 since 2014, used to work closely with Israeli binary options operator MigFin in many other broker scams.

Israel’s binary options and forex broker scene is extremely well networked, acting globally and professionally.

Fibonatix and Tal Miller

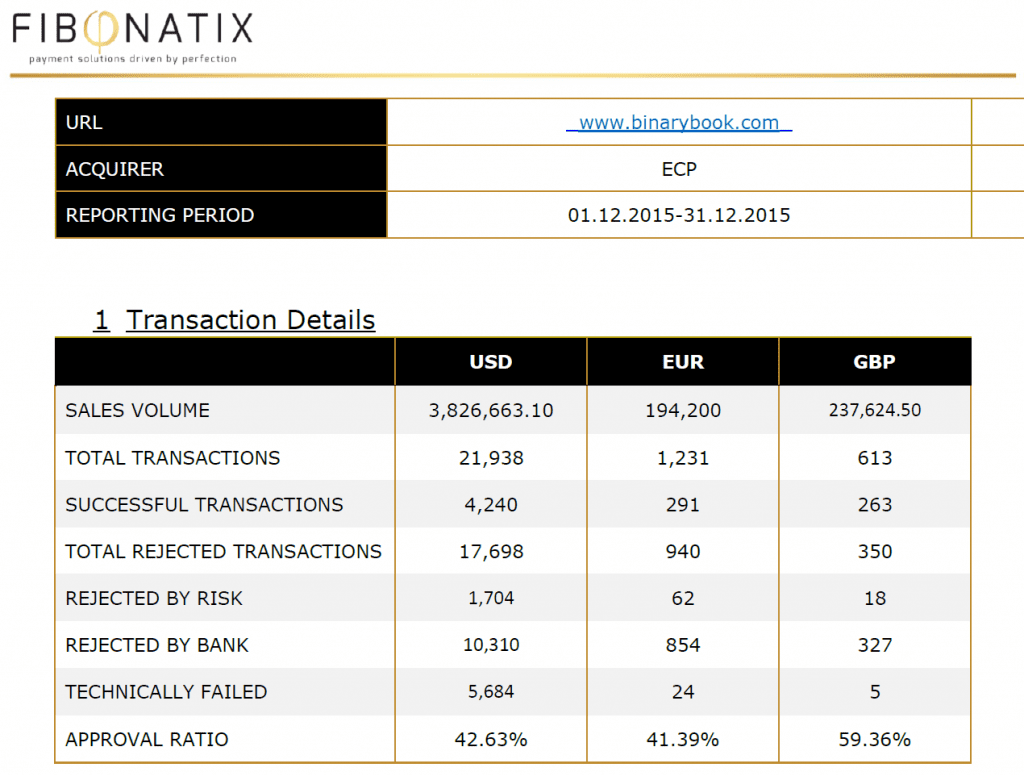

In addition to Payobin and MoneyNetInt, the Israeli payment service provider Fibonatix has been involved in the Yukom Enterprise Schema. The FinTelegram documents show that a considerable volume of credit card deposits to the Yukom Enterprise scheme was settled via Fibonatix (see screenshot below). Fibonatix was founded in 2013 by the Israeli Tal Miller (LinkedIn profile) and has focused its payment services in recent years on the high-risk segment such as gaming, gambling, binary options, forex, and cryptocurrencies.

In the above-shown reporting

On its website, Fibonatix explains that it is a Gold Member m MasterCard Business Partner Program. This makes the cooperation with the Yukom Enterprise Schema interesting because MasterCard has already banned the Binary Options from its network in North America in 2016.

The journey continues

The investigations of the Yukom Enterprise schem