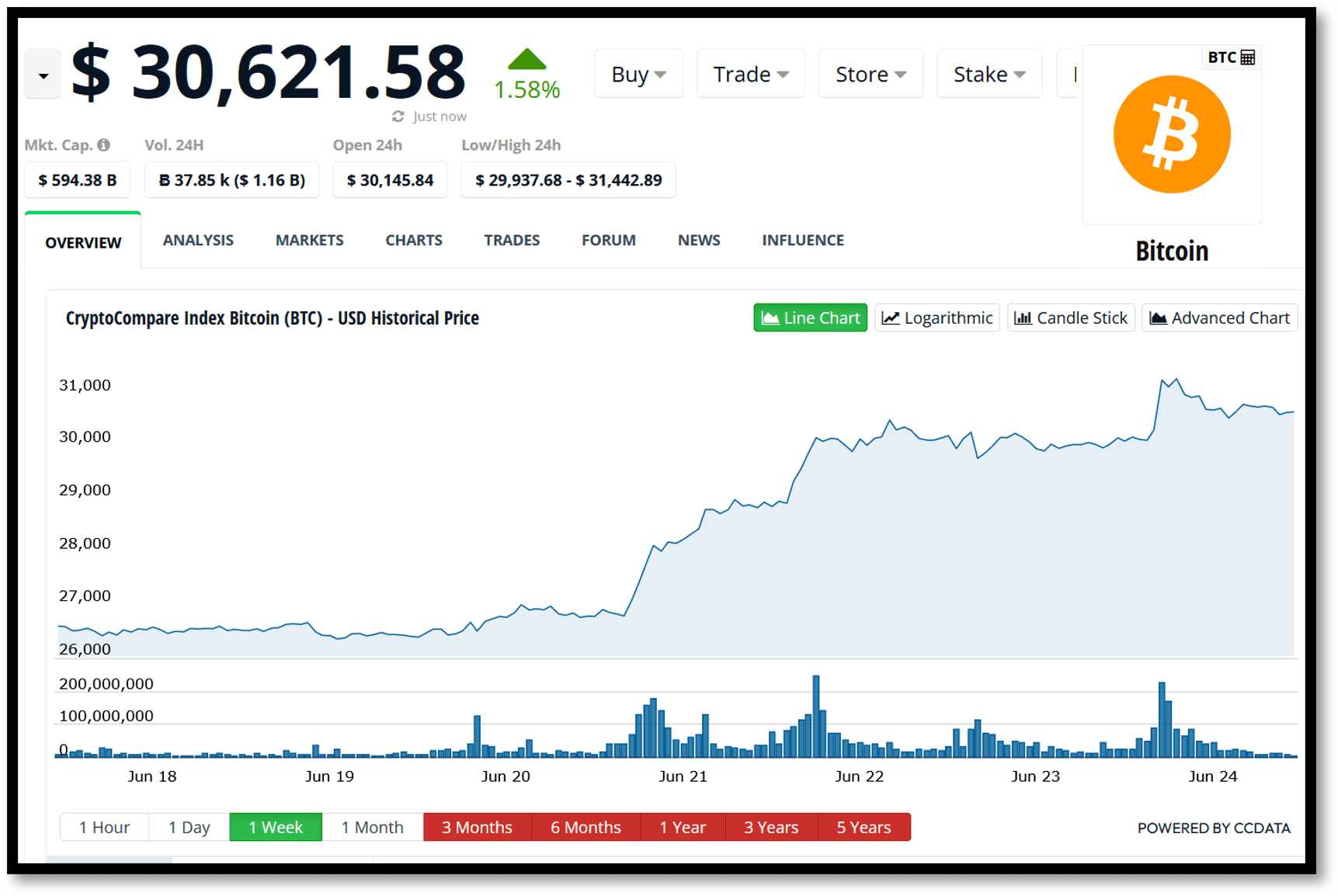

Bitcoin, the largest cryptocurrency, reached a new high in over a year on Friday, partly by BlackRock‘s intention to establish a Bitcoin exchange-traded fund (ETF). BlackRock, the world’s largest asset manager, filed last week to introduce iShares Bitcoin Trust, an ETF that would utilize Coinbase Custody as its custodian and provide institutional investors with exposure to the cryptocurrency. Bitcoin has surged nearly 25% in value and reached a peak of $31,458.

Besides the BlackRock news, the EDX Markets announcement has also driven the bullish market development. This non-custodian crypto exchange, supported by investment firms Charles Schwab, Fidelity, and Citadel Securities, also announced its plans to enable the trading of select cryptocurrencies this week. The exchange caters to institutional clients

Ethereum, the second-largest cryptocurrency globally, has also experienced a 16% increase since last week, reaching $1,903.20 on Friday, a rise of 1.63%.

These developments have reignited investor interest in crypto, which had been slumped due to various crypto company failures, including the sudden collapse of FTX exchange last year. Regulatory scrutiny, such as the recent lawsuits filed by the U.S. Securities and Exchange Commission (SEC) against crypto giants Coinbase and Binance, alleging rule violations, has further dampened sentiment. Both companies deny the allegations.

he involvement of BlackRock, Charles Schwab, Fidelity, and Citadel in the crypto space is highly significant, demonstrating serious institutional commitment despite the recent regulatory crackdown.” Crypto investments soared when interest rates were low, propelling the market to a peak of $3 trillion in 2021. However, as rates rose, investors became more cautious, leading to the current market value of approximately $1.24 trillion, per CoinGecko data.

Some experts believe that the SEC’s actions may benefit Bitcoin since it is generally viewed as a commodity rather than a security, placing it outside the SEC’s jurisdiction.