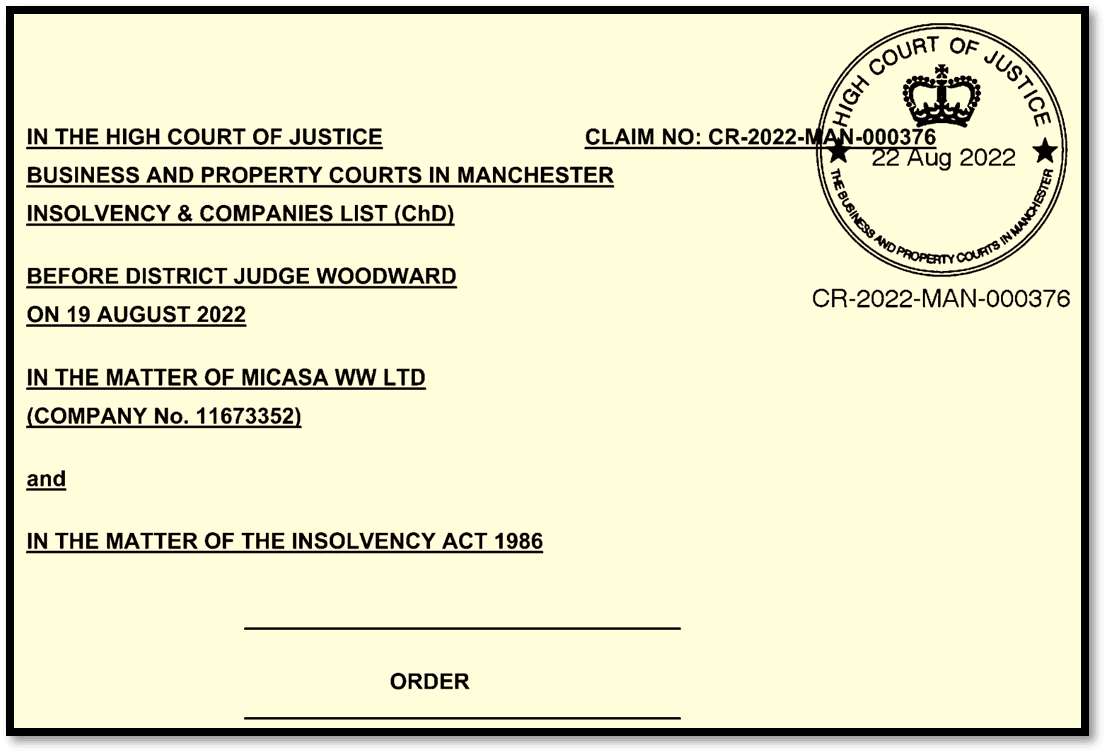

Micasa WW Ltd and Remultex Ltd have been wound up by the UK High Court in the public interest, and the Official Receiver has been appointed liquidator of the companies. A UK Insolvency Service investigation found that Micasa had seen around £1.3 million pass through its accounts from February 2019, when it started operating, until December 2020. The company was potentially involved in a crypto scam and a Covid-19 Bounce Back Loan (BBL) fraud.

While Micasa was allegedly involved in a crypto scam, the lack of accounting records meant it was impossible to verify whether its business was legitimate trading activity. Investigators also identified that it had secured a £50,000 Bounce Back Loan (BBL), although there was also no evidence that the company was eligible under the scheme rules.

Micasa transferred nearly all the BBL to Remultex Ltd, which appears to have started operating in December 2019. Remultex also received its own BBL of £30,000, although it was similarly impossible for investigators to confirm that the company was entitled to the BBL. In addition to the BBL funds received from Micasa, Remultex received payments from three other companies, totaling nearly £250,000 by December 2020. Almost all of this was withdrawn from the business in cash. As with Micasa, there were no accounting records to explain Remultex’s transactions.

Given that both companies traded with a lack of commercial probity and had taken public money to which they may not have been entitled, the UK High Court agreed that closing down the companies was in the public interest. The Official Receiver as Liquidator will seek to recover and realize the company’s assets to make returns to creditors.