The U.S. Commodity Futures Trading Commission (CFTC) ordered Delaware-registered Blockratize, Inc. d/b/a Polymarket, based in New York City, to pay a $1.4 million civil monetary penalty. Polymarket operated off-exchange event-based binary options and failure to obtain designation as a designated contract market (DCM) or registration as a swap execution facility (SEF) and did not comply with the Commodity Exchange Act (CEA) and applicable CFTC regulations. Polymarket was ordered to cease and desist from violating the CEA and CFTC regulations.

About Polymarket

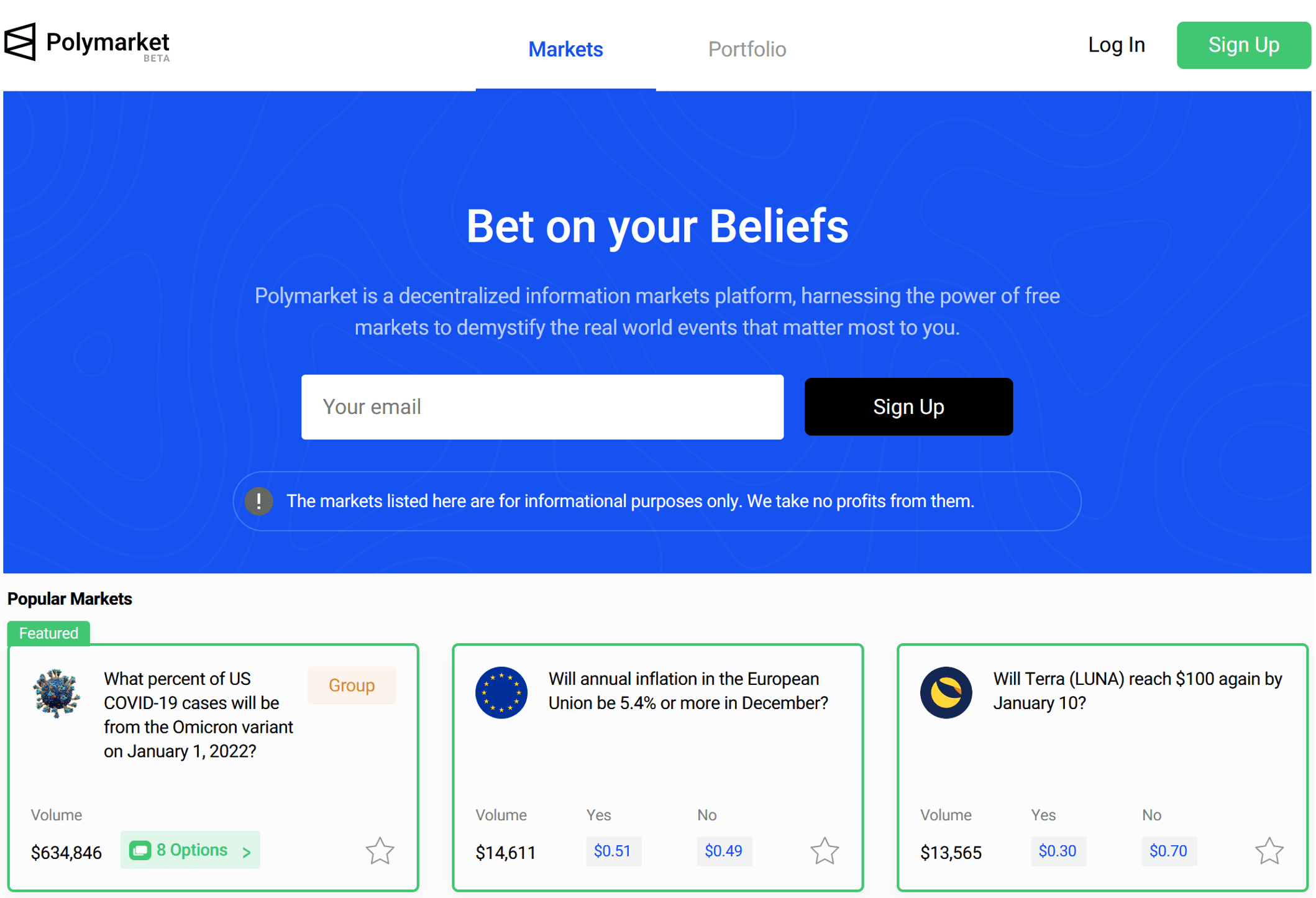

Polymarket (www.polymarket.com) is a blockchain venture that bills itself as an information markets platform that lets you trade on the world’s most highly-debated topics (e.g. coronavirus, politics, current events, etc). It offers binary options in the form of winner-take-all “event contracts” allowing customers to bid on whether a given event will occur or not. Polymarket is built on the Polygon blockchain, which enables users to purchase and sell tokens without network fees.

Polymarket uses an algorithmic functionality called an “Automated Market Maker” (or “AMM”) to price the premiums for each binary option contract based on the relative demand for each position. Contract prices are rebalanced by the AMM after each transaction.

Since June 2020, Polymarket has had over $130 million in trading volume on its various marketplaces. but has not exacted profits from those transactions, the CFTC found.

“All derivatives markets must operate within the bounds of the law regardless of the technology used, and particularly including those in the so-called decentralized finance or ‘DeFi’ space”

Vincent McGonagle, Acting Director of CFTC Enforcement

The CFTC Case

According to CFTC, since June 2020 Polymarket has been operating an illegal unregistered online platform for event-based binary options online trading contracts, known as “event markets.” Through its website, Polymarket offered the public the opportunity to “bet on your beliefs” by buying and selling binary options contracts related to an event taking place in the future that are susceptible to a “yes” or “no” resolution, such as: “Will $ETH (Ethereum) be above $2,500 on July 22?”; “Will the 7-day average COVID-19 case count in the U.S. be less than 15,000 for the day of July 22”; “Will Trump win the 2020 presidential election?”.

Allegedly, Polymarket has offered more than 900 separate event markets since its inception, while deploying smart contracts hosted on a blockchain to operate the markets. Polymarket creates, defines, hosts, and resolves the trading and execution of contracts for the event-based binary option markets offered on its website.