It is a well-known fact that scammers can use TrustPilot in a very targeted way to buy reviews to get a high rating and thus a reputable image. The global scammer scene works with specialized marketing companies that offer good TrustPilot reviews as part of a precisely targeted reputation management. For this purpose, they employ a large number of people and operate many more fake accounts through which reviews are submitted. A case in point is the broker scam Capital Way (see FinTelegram Report here).

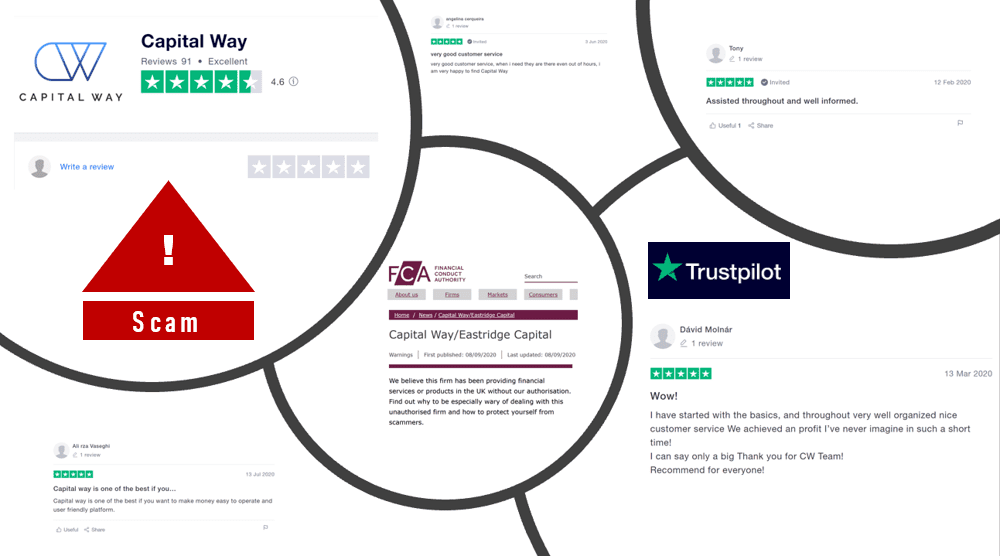

Regulator vs. TrustPilot. While the UK Financial Conduct Authority (FCA) issued an investor warning against Capital Way on September 9, 2020, TrustPilot presents a whopping 4.6-star rating based on 91 reviews. Sure, as a customer you can also be happy with illegally provided services and/or unregulated companies. But we doubt that in the case of Capital Way.

If you take a closer look at the Capital Way reviews and the reviewers, you will discover that

- the 5-star ratings consistently come from people who have given only one rating and have no profile. Among the 76 reviewers that provided 5-star ratings for Capital Way only five had previously submitted more than 2 reviews. Only 16 have reviewed two offerings, i.e. Capital Way plus one other. The remaining 84% of the 5-stars reviewer are novices. This is a statistical anomaly, isn’t it?

- Only 11 reviewers provided a profile and hence have been sort of verified and/or connected with a social media account. Of these 11 reviewers, four have been invited by Capital Way to provide a review.

- The 5-star ratings in many cases consist of only one or two sentences that have to be evaluated as generality without any concrete feedback, such as “Very happy to invest with capital way” or “very accurate and accurate” or “It’s OK. Cannot complain“

The TrustPilot ratings should be treated with the utmost caution. We are aware of cases in which competitors have been damaged with purchased negative reviews.

In the case of Capital Way, it may be that the scam broker works very well for a while before the problems start for their client-victims. This is the typical course of a scam. In the beginning the lure in clients with unrealistic promises, quick but small profits, and the questions for additional investments to generate higher profits. The boiler room agents which call themselves typically “Account Managers” are psychologically trained people.

The fact that Capital Way operates through different legal entities in offshore destinations, multiple domains and that there is now an FCA warning indicates that a bad end for all “real” Capital Way victims could soon be at hand.