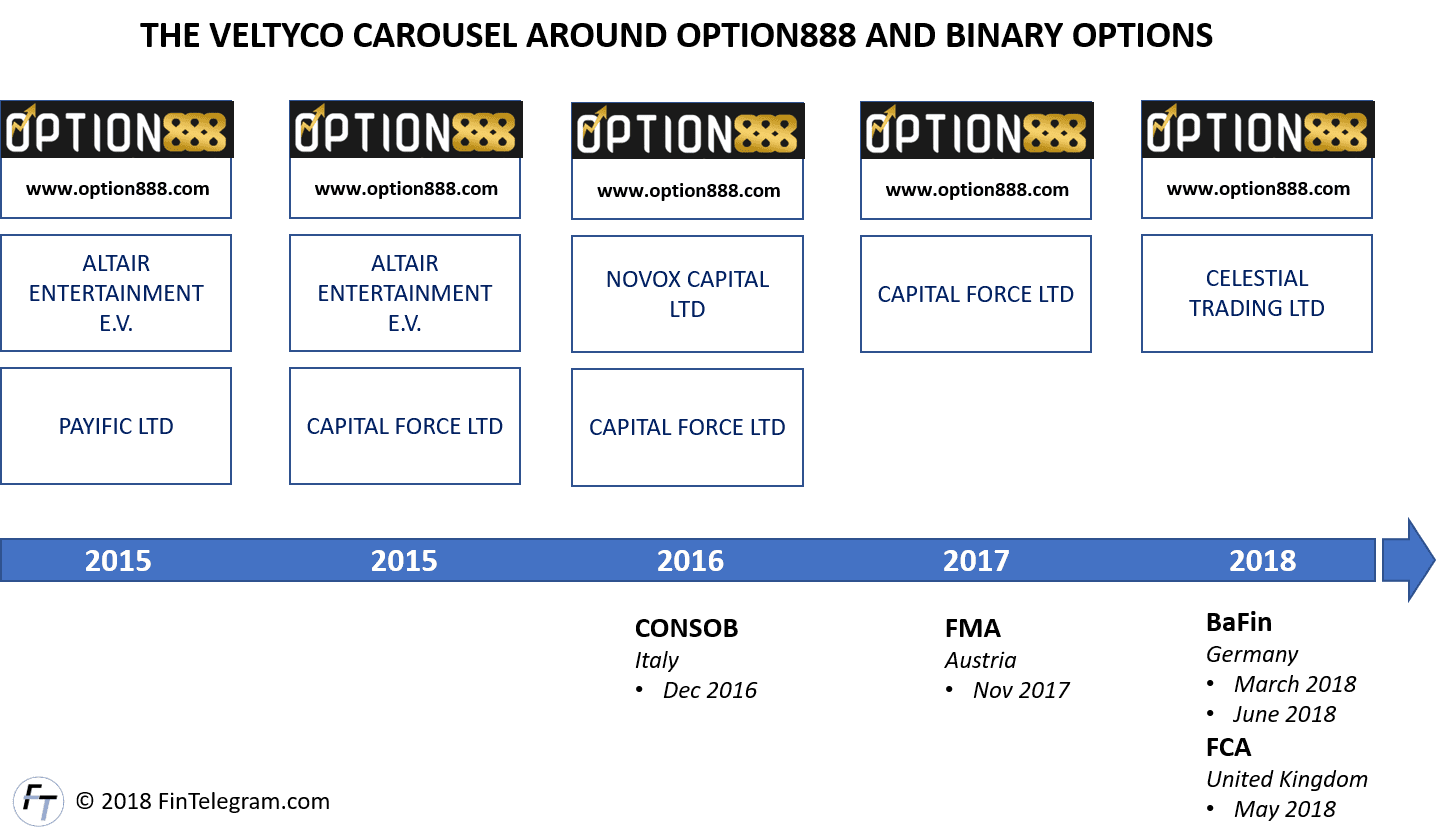

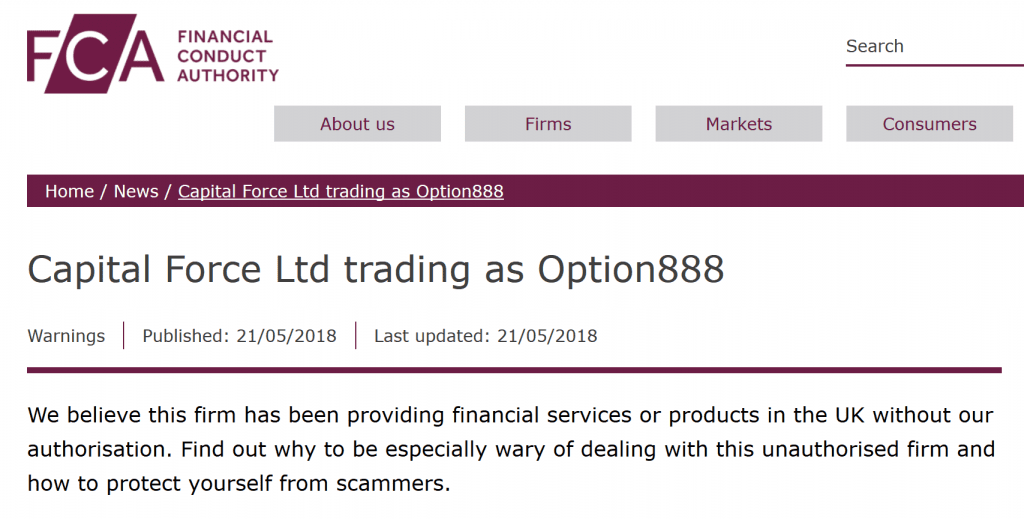

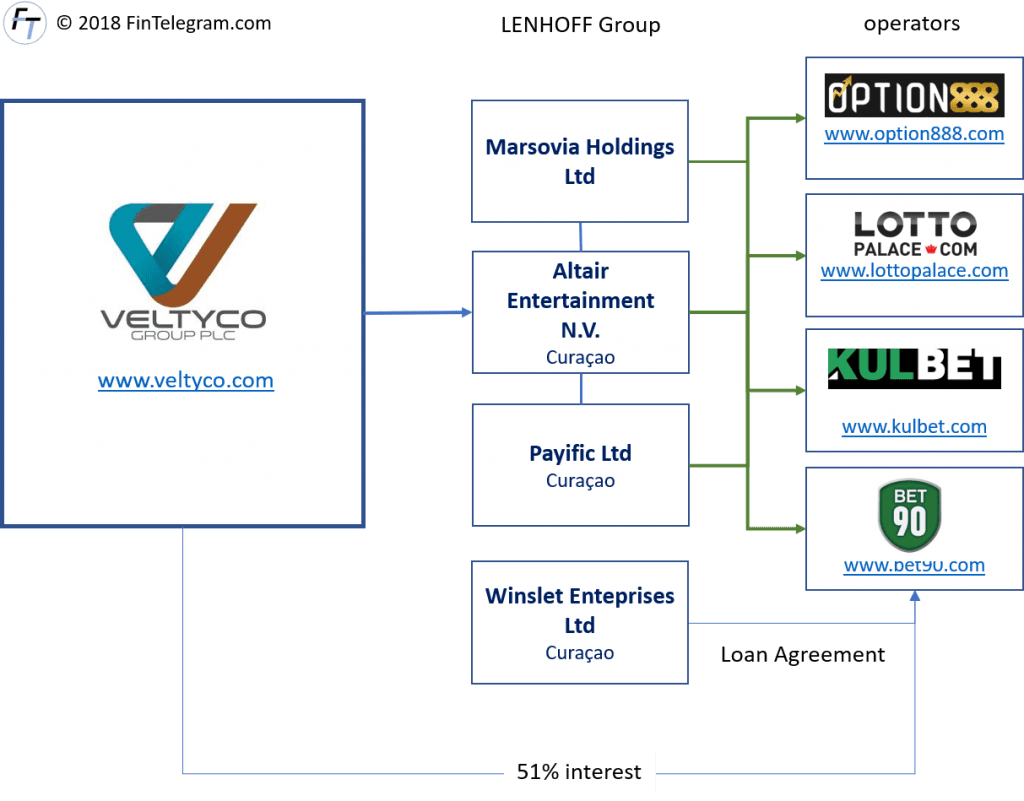

The story of the German Uwe Lenhoff, his public UK company Veltyco Group PLC and the cybercrime organization associated continues to be unfolded. New information is coming up nearly every single day. The authorities are still analyzing the terabytes of data seized in 35 raids in several countries. It is well known that Lenhoff is the principal behind the operation of illegal and fraudulent broker schemes such as Option888,

- more than 200,000 German retail investors involved

- 387 websites identified in the network

- 35 office raids in several countries

- more than 5 terabyte data

Arrest in Austria

As FinTelegram reported, Uwe Lenhoff and his Israeli partner Gal Barak were arrested in February 2019 after more than one year of investigation by various European authorities. Lenhoff was detained near to his Austrian residence. Until his arrest, Lenhoff lived mainly in a Tyrolean five-star hotel and in the noble coastal town of Saint-Tropez on the Côte d’Azur. According to people close to the authorities, some of the other suspects are at large.

The criminal files initially recorded 10 suspects. According to reports, this figure has already risen significantly in the course of the investigations. Lenhoff was extradited to Germany at the beginning of July 2019 where he and his accomplices will be tried for financial crime, fraud and money laundering.

Tagesschau Report uncovers gigantic dimension

The leading German news outlet Tagesschau today published a report which shows that the size of this allegedly Lenhoff-led cybercrime organisation is actually much larger than previously assumed. Accordingly, there may have been about 400 fraud platforms in this network.

Investigators assume that the group around L. has operated five platforms: The websites “Option888”, “TradeInvest90”, “XMarkets.com”, “ZoomTrader” and “TradoVest”. The customer files of these providers alone apparently contain the names of more than 200,000 Germans. Whether each of the customers has lost money and if so, how much, is currently unclear. In Saarbrücken alone, 233 criminal charges are currently being processed in connection with the trading platforms; on average, each injured party has lost more than 40,000 euros. If the damage is extrapolated, the gang could have captured hundreds of millions of euros with the five platforms.

Tagesschau report published on July 3, 2019 (translation by FinTelegram)

EFRI and the tragedies of the victims

The Austrian public auditor and CPA Elfriede Sixt, co-initiator of our European Funds Recovery Initiative (EFRI), was interviewed in the course of the Tagesschau report. She told the Tagesschau about the dramas of the victims. About family fathers who were deprived of the existence of their whole family. About pensioners who have lost their life savings. And about suicides. The cybercrime network led by Lenhoff and his partners has damaged thousands of families and left them in despair.

The EFRI already represents several hundred victims from all over the world with a total damage amount of more than 17 million Euros. “The typical aggrieved party is the pensioner in his prime who has saved a little,” explains Sixt, “but even wealthy businessmen always fall for the swindlers.

EFRI has set up a Veltyco funds recovery campaign to address the despair of thousands of victims. Victims can register their claims here and exchange information with other victims and EFRI via the campaign’s telegram channel. In close cooperation with the authorities of the various countries, Sixt coordinates the funds’ recovery activities. For a registration fee of €75, defrauded retail investors can grant the EFRI a power of attorney and instruct it to take the necessary steps.

Lenhoff was not alone! Responsibility of Veltyco?

FinTelegram has already repeatedly pointed out that the listed Veltyco has played a very important role within this criminal organization. Without the cooperation of Veltyco, this large-scale fraud would not have been possible. Via Veltyco they were stolen by the small investors on the illegal platforms of Lenhoff and its network and washed as so-called marketing payments. The Veltyco was a gigantic washing machine in this respect.

It is clear from the files of the authorities that the then Veltyco board and the persons involved were aware of the illegality of Lenhoff’s actions and of Veltyco’s related contributorship. From the study of the files and the information available, it must be concluded that Veltyco and Lenhoff were part of the same criminal enterprise. They have acted knowingly and willfully. They have acted in a coordinated and coordinated manner and, from our point of view, are to be held accountable in their entirety.

In a FinTelegram of the minutes of a meeting in 2016, Lenhoff speaks to an Austrian business partner sitting in Singapore about an annual payment transaction volume of up to €3 billion. This businessman and his Slovakian partners absolutely wanted to have a part of it. Lenhoff has promised up to 300 million commissions, if one would make common cause.

Veltyco has had so-called marketing contracts with the various operators of these illegal platforms and has taken over the marketing for them. In plain language, Veltyco, under the leadership of Lenhoff, has acquired the victims for the platforms. Lenhoff was a board member of Veltyco until 2018 and was responsible for business development until his last appointment. The issue of Veltyco’s legal responsibility and that of the participating managers and shareholders will need to be clarified in the course of the litigation.

Responsibility of banks and payment services providers

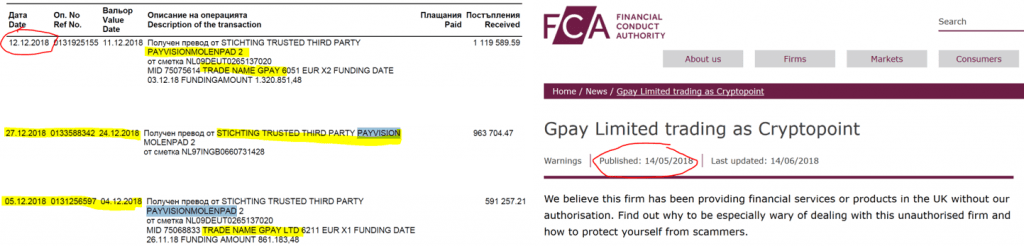

According to the FinTelegram documents available, Lenhoff also cooperated closely with payment service providers in order to be able to launder the stolen funds. He is said to have had a particularly close relationship with Payvision and its CEO Rudolf Booker. Payvision has moved tens to hundreds of millions for the illegal platforms for the entire network over the years. Not only for Lenhoff and Veltyco, but also for Lehnhoff’s partner, the Israeli Gal Barak and his E&G Bulgaria.

Gal Barak was also arrested in his adopted country of Sofia, Bulgaria, in February 2019, but released into house arrest for health reasons. He is allegedly being tried in Austria. Payvision has received and passed on funds from cheated retail investors for the Lenhoff and Barak platforms to the end. FinTelegram, the corresponding bank statements, and payment documents are located. Payvision participated knowingly and willingly in these schemes.

Payvision‘s participation in these schemes happened even though numerous financial market supervisory authorities had long since issued warnings against them. Any KYC/AML exam would have shown that.

Like Veltyco, Payvision and the other payment transaction participants involved will also have to assume their responsibility towards the cheated small investors as potential contributors.