B90 Holdings PLC, a company registered on the Isle of Man, was formerly known as Veltyco Group. The company is listed in the AIM segment of the London Stock Exchange (LSE) and represents a controversial chapter in the online casino, sports betting, and gambling industry. Initially established under a different guise and rebranded following a series of disturbing controversies, this company illustrates the persistent hazards lurking in the intersection of online financial activities and regulatory oversight.

Cybercrime Roots and Operational Turmoil

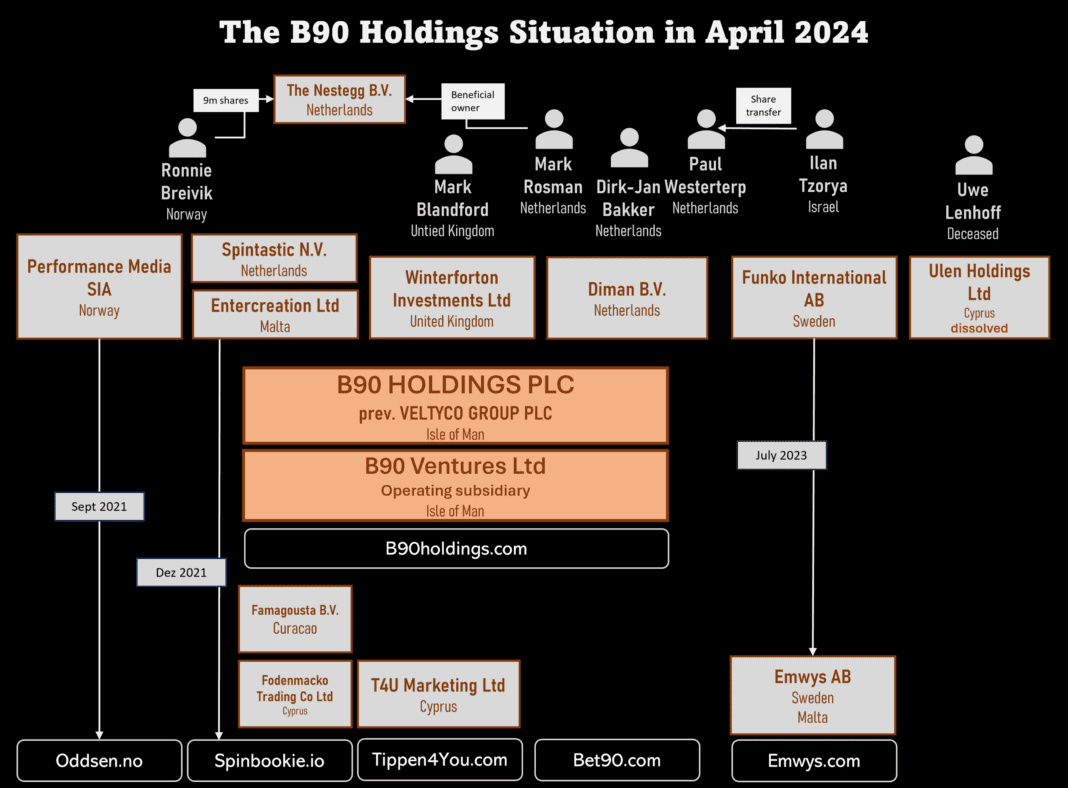

Established in the way of a reverse takeover in 2016 by the German cybercrime mastermind Uwe Lenhoff and his Amsterdam-based partner and financier Dirk-Jan Bakker as Veltyco Group, the firm swiftly became embroiled in allegations of cybercrime, focusing on binary options, online trading, and lottery schemes between 2016 and 2020. The company’s operations during this period were marked by substantial consumer deception, resulting in tens of thousands of victims of various scams orchestrated or facilitated by the firm under Lenhoff’s leadership.

Lenhoff was replaced as CEO by American Melissa Blau in 2018. However, she was unwilling to accept Veltyco’s business practices and stepped down as CEO at the end of 2018. Between 2018 and 2020, Veltyco‘s balance sheet suffered a collapse in sales and an explosion in losses. Without the constant injection of fresh money from investors and shareholders, the company would have been dead long ago. A business model was not recognizable without cybercrime activities.

The arrest and subsequent mysterious death of Lenhoff in a German prison in 2020 revealed the vast scale of Veltyco’s involvement in cybercrime activities. catalyzed a rebranding to B90 Holdings PLC. Despite these changes, the shadow of its past activities continued to loom large, compounded by ongoing financial instability and questionable transactions.

The Era of Ronny Breivik

In 2021, a significant shift occurred when Norwegian gambling veteran Ronny Breivik sold assets and shares in companies to B90 Holdings, subsequently becoming a controlling shareholder.

In 2021, B90 Holdings acquired the B2C brand Spinbookie from Breivik, as reported by FinTelegram. In return, Breivik received 8.6 million shares in B90 Holdings via his company, Entercreation Limited, and a further 8.6 million shares were to be received as performance shares. Breivik had already sold the website Oddsen.no in a cash share transaction to B90 Holdings shortly before. By the end of 2021, Breivik had thus become one of the most important B90 Holdings shareholders alongside Dirk-Jan Bakker.

The acquisition of Spinbookie and the Oddsen assets lacked transparent financial justification, raising concerns about the valuation processes and potential conflicts of interest given the recent establishment of the brand by Breivik himself.

In 2022, there was a public dispute between the two shareholder groups surrounding Breivik and Bakker, in which Breivik prevailed. At the end of 2022, he was appointed director and executive chairman of B90 Holdings.

In 2023, Breivik was able to recruit the British gambling entrepreneur Mark Blandford as a strategic advisor and investor. On the B90 Holdings website (AIM Rule 26), Blandford is listed as the company’s largest shareholder as of January 2024 via his Winforton Investments Ltd. Ahead of Breivik, who holds shares via various legal entities, and Bakker, who is still a shareholder with his Diman.

Financial Mismanagement and Strategic Shifts

The financial trajectory of B90 Holdings has been consistently poor. The brief profitability witnessed in 2016 and 2017 under Lenhoff’s leadership was primarily derived from illicit activities rather than legitimate business operations.

After the reverse merger with Bakker’s Velox3 in 2016, the company, which was then renamed Veltyco Group, generated revenue of just under €16.2 million and an operating profit of just under €7.5 million in 2017. However, there was also a lot of fake.

In the 2017 annual financial statements, it can be read that a significant portion of the commission claims against the affiliated scam companies were not paid by them.

In 2017, under CEO Lenhoff, Veltyco booked commission claims on paper for marketing activities for affiliated scams such as LottoPalace, Option888, and XTrader, thereby inflating the balance sheet and profits, particularly in 2017, with the aim of increasing share prices. However, most of these commission receivables were not paid and were written off in subsequent years. At the end of 2017, the Veltyco receivables exploded to €8.8 million, most of which were due from these affiliated scam companies. As a result, the receivables had to be reduced in subsequent years through various settlements, write-offs, and accounting tricks. Veltyco was always struck with liquidity problems.

As a result, a loss of over €16.7 million was recorded in 2018 and €5.2 million in 2018. Lenhoff resigned as CEO in 2018. Since then, the losses in the millions have continued even after the company was renamed B90 Holdings.

Post-2017, the company’s revenues dwindled, and losses mounted, exacerbated by ineffective attempts to restructure and repurpose the business framework.

In a strategic pivot announced in November 2023 by Breivik, B90 Holdings shifted its focus towards B2B operations while planning to streamline its B2C endeavors. This move, intended to salvage the faltering enterprise, still leaves many questions unanswered regarding the feasibility of achieving profitability given the historical context of mismanagement and ongoing financial drains.

Ongoing Concerns and Market Position

Despite these strategic realignments, the operational reality of B90 Holdings remains grim. The Bet90.com platform, intended to act as a content and affiliate platform, shows minimal user engagement and lacks substantial content, undermining its potential as a revenue generator. The transparency issues, underscored by the absence of essential legal disclosures on its website, further erode trust and question the company’s compliance with standard corporate governance practices.

Conclusion

The narrative of B90 Holdings is one of risks, challenges, and cybercrime within the fintech and online gambling industries, particularly concerning companies with a legacy of involvement in cybercrime. The ongoing saga of financial mismanagement, dubious strategic decisions, and the shadow of past misconduct continue to define the trajectory of B90 Holdings. Stakeholders and regulators must remain vigilant, ensuring that the firm’s activities are closely monitored to prevent further consumer harm and financial instability in the sector.

Report Information

If you have any information about B90 Holdings, Veltyco Group, its activists and facilitators, please let us know via our whistleblowing system, Whistle42.